Voting participation: Trillium Asset management has withdrawn its new proposal about policies that would encourage voting, at Alphabet and Apple. It asked that the companies provide a report about “current policies regarding employee time off to vote, and assessing the merits of strengthening those policies.” There was a procedural problem at Alphabet, but Trillium reports “successful” discussion at Apple.

Working Conditions

Most of the resolutions over the last couple of years about working conditions have zeroed in on how companies handle sexual harassment complaints. New York City Comptroller Scott Stringer began a new campaign last year, joined by the union Change to Win, about mandatory arbitration and non-disclosure agreements. This year’s proposals focus more specifically on mandatory arbitration, which can shield the accused and help perpetuate problems—as shown in many high profile cases such as that against disgraced movie mogul Harvey Weinstein.

Mandatory arbitration: Twelve pending resolutions ask for reports on the use of arbitration and one asks for its end; four are not public:

Invoking a new California law, the New York City pension funds face SEC challenges at Dollar General and Dollar Tree for a proposal that seeks a report

on the use of contractual provisions requiring employees of Dollar General to arbitrate employment- related claims. The report should specify the proportion of the workforce subject to such provisions; the number of employment-related arbitration claims initiated and decided in favor of the employee, in each case in the previous calendar year; and any changes in policy or practice [the company] has made, or intends to make, as a result of California’s ban on agreeing to arbitration as a condition of employment.

The resolution notes high profile sexual harassment cases at companies such as Fox News, Google and Uber about sexual harassment, adding that it is concerned about wage theft, too. It points to a law signed by California Governor Gavin Newson in October 2019 that would have banned mandatory arbitration requirements. The law, AB 51, was to have gone into effect in January, but was put on hold by a federal judge in Sacramento at the end of the year after the Chamber of Commerce and the National Retail Federation sued to block it, claiming it violates the Federal Arbitration Act. At the end of January the judged issued a preliminary injunction that blocks implementation; the law now appears headed for the 9th Circuit Court of Appeals.

Change to Win has returned to Walmart with a resolution similar to its request last year, using the same formulation as the NYC proposals. Last year, a proposal from company employees in the group Organization United for Respect to the company about sexual harassment earned 10.8 percent support. That proposal sought more board oversight of sexual harassment, consideration of it in executive pay, and a review of company policies.

Change to Win has filed a proposal using the 2020 request for a report on mandatory arbitration at Yum Brands, as well.

Nia Impact Capital, a socially responsible investing firm from California, has a similar proposal at Tesla Motors and two small firms, Natus Medical and Pattern Energy. It asks for a report “on the impact of the use of mandatory arbitration on [company] employees and workplace culture. The report should evaluate the impact of [the company’s] current use of arbitration on the prevalence of harassment and discrimination in its workplace and on employees’ ability to seek redress.”

Withdrawal—The Nathan Cummings Foundation withdrew its proposal to Nordstrom that made the same request as the Nia Impact proposal, following an agreement in which the company agreed to review its use of arbitration and the implications for its corporate culture. The proposal noted the high prevalence of workplace discrimination for African American and Hispanic women, and the company’s current requirement for arbitration of any employment-related claims—saying it creates “a long tail risk for Nordstrom,” where two-thirds of employees are women and more than half are people of color.

SEC action—Dollar General and Dollar Tree both have lodged challenges to the NYC proposal at the SEC, arguing it concerns ordinary business. The commission has yet to respond. Yum Brands is making the same argument on its resolution from Change to Win, saying this is a workforce management concern; last year, Yum successfully challenged a proposal seeking an end to mandatory arbitration on these grounds.

Sexual harassment: A few arbitration proposals make the link to sexual harassment in their resolved clauses. Five resolutions come from a union and two socially responsible investing firms:

Arjuna Capital wants Comcast “to conduct an independent investigation into and prepare a report (at reasonable expense, omitting confidential and proprietary information) on risks posed by the Company’s failures to prevent workplace sexual harassment.”

At XPO Logistics, the shipping company, the Service Employees International Union (SEIU) has resubmitted proposal asking the company to “strengthen XPO’s prevention of workplace sexual harassment by formalizing the Board’s oversight responsibility, aligning senior executive compensation incentives, reviewing (and if necessary overseeing revision of) company policies,” with a report by the end of the year. The proposal is a resubmission that earned 18 percent support in 2019, after the company unsuccessfully challenged the proposal at the SEC on several grounds. One more proposal like this is pending at an additional company that has yet to be made public.

SEC action— JPMorgan said its proposal was submitted late and dealt with ordinary business since it’s too detailed, and the proponent withdrew. In still-pending challenges, Comcast says the proposal concerns ordinary business because it discusses legal compliance, while Wells Fargo says it would be moot after a report it planned early this year.

Human capital management: Five new resolutions ask for reports about how companies are managing both diversity and labor law issues, invoking the Sustainability Accounting Standards Board (SASB) standards in three instances:

At Advance Auto Parts, the proposal is for a report

describing the company’s policies, performance, and improvement targets related to material human capital risks and opportunities by 180 days after the 2020 Annual Meeting, at reasonable expense and excluding confidential information, including at a minimum reporting on average hourly wage and percentage of in-store employees earning minimum wage; voluntary and involuntary turnover rate for in-store employees; and total amount of monetary losses as a result of legal proceedings associated with labor law violations.

At McDonald’s, the resolution looks at the company’s restaurant ownership structure, asking for a report

on actions the company is taking to ensure decent work practices are upheld in the company’s owned and franchisee operations, including: Information on the company’s overall approach and board-level oversight of human capital management in the context of emerging workforce-related risks and opportunities in the quick service restaurant sector; and Comprehensive workforce metrics that effectively demonstrate the success and/or challenges the company faces in its management of human capital.

At three companies—Genuine Parts, O’Reilly Automotive and Ulta Beauty, the resolution is for a report on policies performance and improvement targets related to material human capital risks and opportunities by 180 days after the 2020 Annual Meeting at reasonable expense and excluding confidential information prepared in consideration of the metrics and guidelines set forth in the SASB Multiline and Specialty Retailers Distributors standards provisions on workforce diversity and inclusion and labor practices requirements.

Withdrawal—As You Sow withdrew at Advance Auto after reaching an agreement.

SEC action—Genuine Parts unsuccessfully challenged its proposal at the SEC on procedural grounds. Still awaiting SEC responses are challenges from two companies. McDonald’s says the proposal concerns ordinary business because it relates to workforce management, while O’Reilly Automotive contends the resolution is both too long and also moot. As You Sow withdrew a sustainability reporting proposal in 2019 after the company agreed to produce the report, and the company’s challenge this year notes its current sustainability report includes a section on diversity and inclusion.

Worker safety: The United Steelworkers have filed several proposals over the years about worker safety and this year the union approached HollyFrontier, asking it to “prepare a report to shareholders by the 2020 annual meeting...on process safety incidents, environmental violations, and worker fatigue risk management policies for the Company’s refineries.” The resolution was filed too late for consideration last year, and has been withdrawn this year after an SEC challenge in which the company argued that it concerned ordinary business as it dealt with worker safety and legal compliance matters, and that it was too vague. The withdrawal came before any response from the commission.

A new resolution is still pending at Amazon.com, from the AFL-CIO. It asks for a report “on the steps the Company has taken to reduce the risk of accidents. The report should describe the Board’s oversight process of safety management, staffing levels, inspection and maintenance of Company facilities and equipment and those of the Company’s dedicated third-party contractors.” Amazon is contending at the SEC that it relates to ordinary business.

Plant closures: The AFL-CIO is asking United Technologies to report on the impacts of plant closures. The resolution wants to see “a committee, with members drawn from representatives of the employee workforce and management of the Company, to prepare a report regarding the impact on communities from the closure of Company manufacturing facilities and alternatives that can be developed to help mitigate the impact of such closures in the future.”

Diversity in the Workplace

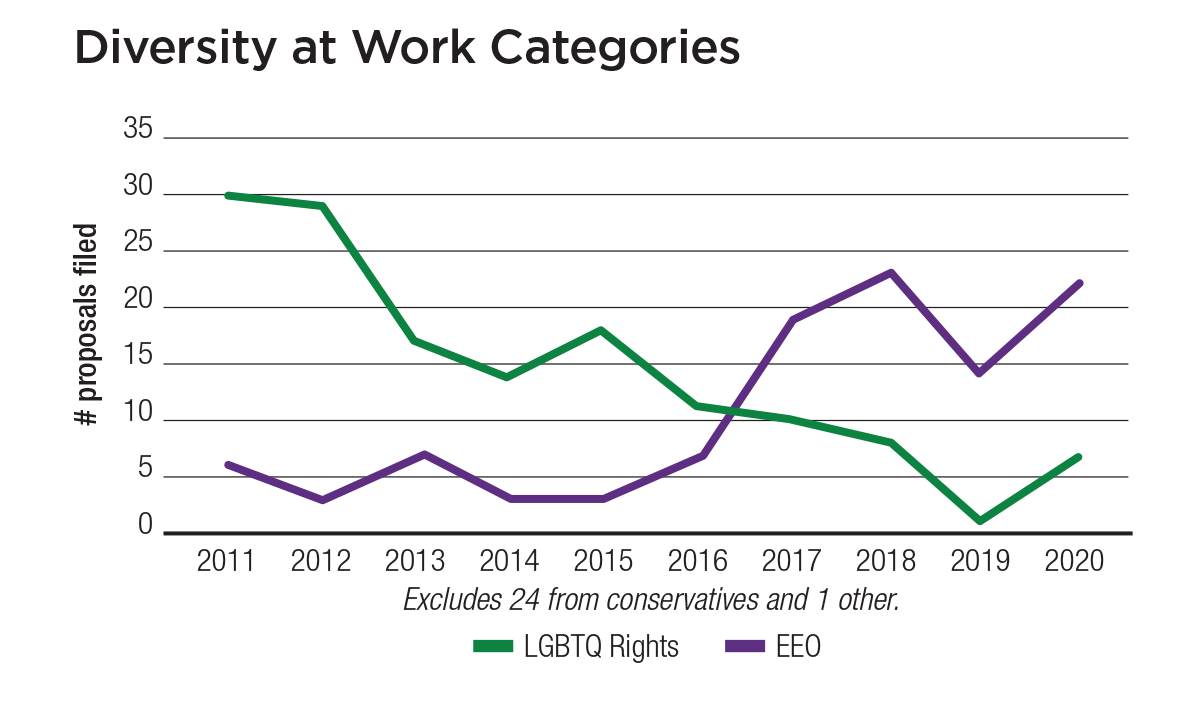

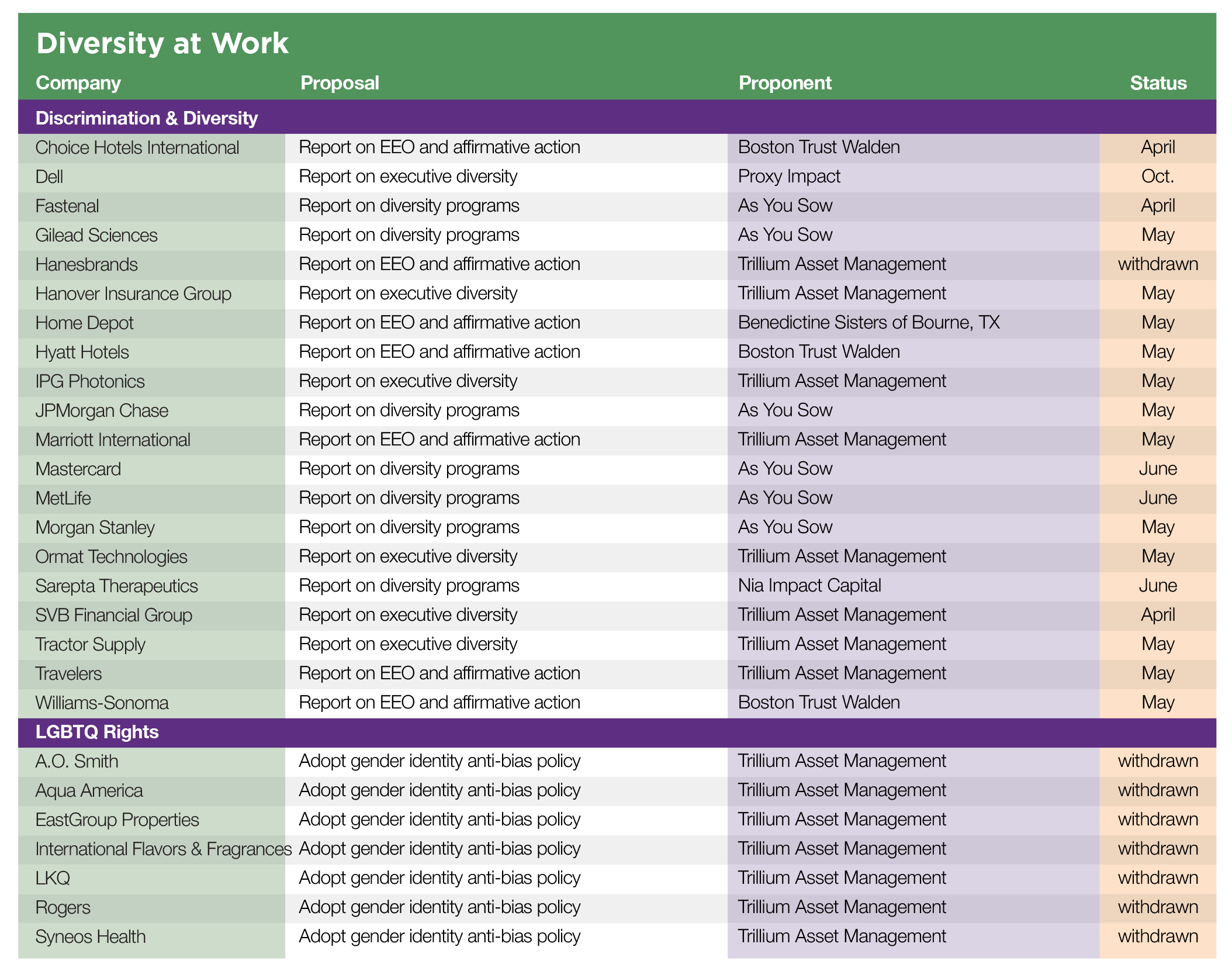

The number of shareholder proposals about diversity at work has jumped back up this year to 29, after seeing just 16 filed at this point in 2019. Resolutions seek reports on diversity programs in general and on the perennial question of equal employment data disclosure and affirmative action. In addition, the effort begun last year to encourage diversity in the upper echelons of management continues. Furthermore, Trillium Asset Management has pressed seven companies to add gender identity provisions to their policies and withdrawn all the requests after the companies agreed to do so.

All of the proposals share a concern about discrimination on the basis of race, ethnicity and gender and support more disclosure and action to provide equal employment opportunities. All but two have been submitted at companies that have yet to consider such a proposal and few have been withdrawn as of mid-February, although more withdrawals seem quite likely given past agreements on employment discrimination in general. Also see proposals seeking executive pay links to diversity, p. 62.)

(Proposals about greater gender pay equity are covered in the Decent Work section above, p. 36. The Sustainable Governance section (p. 57), describes 49 other proposals seeking greater board diversity—focused on women but increasingly minorities; both are deeply underrepresented on corporate boards.)

Discrimination and Diversity

Analysis of programs: As You Sow and Nia Impact Capital have eight resolutions asking for reports on diversity programs. At Gilead Sciences, JPMorgan Chase, Mastercard, MetLife, Morgan Stanley and Sarepta Therapeutics the resolution asks for an annual report “assessing the Company’s diversity and inclusion efforts,” and suggests in the resolved clause that the proposal should include:

the process that the Board follows for assessing the effectiveness of its diversity and inclusion programs,

the Board’s assessment of program effectiveness, as reflected in any goals, metrics, and trends related to its promotion, recruitment and retention of protected classes of employees.

As You Sow expects to file one more such proposal at an additional company. Additionally, a shorter proposal is pending at Fastenal, asking only that it report “assessing the diversity of our company’s workforce.”

EEO data reporting: Trillium Asset Management and Boston Trust Walden have seven proposals between them. At Choice Hotels, Hyatt Hotels and Williams-Sonoma, the proposal asks for a report by the end of the year that will include:

A breakdown of its workforce by race and gender, preferably according to the Equal Employment Opportunity Commission (EEOC) defined job categories (the EEO-1 Report); and

A description of policies and programs implemented to increase the number of minority and female employees in job categories where they are underutilized.

At Hanesbrands, Marriott International and Travelers (where it earned 50.9 percent in 2019), it is slightly different, requesting a report (with no timeline specified), that would include:

A chart identifying employees according to gender and race in major EEOC-defined job categories, listing numbers or percentages in each category;

A description of policies/programs focused on increasing gender and racial diversity in the workplace.

The Benedictine Sisters of Bourne, Texas, have resubmitted an EEO data resolution at Home Depot, where the company has been under pressure to report more fully on its workforce and to describe its affirmative action for 18 years. The resolutions routinely earned more than 20 percent. In 2018, the vote jumped to 48.3 percent; late that year, the company released figures for the breakdown of its workforce overall in 2017 by race, ethnicity and gender and provided comparable data on the board of directors and for officers and “managers and above.” The data show decreasing levels of diversity as posts become more senior but are not as detailed as the EEO-1 reporting sought in the resolution. Further, the proposal last year noted that the company paid a $100,000 disability rights settlement in 2018. The proposal this year reiterates past concerns, seeking EEO- 1 job category breakdowns, “a summary description of any affirmative action policies and programs to improve performance, including job categories where women and minorities are underutilized” and “description of policies/programs oriented toward increasing diversity in the workplace.”

Withdrawal—Trillium withdrew at Hanesbrands after the company agreed to publish diversity and inclusion initiatives, including workforce diversity data.

YOU CAN’T BREAK THE GLASS CEILING WITHOUT A PROMOTION

MEREDITH BENTON

Principal, Whistle Stop Capital

KRISTIN HULL

Founder and CEO, Nia Impact Capital

In the finance industry, there is a mind-boggling 32 percent gap between women represented in entry level roles and women in the executive suite; women make up 56 percent of entry level positions and 24 percent of executives. Finance is not an anomaly. In transportation, logistics, and infrastructure, the gap is 43 percent, healthcare’s gap is 40 percent, and consumer packaged goods’ gap is 35 percent. There is no industry without a significant valley. We know that these valleys also exist around race, ethnicity, sexual orientation, and other immutable characteristics. We are still lacking sufficient public data to understand just how pervasive or extensive these gaps are.

MAJORITY SHAREHOLDER VOTES PUT SPOTLIGHT ON C-SUITE DIVERSITY

SUSAN BAKER

Vice President Shareholder Advocacy, Trillium Asset Management

BRIANNA MURPHY

Vice President Shareholder Advocacy, Trillium Asset Management

Evidence continues to mount that ethnic, racial, and gender diversity at the highest levels of leadership is enormously important to a well-functioning organization. The gains made by corporations to diversify both their boards and senior executive ranks are noteworthy and investor engagement has played a valuable role in these advances.

Executive diversity: Last year, Trillium Asset Management started asking companies to provide more reporting on their efforts to diversify upper echelons of management. It withdrew at four companies after each agreed to provide more information on how they seek to boost women and minorities in their executive ranks. One more went to a vote at Newell Brands, earning 56.6 percent support.

In 2020, Trillium is back with five more similar proposals, at Hanover Insurance Group, IPG Photonics, Ormat Technologies, SVB Financial Group and Tractor Supply. It asks, as it did in 2019, for an “assessment of the current state of its executive leadership team diversity and its plan to make the company’s executive leadership team more diverse in terms of race, ethnicity, and gender.”

Withdrawal—Proxy Impact has withdrawn the same proposal at Dell after an agreement.

LGBTQ Rights

Trillium filed and withdrew a proposal at seven companies, asking each to add gender identity as a protected class of employees in non-discrimination policies. All (see table for a list) agreed to do so.

(See Conservatives, p. 66, for proposals that argue against policies to protect LGBTQ rights.)

Ethical Finance

Tax windfall: Just one proposal on ethical finance is pending for 2020. Taking an idea raised previously by Trillium Asset Management at Gilead Sciences, the Benedictine Sisters of Mt. St. Scholastica and Oxfam are asking Merck to provide “a report, prepared at a reasonable cost and omitting proprietary information, describing how the company plans to allocate tax savings that result from the Tax Cuts and Jobs Act ("TCJA").” The resolution points out the 2017 law cut the corporate tax rate from 35 percent to 21 percent and reduced federal revenue by $100 billion. The proponents say they want to know how the company’s tax savings are being spent to provide long-term value creation. They also point out the company doubled its stock buybacks from $4 billion in 2017 to twice that in 2018, while cutting research and development expenditures. (The Gilead proposal earned just 2.2 percent, not enough or resubmission, although it survived a company challenge, where the SEC disagreed it concerned ordinary business.)

Health

Pending resolutions about health relate to the opioid crisis and tobacco, as in the past. New this year are a few about reproductive health rights and a proposal to two companies about the possible harms of 5G technology, but the latter will not go to a vote. (Related proposals that seek ties between drug pricing risks and executive pay are covered in the Sustainable Governance section of this report, p. 62.)

Pharmaceuticals

Opioids: As litigation progresses towards a national settlement between communities affected by the opioid crisis and the companies that made and sold prescription drugs that helped fuel the epidemic, proponents continue to call for more transparency and accountability. Prompted by clear financial risks from lawsuits, legislation and reputational damage, votes on the subject have been high—majorities above 60 percent in 2018 and 2019 at Walgreens Boots Alliance, Assertio Therapeutics (the former Depomed) and Rite Aid and 41.2 percent at Amerisource Bergen in 2018. Proponents have withdrawn four other resolutions seeking reports since the start of a campaign from faith-based investors, the UAW Retirees’ Medical Benefit Trust and state pension fund. Investors for Opioid Accountability issued a report last year recapping the efforts and describing an array of corporate governance reform requests.

OPIOID CRISIS & INSULIN PRICES PROMPT SHAREHOLDER PUSH FOR BIG PHARMA BOARD ACCOUNTABILITY

DONNA MEYER, PH.D.

Director, Shareholder Advocacy, Mercy Investment Services

In July 2019, Investors for Opioid Accountability, which has been at the forefront of the fight against the opioid crisis, broadened its focus to encompass companies with insulin and generic legal risks and those under scrutiny for anticompetitive practices. Now known as Investors for Opioid and Pharmaceutical Accountability (IOPA), this diverse global coalition of 60 public, faith-based, labor, and sustainability funds, as well as asset managers, represents investors with more than $4.4 trillion in assets under management.

Pending—Two resolutions at new recipients seek comprehensive reports on the crisis. At Johnson & Johnson the request is for a report

describing the governance measures JNJ has implemented since 2012 to more effectively monitor and manage financial and reputational risks related to the opioid crisis, given JNJ’s sale of opioid medications, including whether increased centralization of JNJ’s corporate functions provides stronger oversight of such risks and any changes in how the Board oversees opioid-related matters, how incentive compensation for senior executives is determined, and how the Board obtains input regarding opioids from stakeholders.

A substantially similar resolution is at Walmart. The proposal notes the company is a defendant in the national class action litigation because it is “accused of failing to adequately train employees or monitor suspicious orders of prescription opioids.” It says the company’s Opioid Stewardship Initiative addresses restrictions on prescriptions, but not changes such as board oversight and links to executive pay that the proponents believe are needed.

Withdrawal—Proponents withdrew a proposal this year at Walgreens that asked for the same report. That proposal also said the company should explain “whether and how the Board oversees Walgreens’ opioid-related programs and AmerisourceBergen’s opioid- related risks, and whether and how Walgreens has changed senior executive incentive compensation arrangements.” The requested report is available on the company website.

Reproductive Health

As You Sow and Rhia Ventures have a new proposal in 2020; filed at two companies and planned at one more, it expresses concerns about eroding access to abortion and other related reproductive health care services. As described in a Roll Call article in February, the resolution seeks a report by December “detailing any known and any potential risks and costs to the Company caused by enacted or proposed state policies affecting reproductive rights and detailing any strategies beyond litigation and legal compliance that the Company may deploy to minimize or mitigate these risks.” Target companies include Macy’s and Progressive.

THE BUSINESS CASE FOR REPRODUCTIVE HEALTH

SHELLEY ALPERN

Director of Shareholder Advocacy, Rhia Ventures

Reproductive health is a business issue—this is the message that a new campaign wants companies and investors to know and to act upon. The effort is led by Rhia Ventures, a San Francisco-based venture firm specializing in contraceptive and maternal health investments.

The proposal points to the wide array of legal challenges that affect access, noting 58 new state restrictions about reproductive health rights that were enacted in the first six months of 2019, plus competing measures to secure and remove these rights. Eleven states now have laws banning abortion on the books, although they are being challenged in court, while six states require coverage for abortion.

The proposal reasons that because the companies targeted operate in some of the states with restrictions, and because their employees are affected, investors need a report on how the companies are handling the issue. It quotes statements from the companies supporting diversity and inclusion and better financial returns for diverse companies, then argues that reproductive health rights are key benefits for company employees that bolster diversity and inclusion. The resolution calls on the companies to “evaluate any risks and costs including, but not limited to: effects on employee hiring, retention, and productivity, and increases in litigation and brand risks. Strategies evaluated should include any public policy advocacy programs, political contributions policies, and human resources or educational strategies.”

SEC action: Progressive has challenged the proposal at the SEC, arguing it concerns ordinary business, is too vague, and is not a proper subject for a shareholder proposal. The SEC has yet to respond.

Tobacco

Only one resolution on tobacco appears to have been filed for 2020. The Sisters of St. Francis of Philadelphia has a proposal that asks Altria “to review corporate adherence to Altria’s principles and policies aimed at discouraging the use of their nicotine delivery products to young people, assess the effectiveness of those polices, and the damage inflicted on our nation’s youth and report the results” by November. A similar resolution last year asked Altria to report on nicotine levels in its cigarettes and reducing them earned 3.9 percent in 2019, about the same as the 4.1 percent it got in 2018 and not enough for resubmission.

Technology

Individual investor William Fleming asked Sprint and Verizon to “Cease the deployment by [Verizon’s] contractors of 5G technology immediately, only resuming its deployment after such impact and health risk studies can be completed.” The SEC agreed with each company that Fleming failed to prove his stock ownership. Fleming is concerned about what he sees as the harmful health impacts of microwave transmitters.

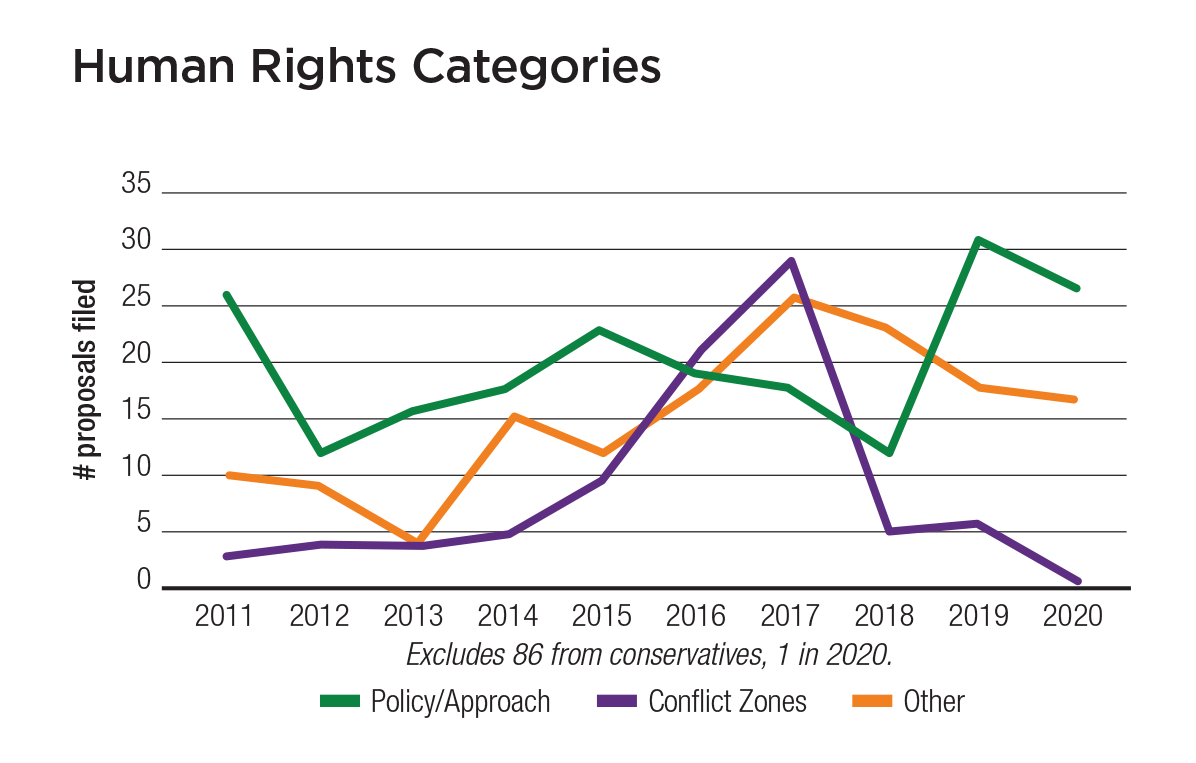

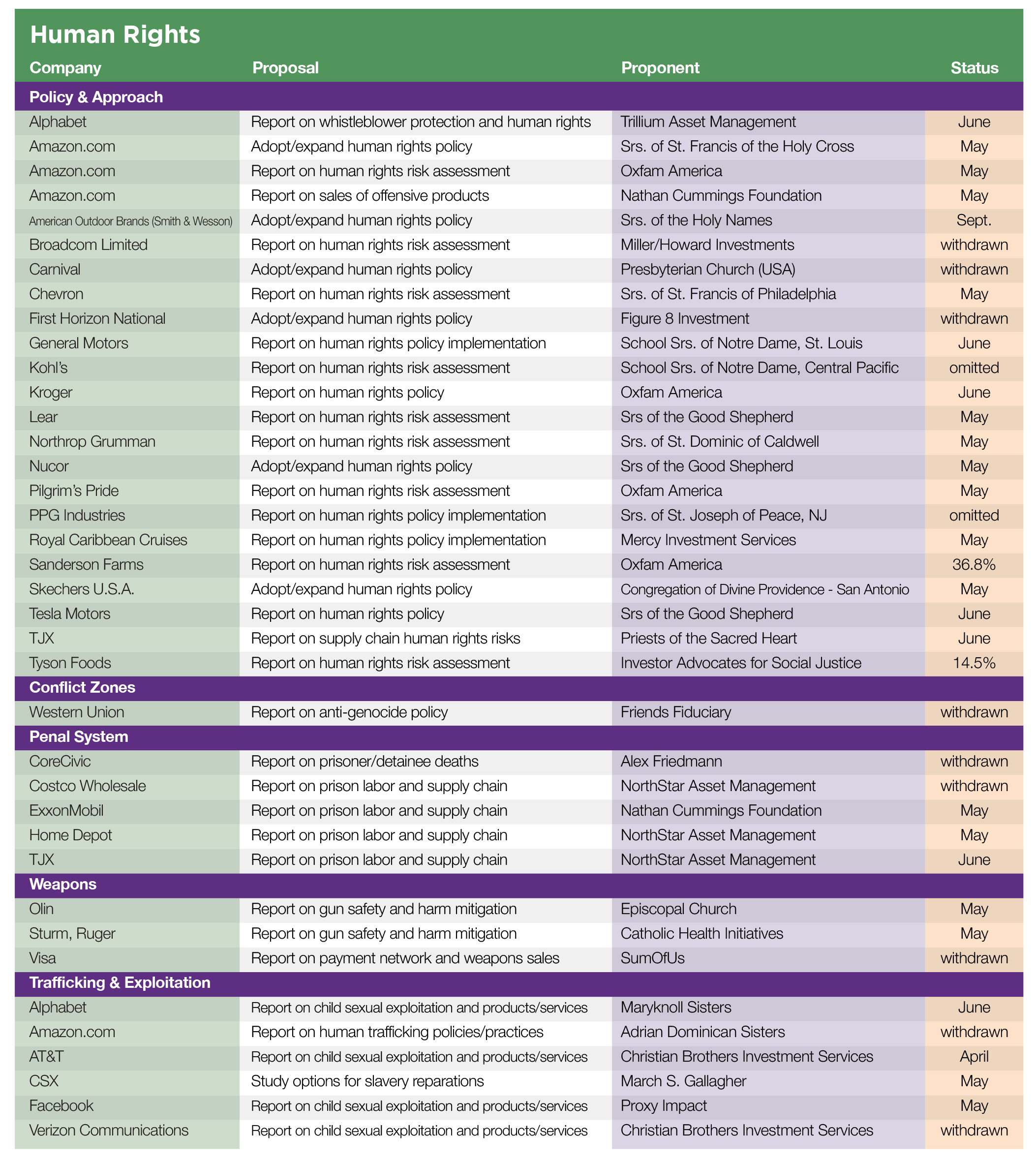

Human Rights

Shareholder proposals about human rights are a mainstay of proxy season and a heterogeneous bunch, reflecting key controversies of the day. The largest group seeks stronger policies and disclosure about how companies attend to risks related to human rights in their operations. Concerns about specific conflicts have waned from a high point in 2017, but last year’s focus on immigrants and the penal system continues, alongside proposals about trafficking and modern slavery, surveillance and privacy issues connected to social media and internet platforms, weapons and the penal system.

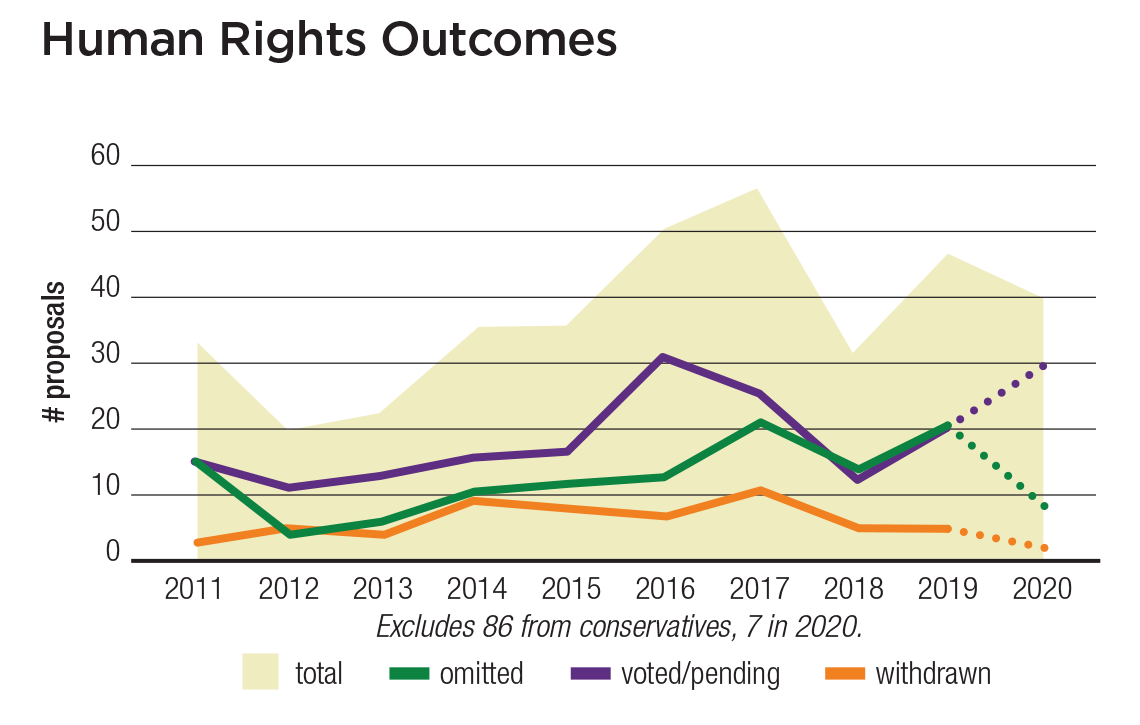

Just eight of the 40 proposals filed on human rights in 2020 are resubmissions. Most resolutions (30) are now pending, eight have been withdrawn and two have been omitted. The SEC has yet to respond to nine no-action challenges.

Policy & Approach

Relatively general resolutions about company approaches to human rights abound this year. The largest group ask companies to report on how their human rights risk assessments are done, six more ask companies to adopt policies in the first place, and five seek reports on how current policies are implemented.

Risk assessments: The proponents want to know how companies assess their supply chains and operations for red flags:

At Broadcom, TJX and Kohl’s, the proposal

asks about the “process for identifying and

analyzing potential and actual human rights

risks of its operations and supply chain.”

Longstanding concerns exist about workers

in long global supply chains for textiles at the last two companies, the proponents note, while the issue at Broadcom is one of forced labor in the electronics sector, both in product assembly as well as from sourcing for raw materials like tin, tungsten, tantalum and gold (“conflict minerals”). The resolutions note low

scores for all three companies in reports from KnowTheChain and the Corporate Human Rights Benchmark and say current company policies and disclosures are insufficient.At three chicken processors—Pilgrim’s Pride, Sanderson Farms and Tyson Foods—the request is for a report on the “human rights due diligence (HRDD) process to assess, identify, prevent and mitigate actual and potential adverse human rights impacts.” Shareholder proponents have long been concerned about working conditions at chicken processors, highlighted in an Oxfam initiative called Lives on the Line.

In a similar vein, the Sisters of St. Francis of Philadelphia would like Chevron to “commission an independent third- party report...evaluating the effectiveness of Chevron’s efforts to prevent, mitigate and remedy actual and potential human rights impacts of its operations.” The proposal calls for information about community consultation and environmental justice—and notes the Sustainability Accounting Standards Board says these all are material concerns for the oil and gas industry. The proposal observes, “Emissions from the use of Chevron’s products and operations contribute to the climate crisis, which may compound impacts to already burdened communities,” giving examples about contamination near California refineries and controversy about cleanup in Ecuador. The proposal notes the company received zero points from the 2019 Corporate Human Rights Benchmark report grading how it is resolving problems.

Three of the risk assessment resolutions explicitly focus on products they call “high risk.” At Amazon.com, Oxfam America seeks an assessment “examining the actual and potential impacts of one or more high risk products sold by Amazon or its subsidiaries...throughout the supply chain.” The resolution says the company can focus on areas with known problems, such as the Southeast Asian shrimp industry, palm oil plantations in Malaysia and “rampant labor abuse among U.S. tomato producers.” The company’s ownership of Whole Foods and AmazonFresh make these issues particularly salient, Oxfam says.

Similarly, proponents want Lear and Northrop Grumman to report on examinations of “company’s high-risk business activities in its operations and value chain.” At Lear, the proposal mentions the automotive supply chain and its long raw materials supply chain in high-risk countries for sourcing of leather, assembly of seating, and also domestic health and safety issues. The proposal was prompted by a campaign from the Investor Advocates for Social Justice called “Shifting Gears.” At Northrop, the company’s heavy dependence on defense contracts is the issue, including its work using biometric data in its work on the Homeland Advanced Recognition Technology (HART) database; the proposal says the database will hold information on some 260 million people and poses risk to privacy, the First Amendment and immigrant communities. Longstanding concerns about the company’s weaponry also are at issue, including in its sales to Saudi Arabia given the war in Yemen.

Votes—Two of the resolutions to chicken processors have already come to votes. Shareholders gave the Sanderson Farms proposal 36.8 percent support on Feb. 13. Before that, the vote at Tyson Foods was 14.5 percent.

SEC action—Amazon.com is arguing the proposal is not significantly related to its business and concerns ordinary business but the SEC has yet to respond. (Last year the company successfully challenged a similar resolution and the SEC agreed it was ordinary business.) The proposal expresses concerns about potential use of child or forced labor in the company’s supply chain, for various commodities as well as shrimp in Southeast Asia.

Northrop Grumman is contending the resolution relates to ordinary business, and also that it is moot and too vague; the first two arguments reiterate an unsuccessful challenge by the company in 2019 on a similar human rights proposal that earned 31 percent support.

INVESTORS WANT AUTO INDUSTRY TO SHIFT GEARS ON HUMAN RIGHTS

MARY BETH GALLAGHER

Executive Director, Investor Advocates for Social Justice

GINA FALADA

Senior Program Associate, Investor Advocates for Social Justice

Accountability for corporate supply chain impacts is now before the courts as Tesla and five other companies face a class action lawsuit filed on behalf of 14 children and parents from the Democratic Republic of Congo (DRC) for allegedly “aiding and abetting in the death and serious injury of children who claim they were working in cobalt mines in their supply chain.” This risk faces all companies in the automotive industry, which relies on complex, extended supply chains to source the wide range of raw materials that go into the 30,000 different parts in a vehicle.

Withdrawal—Miller/Howard Investments withdrew at Broadcom after reaching an agreement.

Adopt and strengthen policies: Six proposals contend companies should adopt policies or strengthen the ones they already have. Five are quite similar, asking American Outdoor Brands, Carnival, First Horizon National, Nucor and Skechers U.S.A. to adopt policies that explain the companies’ approach to the “due diligence processes” that will “identify, assess, prevent and mitigate actual and potential adverse human rights impacts.” Another at Amazon.com is more detailed, asking it to adopt and

publicly disclose a comprehensive policy applicable to Amazon’s operations and subsidiaries that commits the company to respect human rights, including ensuring safe and healthy workplaces; prohibiting discrimination and retaliation; affirming the right of workers to form and join trade unions and bargain collectively; and describing the process the Company will use to identify, assess, prevent, mitigate, and, where appropriate, address adverse human rights impacts.

Withdrawal and SEC action—Two of the policy adoption proposals have been withdrawn. Mercy Investments and the Presbyterian Church (USA) withdrew after Carnival agreed to continued engagement as well as to “expand its existing policies and practices on human rights and develop a more strategic and holistic approach to these issues.” At First Horizon, the withdrawal came after a company challenge at the SEC that argued the resolution was moot, concerned ordinary business was not significantly related to the company. Discussing the withdrawal, the proponents report that the company has developed and made public its initial Human Rights Policy and Supplier Code of Conduct and agreed to dialogue with shareholders.

Reporting on implementation: Four out of five resolutions seeking information on how companies are implementing extant human rights policies are pending. Each is slightly different:

At Tesla Motors, the request is for information on “processes for embedding respect for human rights within operations and through business relationships.”

At Royal Caribbean and PPG Industries it is to describe “processes to implement the commitments” set out in company policies.

At General Motors, the proposal seeks a report “on GM’s systems to ensure effective implementation of its Human Rights Policy.”

A Kroger, Oxfam America wants to know about the company’s “human rights due diligence (HRDD) process to identify, assess, prevent and mitigate actual and potential adverse human rights impacts in its operations and supply chain.”

SEC action—PPG Industries persuaded the SEC the resolution is moot given current disclosures.

Conflict Zones

Just one proposal made the case that a company should take action to extricate itself from a specific conflict, and it has been withdrawn. Friends Fiduciary sought a report from Western Union “evaluating the feasibility of adopting a policy of not doing business with governments or military forces that are complicit in genocide, and/or crimes against humanity, and/or mass atrocities as defined by the U.S. Department of State or the appropriate international body.” The resolution noted that the company did business in Myanmar (Burma) through Myawaddy Bank, owned by the military. It pointed out that the UN has found systematic human rights abuses in the country by the military, including genocide against the Rohingya people. It asserted companies are under increasing pressure to cut all business ties and points out a contrast between “CEO Hikmet Ersek’s public advocacy for migrants and refugees with the fact that the company’s business partner, the Burmese military, is responsible, through its attacks on Rohingya communities, for creating one of the world’s largest refugee populations.” Friends Fiduciary withdrew after the company announced it is ending their relationship with Myawaddy; it will consider implementing a human rights policy and also will take part in more dialogue with the proponent.

Penal System

While 2019 saw several proposals raising concerns about corporate connections to controversies about U.S. immigration and similar concerns about the U.S. penal system, these concerns in 2020 seems to be folded into a larger framing about a perceived need for better human rights policies and implementation in general, as discussed in the sections above. There are, though, four proposals about reporting on prison labor and corporate supply chains and one on prisoner and detainee deaths that has been withdrawn.

Prisoner labor: NorthStar Asset Management filed resolutions asking for reports at Costco Wholesale, continuing its reform efforts there from earlier, as well as at Home Depot and TJX:

NorthStar withdrew at Costco after the company agreed to more disclosure about supply chain prison labor, although Costco also had challenged the proposal at the SEC saying it was moot. A very similar proposal in 2019 earned 28.7 percent support. In 2018, a proposal asking for a policy on supply chain prison labor received 4.8 percent; despite the low vote the company adopted a new policy on the subject that year.

Home Depot contends at the SEC that a resolution seeking an annual report “summarizing the extent of known usage of prison labor in the company’s supply chain” concerns ordinary business. A similar resolution received 30.3 percent support last year.

TJX has challenged a proposal asking for an annual report “assessing the effectiveness of current company policies for preventing prison labor in the company’s supply chain.” The company is arguing at the SEC that this is ordinary business since it addresses supplier relationships and also workplace safety and working conditions. A similar proposal earned 37.6 percent in 2019, up from 7.7 percent in 2018. Negotiations surrounding the proposal caused management to update the Vendor Code of Conduct to more explicitly prohibit forced or voluntary prison labor.

The Nathan Cummings Foundation has filed a proposal for the first time at ExxonMobil that addresses the issue. The SEC has yet to respond to Exxon’s challenge that it is moot. The proposal seeks

a policy committing the Company to take steps to address the use of prison and unpaid diversion program labor in its operations and supply chain. In doing so, ExxonMobil might consider surveying suppliers in order to identify sources of unpaid diversion program labor in its supply chain, reporting to shareholders on these findings and developing additional criteria or guidelines for suppliers and operators regarding the use of prison and diversion program labor.

A TALE OF TWO PRISONS: HUMAN RIGHTS FOR INMATES AND DETAINEES

MARY BAUDOUIN

Provincial Assistant for Social Ministries for the Jesuits of the US Central and Southern Province

BRYAN PHAM

SJ, JD, USA West Province Society of Jesus

PAT ZEREGA

Senior Director of Shareholder Advocacy, Mercy Investment Services

At the turn of this century, the United States saw increased use of private prisons because of more incarceration, aging local prisons, and a belief that contracting private prisons was cheaper. Cities, counties, and states began to contract with the private sector to handle their inmates. At the same time, the industry began consolidating, and CoreCivic (formerly Corrections Corporation of America) and GEO Group dominated the field. The faith community, with a long history of prison chaplaincy, was concerned with what they saw in these facilities. Reports included untrained and limited staff, problems with health care and food, inability to meet families, and an increase in violence. Faith-based organizations such as Wespath and the Presbyterian Church (USA) began to exclude private prisons from their investments.

The proposal asserts that goods made by prisoners can post risks to the company, reputational and financial, and states, “Diversion program labor does not fall under the 13th amendment exemption. Participants in these programs have not been convicted of any crime. According to recent reports by the Center for Investigative Reporting, diversion programs have supplied unpaid and involuntary labor to corporations, including ExxonMobil.” Nathan Cummings Foundation says this violates the company policy and asserts the company should carefully review its policies. In its challenge to the proposal at the SEC, Exxon noted the allegation is that patients from a drug rehabilitation program were sent to work at a company refinery, but it says its investigation of the matter found no documentation to prove it.

Deaths: Inmate rights advocate Alex Friedmann had a new resolution this year about prisoner and detainee deaths, at CoreCivic, but he withdrew it after an SEC challenge that argued it could not be implemented and concerned ordinary business since it would micromanage the business. The proponent has filed other detailed proposals in the past about prisoner and detainee rights, but this is a new formulation. It sought annual reports that would include information on:

The, number of prisoners/detainees who died while housed at or assigned to the company’s facilities during the previous calendar year;

The name of each of the prisoners/detainees described in section 1, above;

The date of death for each of the prisoners/detainees described in section 1, above;

The name of the facility where each death of the prisoners/detainees described in section 1, above, occurred;

When known to the Company, the cause of death for each of the prisoners/detainees described in section 1, above; and

What actions the Company has taken or plans to take to reduce the number of deaths in its facilities. The annual reports described

above shall be posted on the Company’s website to reduce costs to shareholders.

Human Trafficking and Exploitation

Child sexual exploitation: Christian Brothers Investment Services, Proxy Impact, and several faith-based ICCR members launched a new effort last year to enlist corporate support for ending child sexual exploitation online. Just one of three proposals went to a vote in 2019, earning 33.9 percent at Verizon Communications. Also last year, CBIS ended up withdrawing at Apple after discussions with the company about its policies. This year, there are four proposals:

At Verizon and AT&T proponents want:

a report on the potential sexual exploitation of children through the company’s products and services, including a risk evaluation... assessing whether the company’s oversight, policies and practices are sufficient to prevent material impacts to the company’s brand reputation, product demand or social license.

At Alphabet, they want a report

assessing the risk of children being sexually exploited across the Company’s platforms and businesses...by February 2021, including whether the Company’s existing policies and practices are sufficient to prevent adverse impacts to children (18 and younger) and to the company’s reputation or social license.

At Facebook, proponents led by Proxy Impact seek the same sort of report, specifically about the risk of increased sexual exploitation of children as the Company develops and offers additional privacy tools such as end-to-end encryption. The report should address potential adverse impacts to children (18 years and younger) and to the company’s reputation or social license, assess the impact of limits to detection technologies and strategies.

Withdrawal—In a late-breaking development as this report was being finalized, the proponents withdrew at Verizon after the company agreed to conduct a child risk assessment across its business, provide metrics on its efforts to fight child sexual exploitation online and report annually to the board on these efforts.

FACEBOOK AT CENTER OF STORM OVER CHILD SEXUAL EXPLOITATION ONLINE

MICHAEL PASSOFF

CEO, Proxy Impact

There has been an explosion of child sexual abuse material (CSAM) online and it is likely going to get much worse unless tech companies take more aggressive action to stop it. What was once the province of individual child predators taking photos for their own use has–through the proliferation of smart phones, social networks, and data storage—increased exponentially with the growth of the internet and children going online. (One third of Internet users are children and 800 million kids now are on social media.)

Trafficking: The Adrian Dominican Sisters have withdrawn a proposal at Amazon.com that asked for a report on the company’s “management systems and processes to implement its commitment to prohibit human trafficking in its operations.” It pointed out what it saw as deficiencies in the company’s implementation of a policy against trafficking—contrasting it to other companies including Albertsons, Costco, FedEx and UPS that work with groups such as Truckers Against Trafficking to take proactive measures. It noted the vast array of delivery services commanded by the company. The withdrawal came after the company agreed to engage further on the issue with investors; increase disclosure of its prevention efforts to prevent and raise awareness of the problem. It also agreed to partner with Truckers Against Trafficking.

U.S. slavery reparations: In a first, an individual named March S. Gallagher has proposed that the railroad CSX take steps to atone for pre-Civil War slavery through a company it now owns. The resolution asks that the company

set aside sufficient funding to commission a study, beginning no later than the fourth quarter of 2020, to determine how the corporation can best atone for its participation in slavery. The commission, made up of recognized scholars with knowledge and experience in reparations, will: (1) study how other corporations have atoned for slavery; (2) formulate CSX’s own atonement with an emphasis on apology and community-building reparations through an atonement trust fund; and (3) clarify the historical record regarding CSX’s participation in slavery so that the corporation’s shareholders and the public at large understand why atonement is being made.

The body of the resolution makes the case for reparations given current economic disadvantages for African Americans, noting that the U.S. government has paid reparations to Japanese Americans forced into internment camps during World War II and the German government to Holocaust victims. It says, “Many companies benefitted from the use of slave labor during the time it was legally sanctioned.” Further, it notes that CSX now owns the Richmond, Fredericksburg & Potomac Railroad, which “is still operating on infrastructure built with slave labor,” which produced capital for the company.

CSX has challenged the resolution at the SEC, arguing it concerns ordinary business since it would micromanage the company and because it is not significantly related to the company’s business.

Weapons

Two proposals at firearms companies are pending from faith-based investors. The Episcopal Church wants to see a report from Olin, a new recipient, “on the company’s activities related to gun and ammunition safety measures and the mitigation of harm associated with gun products.” The company makes ammunition and licenses the Winchester brand to a gunmaker.

Catholic Health Initiatives has returned to Sturm, Ruger, where a resolution about gun safety earned 68.8 percent in 2018 but missed a filing deadline last year after the company switched its annual meeting date. The proposal this year seeks a report “with the results of a Human Rights Impact Assessment...examining the actual and potential human rights impacts of Sturm Ruger firearms sold to civilians.” The company is arguing at the SEC that it concerns ordinary business.

Finally, SumOfUs has withdrawn a resolution to Visa about facilitating gun sales through its payment network, because the proposal arrived past the submission deadline. It asked for a report on the risks to Visa from mounting public scrutiny of the role played by credit card issuers and payment networks in enabling purchases of firearms, ammunition, and accessories used to commit crimes, including mass shootings, and the steps Visa is taking to mitigate those risks.”

Offensive Products and Whistleblowers

The Nathan Cummings Foundation has resubmitted a proposal about Amazon.com’s approach to hate speech and products that foment it on the company’s platforms. It earned 27.2 percent in 2019 and again asks for a report on

efforts to address hate speech and the sale or promotion of offensive products throughout its businesses. The report should...discuss Amazon’s process for developing policies to address hate speech and offensive products, including the experts and stakeholders with whom Amazon consulted, and the enforcement mechanisms it has put in place, or intends to put in place, to ensure hate speech and offensive products are effectively addressed.

The proposal raises the issue of hate speech and its prevalence among product offerings on Amazon’s platform, saying that while Amazon has a policy against offensive materials, it appears to be applied inconsistently, citing examples of various white supremacist paraphernalia available for purchase on the site. Nathan Cummings points to other companies that have experienced boycotts over similar issues, and notes tightening hate speech legislation in Europe that comes with fines for non- compliance. The proponent also makes a case that employee engagement and satisfaction may suffer if the company allows hateful materials on its platform. Amazon said last year that it takes these issues seriously, and pointed to its policies on the subject; it said that as part of its enforcement activities around the world in a wide array of cultural contexts, it “seeks information about potentially offensive products from various sources including customer contacts, social media posts, and the press.” The company uses an automated process to support its offensive products policies and may include human intervention in ambiguous cases.

A new proposal at Alphabet from Trillium Asset Management wants to see more scrutiny of whistleblower protections. It asks for a report “evaluating” these policies “and assessing the feasibility of expanding those policies and practices above and beyond current levels to cover, for example, information concerning the public interest and/or information concerning rights contained in the United Nations Declaration of Human Rights.” The resolution says that protecting employees who identify dishonest behavior “is vital to a well-functioning system,” but such protections are patchy. It notes human rights groups urged subsidiary Google to provide protections to employees who felt the company is “failing its commitments to human rights.” The company faced an employee walkout connected to employee unionization efforts in November, the resolution notes; the company fired employees who were protesting company work they found ethically objectionable, such as its work in China and that for Project Maven, an artificial intelligence offering for the Department of Defense that the company later cancelled.

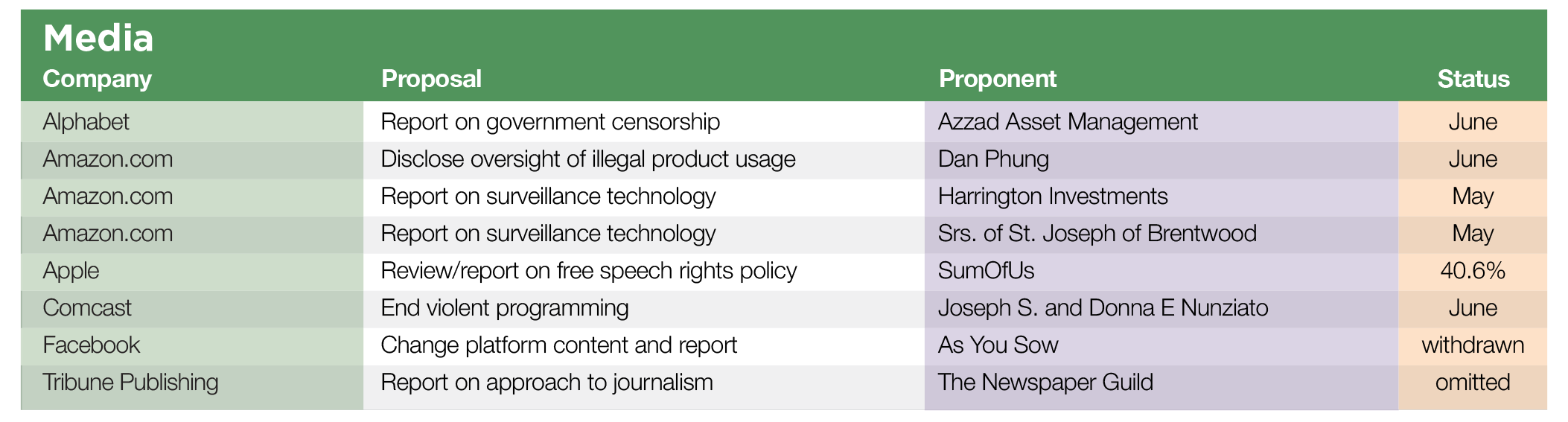

Media

Investors continue to file shareholder resolutions that mirror the public debate about the influence of electronic media and platforms on public and private discourse and behavior—and the related risks to companies. Resolutions continue to focus on problematic content, with a few new ones this year from individual investors that seem headed for omission. Cybersecurity may be on the agenda again at one more company, but information on a pending proposal is not yet public.

Platform Content and Restrictions

Azzad Asset Management has a new proposal to Alphabet for a report “assessing the feasibility of publicly disclosing on an annual basis, by jurisdiction, the list of delisted, censored, downgraded, proactively penalized, or blacklisted terms, queries or sites that the company implements in response to government requests.”

At Amazon.com, individual Dan Phung characterizes as illegal the use of Amazon Web Services by Amazon’s customer, Palantir, for a contract with U.S. Immigration and Customs Enforcement. It reasons that Palantir’s efforts to identify people for deportation are forbidden by laws in several states, and that because illegal activity is contrary to the terms of service, this is a violation of company policy. It notes company employees have protested the contract, which its says disrupted operations and hurt the Amazon’s reputation in a key demographic from which it draws talent. The company is contending at the SEC that this concerns ordinary business since it is about customer relations.

At Apple, investors voted on a new resolution from SumOfUs. The SEC rejected a company challenge arguing that it was similar to an earlier proposal that did not earn enough support for resubmission, and investors on February 26 gave 40.6 percent support for a request that it produce annual reports

regarding the Company’s policies on freedom of expression and access to information, including whether it has publicly committed to respect freedom of expression as a human right; the oversight mechanisms for formulating and administering policies on freedom of expression and access to information; and a description of the actions Apple has taken in the past year in response to government or other third-party demands that were reasonably likely to limit free expression or access to information.

Several members of the Nunziato family want Comcast to curtail programming that shows the use of guns, asking that it

draw up a plan and begin implementing it to eliminate, step by step, all violence being shown on our network, beginning six months from passage of this proposal, and completed in no more than seven years. This would include all programming, past, present and future, whether produced by Comcast, our subsidiaries, or other companies that rent or lease our channels, specifically, anything showing automatic or semi-automatic weapons would be eliminated in no more than two years.

The company has challenged the proposal at the SEC, arguing it concerns ordinary business since it relates to programming and related business choices.

After an SEC challenge, As You Sow withdrew a proposal that suggested ways Facebook could change its business model to eliminate many of the reputational and legal risks that the company faces. It asked for a “reboot” by September in which the company would:

Delete all images of child pornography and torture, remove all associated accounts, and work with law enforcement to bring abusers to justice;

Delete all fake accounts and establish a verification system to improve expeditious removal;

Delete all political ads containing lies and mistruths based on Facebook employee recommendations to avoid adverse impact on our political system;

Publicly agree to a policy stating that Facebook will abide by campaign advertising rules like all U.S. broadcasters and end micro- targeting of groups smaller than 5,000 people;

As a show of Goodwill and until the platform can be effectively monitored, disallow any political ads Labor Day through the 2020 election;

Provide full transparency of the Reboot process including listing deleted political ads, Bots, fake accounts, fake news, deepfakes and accounts closed;

Disclose budget committed to fix these issues to inform other platforms as a case study of best practices; and

Establish systems to maintain all of the above going forward with public transparency.

A final resolution to Tribune Publishing has been omitted on procedural grounds. It sought “an annual “journalism report” detailing the company’s commitment to its core product—news. Available to investors, this report should... consider the relative benefits and drawbacks of the Company’s approach to journalistic integrity...”

Surveillance

Two proposals at Amazon.com address concerns about surveillance and technology. Harrington Investments has resubmitted a proposal that survived an SEC challenge last year and went on to earn 28.2 percent. It asks the company to report by September after commissioning an independent study that would examine

The extent to which such technology may endanger, threaten, or violate privacy and or civil rights, and unfairly or disproportionately target or surveil people of color, immigrants and activists in the United States;

The extent to which such technologies may be marketed and sold to authoritarian or repressive foreign governments, identified by the United States Department of State Country Reports on Human Rights Practices;

The potential loss of good will and other financial risks associated with these human rights issues.

The other resolution is from the Sisters of St. Joseph of Brentwood. They earned 2.2 percent last year for a proposal seeking a ban on facial recognition software. This year, they ask for “an independent third-party report...assessing Amazon’s process for customer due diligence, to determine whether customers’ use of its surveillance and computer vision products or cloud- based services contributes to human rights violations.” Amazon is arguing at the SEC that the resolution duplicates the Harrington proposal, which it received first; this challenge is likely to succeed.

Sustainable Governance

The convergence between more traditional concerns about how companies are governed and social and environmental topics continues. This interest is expressed in proxy season in resolutions about how companies make their overarching social and environmental policy decisions—and who is on the board to do so—as well as in proposals about how companies make themselves accountable to their investors on strategic sustainability issues. This section examines these issues, looking at board diversity, board oversight and sustainability disclosure. We also include discussion of proposals about executive pay links to ESG issues, which continue to increase in number, and those about ESG proxy voting policies at mutual funds.

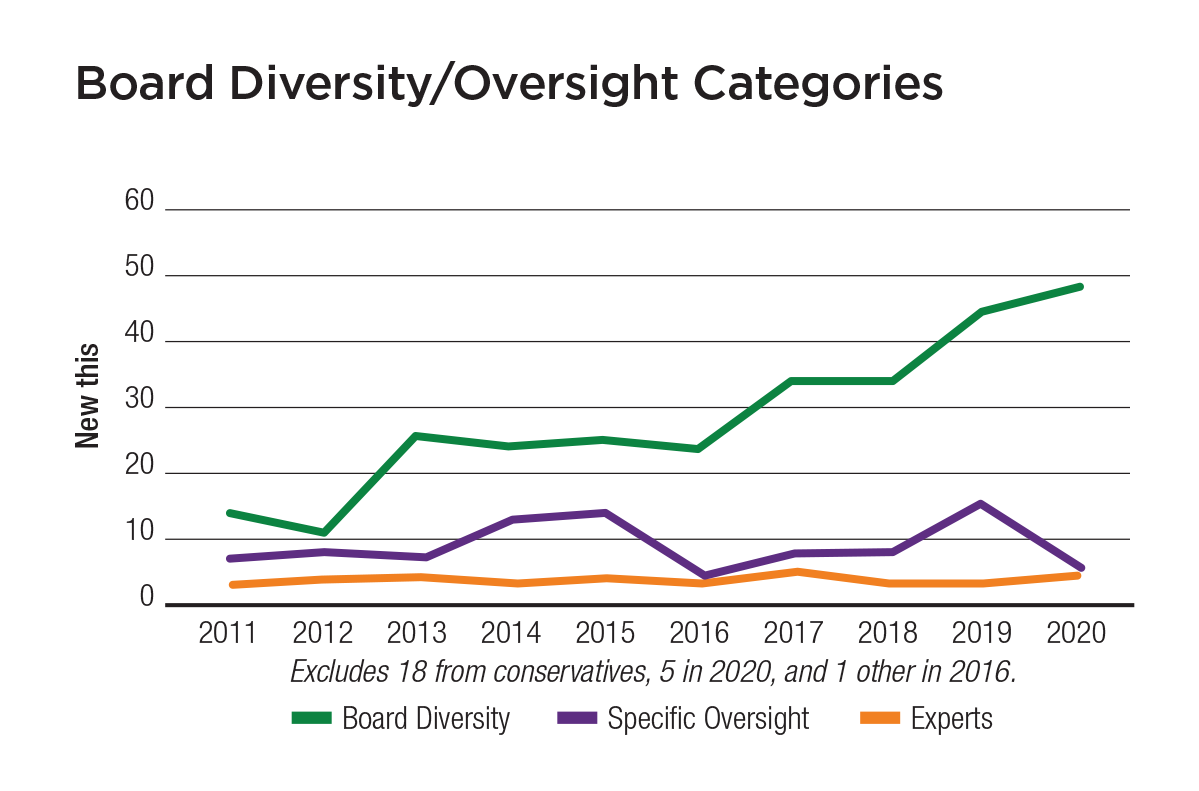

There are 59 resolutions about boards, nearly as many as the 64 filed on these issues in 2019; 49 focus on board diversity and another 10 address a variety of board oversight matters. But this year shows a big drop in sustainability reporting resolutions (five, down from two dozen last year), although the number asking for links between various ESG issues and executive pay is about the same as last year (23). Four are on proxy voting and seven new resolutions ask companies about their support for new Business Roundtable Statement of Purpose that expands the definition of the stakeholders companies say are relevant.