2017 Proxy Season Review

The 2017 spring proxy season ended with a bang, with long awaited success for investor activists bolstered by mainstream investors, tempered by legal peril for the entire shareholder resolution process. By far the most significant vote was the 62 percent result for a climate risk proposal at ExxonMobil’s May 31 annual meeting—which occurred after the mutual fund giants BlackRock, Vanguard, and Fidelity decided for the first time to lend their support. Exxon has considered shareholder resolutions for many years and has been a high profile target for shareholders but the highest vote until now was 38.1 percent for a climate strategy resolution in 2016. The new vote at Exxon was not the only unusually high climate tally of the season, given the change in voting by the large funds; still, while several voted in favor of a few climate resolutions, for the most part they continued not to support shareholder resolutions.

But the ink on celebratory press releases was hardly dry when the House of Representatives’ approved the Financial CHOICE Act in June 2017. Its passage would gut the shareholder proposal process and also walk back many of the Obama-era financial reforms; while as of February 2018 it still is not expected to pass the Senate, it nonetheless sets out long-held aspirations of those who have opposed shareholder resolutions for years. Efforts to significantly scale back the ability of investors to file and proposals do seem to have made their way into SEC Staff Legal Bulletin 14I, issued on November 1, but its full impact remains to be seen. Other efforts for a full-blown rulemaking to restrict shareholder rights remain an aspiration for the U.S. Chamber of Commerce, the Business Roundtable and others—who may yet see their ambitions come to fruition in the Trump administration.

Resolution trends:

After a dip in 2016, the total number of environmental and social policy shareholder resolutions filed in 2017 rose substantially, reaching a record of 494 by the end of the year—compared with 433 in 2016 and 462 the year before. The marked increase in volume during 2017 came not from environmental resolutions, but rather from social policy issues— specifically a raft about equitable pay (which continue in 2018), as well as a campaign with 20 resolutions about the Holy Land Principles (which have not continued).

In all, there were seven majority votes among the 237 that investors considered on proxy ballots—down from a record 243 votes in 2016 but still above the 221 voted on in 2015. Dips during 2016 in the rate of proposals withdrawn and omitted reversed, however, and proportionally more companies than in the previous few years persuaded the SEC that they could omit resolutions. This trend seems to be continuing in 2018, although it is too early for definitive conclusions yet.

Average overall support was 21.5 percent in 2017, up from 21.1 percent in 2016 and 20 percent in 2015.

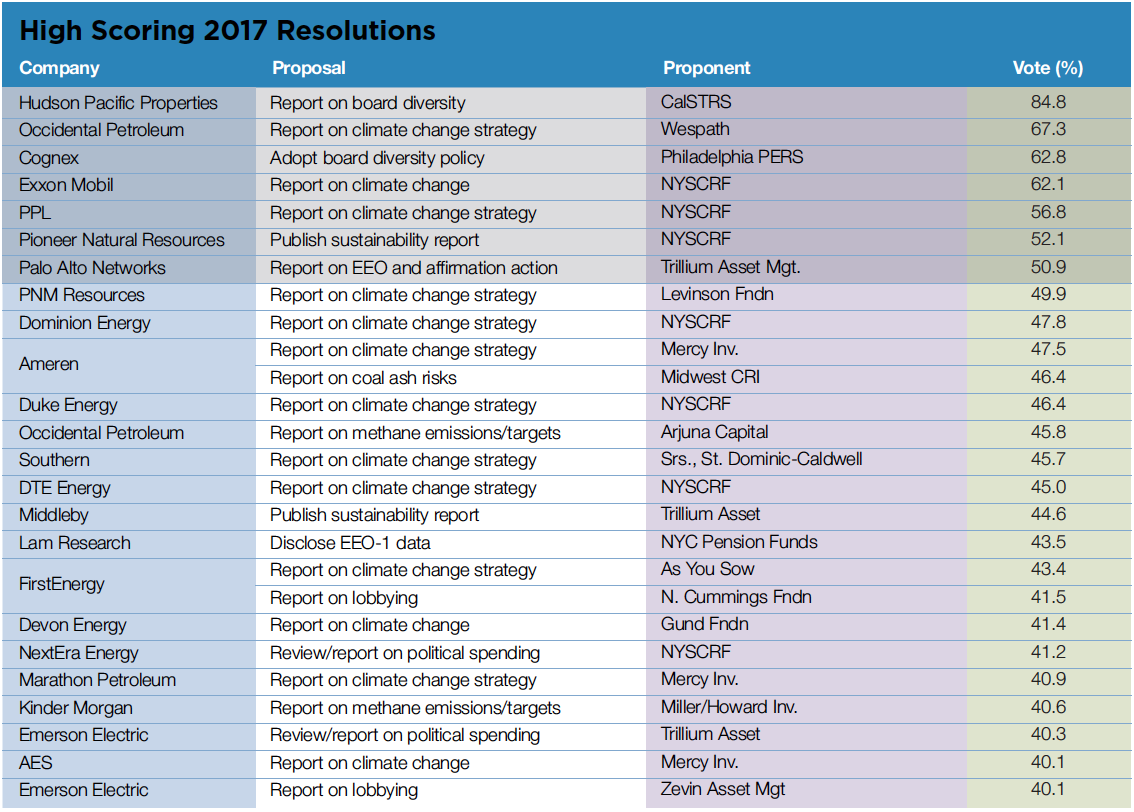

Majority votes—Investors cast majority votes in favor of board diversity with wide margins at the real estate firm Hudson Pacific Properties (84.8 percent) and the scientific instruments firm Cognex (62.8 percent). But climate change also came into its own in 2017, reflecting the global scientific consensus about its risks that many on Wall Street seem to have taken to heart: shareholders gave climate risk reporting proposals 67.3 percent at Occidental Petroleum, 62.1 percent at ExxonMobil and 56.8 percent at the utility PPL. A sustainability reporting proposition at Pioneer Natural Resources, another oil and gas firm, also received a majority of 52.1 percent. In December, a request for a report on equal employment and affirmative action at cyber security firm Palo Alto Networks received 50.9 percent support from shares cast for and against, as well, although the company counts abstentions as votes against and reports it did not pass. This was the highest vote to date for this issue and the first majority. (There were eight majorities in 2016 for proposals opposed by management, as well.)

Withdrawals—Company action that usually involves more disclosure as well as shifts in policy are the prime objective of shareholder proponents. In the end, they withdrew 173 resolutions in 2017, nearly always because of negotiations. In volume, this is below the all-time high of 181 withdrawals back in 2014 but a bump-up, as noted, from 139 in 2016.

In major 2017 subject categories, proponents were far and away most likely to withdraw board diversity resolutions (fully 73 percent of filings on that subject). They also withdrew half the resolutions on workplace diversity and nearly the same proportion (46 percent) of those on board oversight. In what may not be surprising in this age of political discord, proponents withdrew just 17 percent of resolutions they filed asking for more corporate political spending transparency; the majority of these dealt with lobbying.

High scorers—In addition to the majority votes, another 19 earned between 40 percent and 49 percent (table, below). As in 2016, more of the top-scorers related in some way to the environment and sustainability (14) than any other categories; three more concerned election spending or lobbying.

SUMMARY RESULTS BY TOPIC

This section describes the main topics raised in proxy season, highlighting new issues, continued big campaign and significant results.

Environment

Environmental issues included climate change, environmental management (mostly recycling), toxics and industrial agriculture (including pesticides and animal welfare). Additionally, proposals on sustainable governance encompassed elements of environmental issues as well as social impacts and related corporate governance, looking at board diversity, board oversight and disclosure and management.

Climate Change

The proxy season produced the several unprecedented votes on climate change, as noted, including the three majorities plus 13 more above 40 percent. A total of 90 resolutions focused specifically on climate change (additional sustainability reporting proposals also invoked climate-related subjects).

Impacts and strategies:

Twenty-seven resolutions took up different aspects of climate risk and the ways in which companies are grappling—or not—with these challenges, including potentially stranded assets. Proponents went to nine fossil fuel producers and 12 utilities; investors responded across the board with high levels of support for more disclosure. Fifteen of the 22 proposals were resubmissions. The unprecedented majorities at ExxonMobil (62.1 percent) and Occidental Petroleum (67.3 percent) appear to show that many investors agree companies provide more transparency about their longterm portfolio risks from governments action to curb global warming in line with the Paris climate treaty. A new resolution to Marathon Petroleum went even further, asking about impacts from a business plan that would cut warming to well below the treaty’s 2-degree aim; it earned 40.9 percent. The utility votes were especially high, with a 56.8 percent majority at PPL and seven more proposals over 45 percent.

Proponents withdrew when Anadarko Petroleum and Chevron agreed to provide more climate risk projections, while NRG Energy, Southern and Xcel Energy also saw withdrawals when they agreed to provide more risk management information. The SEC turned back arguments from companies that contended current reporting made more disclosure moot.

Shale energy:

With 15 proposals, investor attention to shale energy sharpened to focus more particularly on methane emissions and leaks. (In 2018 this is the main focus.) Among the five votes, high scores included 40.6 percent at Kinder Morgan and 45.8 percent at Occidental on requests for reduction goals. (The Occidental vote rose from 33 percent in 2016.)

After a majority vote in 2016, the California State Teachers’ Retirement System (CalSTRS) reached an agreement with WPX Energy, which agreed to provide more information. Three other utilities—Sempra, Southern and WGL Energy—also agreed on more disclosure and prompted withdrawals, which numbered 10 in all.

Carbon accounting:

Investors filed about two dozen resolution on GHG emissions accounting in 2017, 10 were withdrawn, 10 voted and five omitted. A new push included the proposition that companies should set targets to achieve net-zero emissions, but these earned far less than more general and familiar proposals to set goals and report on them. Four votes for the latter “traditional” carbon accounting resolutions were in the 30-percent decile, with the highest being 36.7 percent at Fluor.

Amalgamated Bank and Jantz Management proposed the net-zero resolutions, the highest of which resulted in 23.9 percent for a report request at PayPal. The SEC opined that two detailed resolutions seeking the establishment of these more aggressive goals were ordinary business issues companies need not put forth for shareholder consideration, but it found reporting on such goals acceptable. (In 2018, it seems to have reversed this view, however, as noted by Jackie Cook.)

Renewable energy:

In a dozen proposals, proponents asked big energy producers and users to set goals for employing more renewable energy. Requests for reports on such goals earned the most—the highest being 24.8 percent at Kroger. A single reprise of the mostly-abandoned tack to encourage greater use of distributed energy earned much more, though—35 percent at Entergy. There were seven votes and five withdrawals in all during 2017. (A decision in late February at the SEC about a renewable energy goals proposal at Gilead Sciences suggests proponents will have to reformulate requests on this topic going forward; the SEC agreed with the company’s assertion this concerns ordinary business given a focus on energy costs.)

Other climate issues:

New resolutions tying action on deforestation to both climate and human rights problems produced scores of about 23 percent at Domino’s Pizza and Kroger, with proponents seeking action in these firms’ commodity supply chains. A new proposition that Berkshire Hathaway divest from fossil-fuel related companies came in with a particularly low vote of just 1.3 percent. On the other hand, Arjuna Capital won 26 percent at Chevron asking it to consider selling off high carbon assets. The “climate dividend” idea, that oil companies should give money to investors instead of developing their reserves, remains unpopular with shareholders, however, and votes on this issue were less than 4 percent. On coal, though, shareholders are keen for more information about coal combustion residuals from Ameren, where the vote was 46.4 percent.

Environmental Management and Toxics

Half of the 16 proposals about environmental concerns outside the direct climate arena were on recycling, as has been the case for some years. The highest vote—out of six overall on environmental management—was 32 percent at McDonald’s on cutting the use of Styrofoam cups; this vote helped lay the groundwork for the company’s decision in 2018 to end all use of Styrofoam, a major victory for the proponents. On a closely related angle, both Amazon.com and Target agreed to curb foam packing. Food waste is also an emerging concern and a repeat resolution asking for details at Whole Foods Market attracted 30.4 percent support. (A similar proposal is before Amazon.com in 2018, given its purchase of Whole Foods.)

There were no votes on toxic materials, since the SEC decided a new proposal seeking company help to educate the public about lead risks was ordinary business at Lowe’s, although Home Depot agreed to work on it and prompted a withdrawal from Arjuna Capital.

Industrial Agriculture

Eighteen filings yielded a mixed bag of 11 votes and seven withdrawals.

Antibiotics:

In the realm of food production, a recurrent push from ICCR to get companies to restrict antibiotic use in the meat supply chain continued and attracted its highest support of 31.5 percent at Sanderson Farms, which contests the science connecting agricultural use of drugs with growing antibiotic resistant illnesses. (The vote in 2018 was 43.1 percent, showing investors remain concerned.) At McDonald’s, a resolution seeking an extension of the company’s ban on antibiotics for chicken to beef and pork also earned 31 percent. Such an extension is more difficult since beef and pork production is less vertically integrated than chicken farming, but going forward attention to the issue is likely to continue given the threat to human health.

Pesticides:

Otherwise, regarding pesticides, As You Sow raised the new issue of pre-harvest glyphosate treatment in a resolution it withdrew at Kellogg, which agreed to explore how often this occurs among its suppliers as part of its focus on sustainable agriculture. Investors also gave significant support of 31.6 percent at Dr Pepper Snapple Group for a report on how it can cut pesticide use by its suppliers to protect pollinators that appear to be hurt by the use of neonicotinoids.

Farming practices:

The highest scoring of just four resolutions on the treatment of animals was 24.3 percent on a proposal to cereal company Post Holding, seeking a report on brand risks connected to caged egg production. Egg products make up 28 percent of the company’s net sales and Post says it is committed to a transition to cage-free housing. A new proposal at Tyson Foods combined climate concerns with animal welfare, but Green Century Capital Management ended up withdrawing that request for evaluation of the potential impact on Tyson of more vegetarians when it learned the company had acquired Beyond Meat, a meatless protein firm.

Social Issues

Animal Welfare

Investors put to bed a resubmission of a 2016 proposal from PETA on how a Texas monkey farm owned by Laboratory Corp. of America might become a vector for the spread of the Zika virus, giving it just over 4 percent and not enough for resubmission. Shareholders also gave scant support (2.6 percent) for a Charles River Labs resolution on banning business with primate dealers and labs that have violated the Animal Welfare Act. But the proposal highlighted the Trump administration’s move early in the year to yank animal use reports from the U.S. Department of Agriculture website. That has prompted a spate of Freedom of Information Act requests since.

Corporate Political Activity

Shareholder proponents continued their push for more disclosure from companies about their spending on lobbying and elections, with the focus most intense on lobbying. The lobbying proposal votes drew even in 2017 with those on elections (both averaged about 27 percent, erasing a previous spread of a few percentage points that favored election proposals). The withdrawal rate for both types overall is relatively low, although proponents remain more likely to withdraw election resolutions than those about lobbying. In all, there were 67 votes in 2017 on corporate political activity, with 18 withdrawals and five omissions.

Proponents encountered a new problem that arose at Anthem when it successfully challenged a lobbying proposal that the SEC agreed was like earlier election spending proposals since both mentioned trade group spending, which encompasses both lobbying and election activity. Careful drafting in the future could solve the problem and allow both subjects to be raised at a single company.

Lobbying:

Votes above 40 percent occurred at FirstEnergy and Emerson Electric, while four more were in the high 30-percent range at AT&T, Honeywell International, Travelers and Walt Disney. A notable withdrawal occurred at Pinnacle West, where the company has come under fire for its efforts to influence the Arizona public utilities commission; the utility agreed to provide more information on both lobbying and contributions to non-profit charities, social welfare groups and political committees—a key point of contention.

Election spending:

The overall average for Center for Political Accountability (CPA) proposals fell, as did the number filed, although there were several high votes—just above 41 percent at both Emerson Electric and Next Era Energy. The average dropped from earlier results given tallies in the low teens at Alphabet, Berkshire Hathaway and Expedia, and just under 8 percent at Occidental Petroleum.

At least three of the seven withdrawals came at companies with previous high votes—Fluor (61.9 percent last year), McKesson (44.4 percent in 2016) and NiSource (50.3 percent in 2016). All three agreed to the CPA-defined oversight and disclosure approach.

Other political issues:

Six of seven additional filings on political money went to votes. Investors gave the most support to the AFL-CIO’s proposition that companies end premature vesting of equity awards when employees leave for government jobs—what the union terms “government service golden parachutes.” This earned 35.5 percent at Citigroup but less at JPMorgan Chase (26.8 percent) and Morgan Stanley (17.7 percent).

Decent Work

The big surge that started in 2016 with pay equity proposals grew further in 2017, with a total of 53 filings on this plus labor standards and working conditions more broadly. Votes were not high—in the teens—but proponents withdrew half of the pay equity resolutions after agreements for more reporting by companies. The highest vote was 18 percent for a report on gender pay equity at Travelers. Just four proposals that addressed pay equality more generally went to votes but earned little support— the highest was 7.4 percent at CVS.

Resolutions on working conditions produced higher support, with 28.1 percent for an accident prevention resolution at Du Pont, down from 30 percent last year. Companies promised more reporting on supply chain labor standards in response to the New York State Common Retirement Fund (NYSCRF) and it withdrew five proposals; one was omitted on ordinary business grounds, however.

Diversity in the Workplace

Twenty-nine resolutions in 2017 on workplace diversity and more opportunity for women and minorities complemented the pay equity proposals with a call to end discriminatory practices beyond compensation, but also addressed LGBTQ rights. In the end, there were 14 votes, 13 withdrawals and two omissions.

While the pay equity resolutions focused for the most part only on women, the workplace diversity slate included race, reflecting the national conversation. Four votes were over 30 percent at financial firms: First Republic Bank (32.9 percent), T. Rowe Price (36.8 Percent) and Travelers (36.4 percent), as well as for the long-time resolution at Home Depot (33.6 percent). Given agreements to adopt LGBT policies, no proposals went to votes out of seven filings. One new angle came up in a proposal to Amazon.com about potentially discriminatory use of background checks in hiring, but it earned just 7.3 percent.

A notable SEC decision occurred at Cato, where the commission staff agreed that a proposal to include LGBTQ protections in the company policy was moot given putative federal protections. The company argued court decisions ensure the federal protections, but no law is in place to that effect. The company’s policy also does not explicitly protect LGBT workers.

Human Rights

Half of the human rights resolutions were about the Israeli-Palestinian conflict while the rest addressed a variety of mostly longstanding issues. In all, there were 68 proposals on human rights; 25 went to votes, 22 were withdrawn, 18 were omitted and three more did not go to votes for other reasons.

Conflict zones:

Despite many filings, the 29 resolutions about conflict zones for the most part got very low votes. The campaign for the Holy Land Principles about fair employment attracted little traction and eight votes missed resubmission thresholds, while the SEC turned back an attempt by the Holy Land Principles organization for a second type of resolution (following missed resubmission thresholds on the main proposal) asking for a breakdown of Arab and non-Arab employees.

More successful was a resolution from the Heartland Initiative at Merck, which earned 23.6 percent. It was a detailed request for information on the company’s approach to doing business in “situations of belligerent occupation”—including but not limited to the Middle East. (A resolution with this approach was filed in 2018 at First Solar.)

Other issues:

New proposals addressed the rights of indigenous peoples and earned the highest support, with 35.3 percent at Marathon Petroleum. Companies appeared somewhat willing to negotiate and Goldman Sachs prompted a withdrawal after it agreed to report, as did Morgan Stanley and Phillips 66. Few additional human rights proposals went to votes. The highest score was 29.1 percent for a request asking Newmont Mining to provide a human rights risk assessment. But proposals about technology and privacy all fell (again) to the ordinary business exclusion, as did resolutions on the penal system that included ones about execution drugs. Resolutions seeking corporate affirmation of the human right to water all were withdrawn by NorthStar Asset Management after companies agreed to policy changes.

Media

Among five resolutions a new one asking Alphabet and Facebook to report on the risks posed by “fake news” touched on a key point of public contention but investors did not appear to think much of it; since votes were 1 percent or less the proposal failed to earn enough for resubmission. (Investors are trying again in 2018 with a slightly different approach about content management.)

Sustainable Governance

Proponents increasingly have added a corporate governance flavor to their requests that companies reform how they handle a wide range of social and environmental risks, seeking to change the composition of boards, to ensure proper oversight of sustainability and to report using commonly agreed upon standards.

Board Diversity

Proposals seeking greater diversity on corporate boards have always attracted lots of support from investors at large, but in 2017 there were spectacularly high scores—62.8 percent at Cognex and 84.8 percent at Hudson Pacific Properties, with just eight votes overall and 24 withdrawals after companies agreed to change their board recruitment policies to include more women and minorities. A new feature introduced in 2017—and continued into 2018—was the “Rooney Rule” idea borrowed from the National Football League, that at least one candidate should be a woman or minority. Also new was a focus by the UAW Retirees Medical Benefits Trust on smaller companies in the Midwest.

There were 34 resolutions filed in 2017 on board diversity, but proponents endued up withdrawing 25 of them.

Board Oversight

Proponents filed 13 more resolutions seeking more explicit board involvement in ESG oversight; six went to votes and six were withdrawn. Support was in the teens for resubmitted resolutions to Chevron and Dominion Energy, but proponents logged what they saw as a big win when ExxonMobil elected atmospheric scientist Dr. Susan Avery to its board in January. Trillium Asset Management also reported success in its effort to concentrate pharmaceutical company boards’ attention on safety and quality when it convinced Zimmer Biomet to add more explicit board responsibility for this issue and increase its disclosure.

Disclosure and Management

Reporting:

Sustainability reporting proposals peaked in 2014 but the number of votes has not fallen precipitously since proponents recently have been withdrawing proportionally far fewer than in the past. In 2017, there were 26 resolutions filed seeking more reporting; proponents withdrew 15 and another 11 went to votes. The results were again substantial, with a 52.1 percent majority at Pioneer Natural Resources, where its disclosure lags peers, followed by 44.6 percent at Middleby.

While resolutions asked for more reporting on many social and environmental issues, the most common requests were about climate change. In a notable withdrawal, after annual resolutions since 2011 that attracted ever-increasing levels of support, Emerson Electric agreed to produce a sustainability report, adding to the total of 12 withdrawals.

Links to pay:

Investors gave mostly low marks to eight proposals that went to votes seeking explicit links between various sustainability issues and executive pay, as in the past and despite some movement by companies to adopt such measures. Still, three votes came in around 20 percent or more: Discovery Communications (19 percent, double last year’s vote), 21.8 percent at Expeditor’s International of Washington and Walgreens Boots Alliance (23.1 percent, way up from only 5.7 percent last year.) Yet proposals asking for ESG links from some proponents—Mercy for Animals, an animal rights group, and the Heartland Initiative that has focused on the Arab-Israeli conflict—each earned less than 5 percent. Two more were withdrawn and two were omitted.

(In 2018, proponents seem undaunted by these results and have filed a slew of proposals invoking a range of different issues; see here).

Proxy voting:

The decision by mutual fund giant BlackRock and other big funds to support at least some climate change resolutions proved to be a game changer in 2017 and proponents with a resolution asking the fund to examine its proxy voting practice on climate change and other ESG issues withdrew after it agreed to do so. An additional new wrinkle at BlackRock came in a proposal about supporting LGBTQ non-discrimination proposals; Trillium withdrew after the fund agreed to address the subject as part of its discussions about human capital management with its portfolio companies.

Ethical Finance

Just one resolution about ethics and lending occurred in 2017—a proposal to Wells Fargo asking for a report on the “root causes” behind its business practices that prompted regulatory scrutiny last year. It earned 21.9 percent. (A slightly different formulation is also pending for 2018.)

Conservatives

Advocates for free market solutions—mostly the National Center for Public Policy Research (NCPPR)—kept up efforts to recruit companies to their approach. But NCPPR received no more affirmation than in the past from investors, with most proposals omitted and votes below 3 percent for those that made it onto proxy statements. New in 2017 were two ideas—that companies face risks from advertising in the mainstream media given its putatively inherent bias, and that corporate support for LGBT rights violates religious freedom rights. The SEC said both were ordinary business affairs and blocked any votes.