Proponents have filed at least 386 shareholder resolutions on environmental, social and sustainability issues for the 2019 proxy season, with 303 still pending as of February 15. Securities and Exchange Commission (SEC) staff have allowed the omission of only six proposals so far in the face of company challenges, far fewer than the 27 omitted at this point last year because the SEC was included in the recent six-week government shutdown. Companies have lodged objections to at least 54 more proposals that have yet to be decided.

Proponents have already withdrawn more proposals than they had last year—71, up from 62 in mid-February 2018. Usually these are a sign that proponents and companies have reached an agreement.

Last year, the overall tally of resolutions reached 460 by year’s end, down from 494 in 2017. The proportion voted on dropped by 10 percentage points, to 177 resolutions, the lowest level of the decade and well below a high of 243 in 2016. Proponents withdrew 210 resolutions in 2018, nearly half of all they filed. Companies omitted a total of 65 proposals after SEC challenges in 2018, down from 77 in 2017. (Bar chart)

Corporate political activity and environmental proposals (mostly on climate change) account for just under half of the resolutions this year. The categories of board diversity and oversight, sustainability, human rights and decent work each contribute about 10 to 12 percent. Diversity in the workplace makes up another 4 percent of proposals. The remainder are about health issues, media concerns, ethical finance and animal testing. (Pie chart)

Key Recent Developments

Mutual funds voting: Several of the huge mutual funds that have influential stakes in nearly every corner of the American financial markets have begun to pay attention to proxy voting on environmental, social and sustainability issues. This started in 2017 with votes supporting climate change and last year expanded to include proposals about the opioid epidemic and gun control. This pushed average support to more than 25 percent. Votes in 2019 are likely to be high, as well.

Possible changes to the proxy voting process: Growing votes, combined with Republican control of the White House and both houses of Congress until last fall’s election, seem to have sparked a backlash. Some trade organizations and business groups express the belief that many shareholder proposals create a bothersome distraction for boards and companies; they are continuing to press for changes to tighten up the SEC’s Shareholder Proposal Rule arguing that the proxy process is badly in need of an update. (The last rulemaking was in 1998, just as the Internet was taking hold and many agree some technical changes would improve the process, but there are significant differences of opinion about whether and how the filing and resubmission of proposals should be changed.)

Any change in the process likely would have to come from rulemaking by the SEC. One indicator of change is the shifting interpretation by SEC staff of what may be included in proposals, explained in interpretive bulletins released by the commission in late 2017 and 2018. Another was an SEC roundtable in mid-November where investors and companies exchanged fire over whether the process is broken. (The commission is continuing to invite comments, which can be viewed on the SEC website.) Meanwhile, on Capitol Hill, a bill that could impose some restrictions on proxy advisory firms that make voting recommendations on resolutions passed the House in 2017 and proceeded to the Senate, which held a hearing last December that largely replayed the viewpoints set out at the SEC roundtable. (See Update on Shareholder Proposal Rule Reform for more.)

INVESTORS DETERMINE MATERIALITY

Robert J. Jackson

Commissioner, U.S. Securities and Exchange Commission (SEC)

We are at a crucial moment in the history and future of our securities laws. I am delighted to have a chance to share my thoughts on the critical work that Proxy Preview is doing to help investors hold American corporations accountable to ordinary American investors.

New Proposals and Questions for 2019

Climate change: This issue is still a major feature of the proxy season, but there are fewer climate-related proposals in 2019, although some escalated the issue by including Paris-compliant transition language. It remains unclear if proposals seeking greenhouse gas emission goals will be struck down by the SEC following a surprise decision in 2018; several reformulated goals proposals will provide test cases. The New York City pension funds decided not to wait for the commission to weigh in and sued TransDigm in December to force the inclusion of a GHG goals proposal; the company ultimately settled, but similar cases may occur—pushing questions to the courts.

Environmental management: Plastic “nurdles” (also known as pellets) are being targeted as pollution that should be controlled at four petrochemical companies in a new campaign.

Corporate influence spending: Proponents of more corporate oversight and disclosure of election spending have revved up their longstanding campaign and filed a record 57 resolutions this year, double what was filed last year, although lobbying proposal numbers are down.

Decent work: Last year’s surge in gender pay equity proposals is continuing and a new resolution asks companies not to require mandatory arbitration and non-disclosure agreements, which proponents say is particularly harmful for victims of sexual misconduct but also can allow other malfeasance to fester.

Diversity at work: Half as many resolutions as in 2018 have been filed so far seeking data on gender, race and ethnicity of employees, but a new proposal is specifically targeting diversity in management.

Health: The Investors for Opioid Accountability coalition, in its second year, got an early win with a 60.5 percent vote at Walgreens Boots Alliance in January for a resolution seeking risk management disclosures. Its campaign at opioid makers, distributors and treatment makers continues, after two majority votes last year.

Human rights: New proposals ask about immigrant rights and detention, and online child sexual exploitation. New proposals at travel companies Booking and TripAdvisor ask how they avoid complicity in conflict zones.

Media: Alphabet, Facebook and Twitter continue to face questions about how they manage content and address risks posed by those who use their platforms to secretly influence elections and disseminate hate speech. Amazon.com is being asked about facial recognition software used by U.S. Immigration and Customs Enforcement (ICE) in a new proposal.

Board diversity and oversight: Alongside continued requests to diversify board nominees is a notable request to include sexual orientation and gender identity in the definition of desired diversity for directors. New proposals also raise pointed questions about a wide range of hot button issues—racism, immigrant detention, drug pricing and the social impact of Amazon.com’s business—with many SEC challenges.

Sustainability disclosure and management: Proponents are testing out a new idea—asking for reporting using the metrics defined as material by the Sustainability Accounting Standards Board (SASB). Resolutions about tying executive pay to a wide range of issues continue.

SEC Challenges

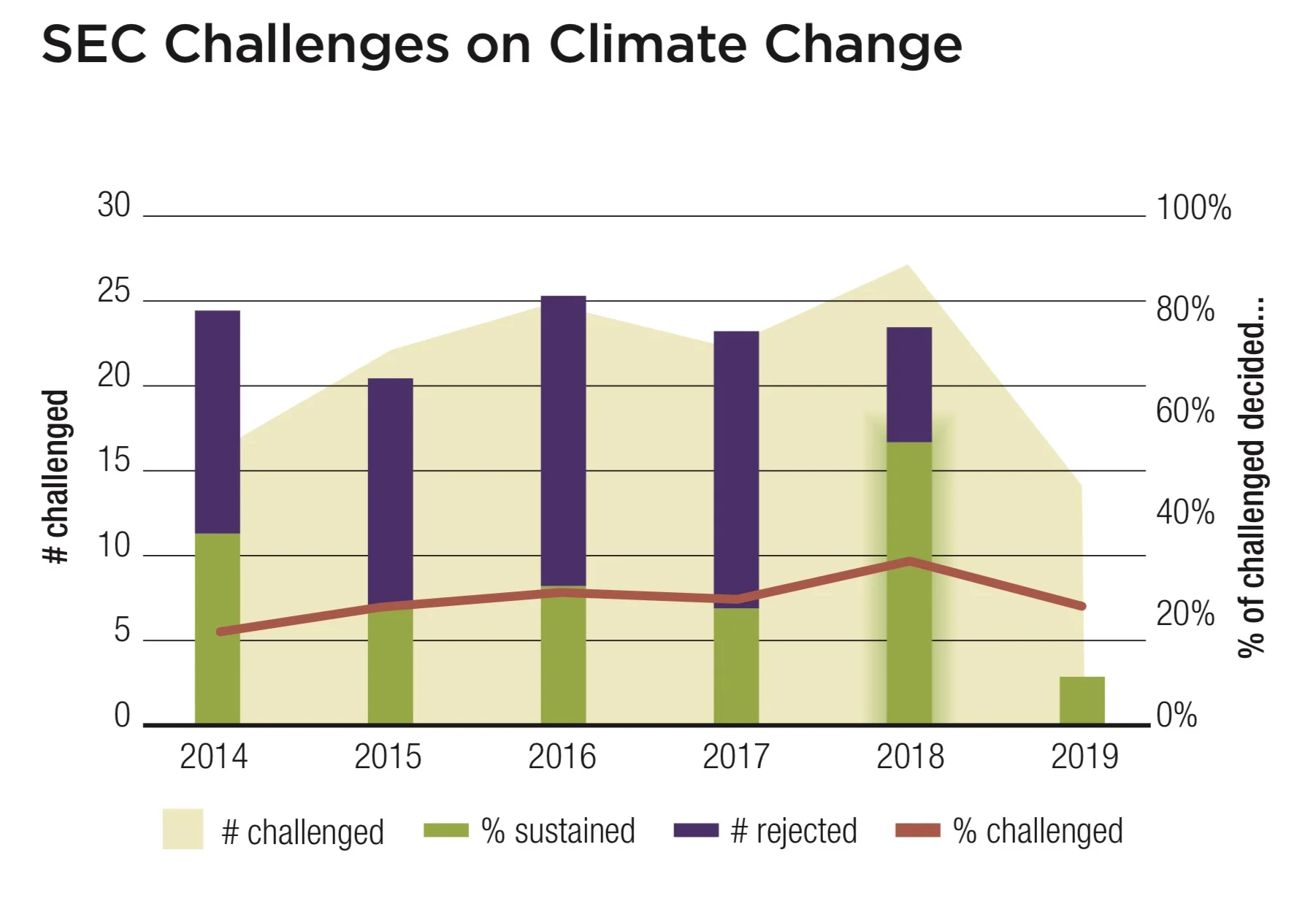

The ultimate impact of the SEC’s new clarifications of the Shareholder Proposal Rule in 2017 and 2018 remains to be seen. Overall, the new approaches did not substantially affect the outcome of challenges in 2018 (left graph); this was not true for climate-related proposals, however, which were disproportionately affected (right graph).

All are hampered by the lasting impacts from the six-week government shutdown that has left the SEC far behind in responding to 2019 company challenges. Incomplete figures based on data gathered by Si2 from proponents suggest that three-quarters of the challenges have yet to be decided, significantly lagging where things stood at this point in years past.