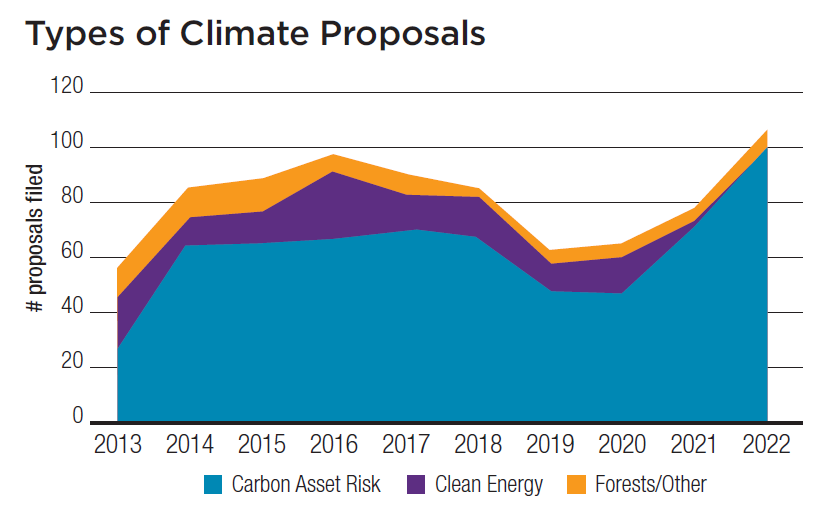

The 2021 proxy season marked the first time that average support for climate change resolutions surpassed 50 percent. The drumbeat for corporate action and disclosure is powered by mainstream investor concerns about impending financial risks, more evident each year with extreme weather and supply chain disruptions. Almost all the 2022 proposals ask about greenhouse gas (GHG) emissions goals and they are more specific than in recent years given a shift at the SEC. Also, proposals asking about climate-related public policy activities have nearly doubled.

As of mid-February, 101 proposals ask about carbon asset risk issues, including emissions, another eight are about deforestation and water; in addition, climate lobbying proposals have risen from 13 last year to at least 20. This year also is notable for the number of companies facing climate change resolutions for the first time.

It is too early to see the impacts last year’s surging support will have on the 2022 season. But last May’s unprecedented proxy fight at ExxonMobil, fueled by investors dissatisfied with its climate change stance, may have shifted engagement dynamics, and more withdrawals this year seem possible.

President Biden continues to take a very different approach to environmental protection than his predecessor. But his major climate-related initiatives included in the larger Build Back Better infrastructure bill are blocked, although some action still seems possible since the legislation is being deconstructed into smaller initiatives and holds the potential for substantially resetting the regulatory context for U.S. companies and investors.

Proponents: The Ceres coalition coordinates most climate change proposals, through its Investor Network on Climate Risk (INCR) and a broad coalition of investors, including many from the Interfaith Center on Corporate Responsibility (ICCR), the New York City and State pension funds, other state pension funds around the country, plus responsible investment firms and some individuals. Many support Climate Action 100+, a global initiative focused on more than 100 corporate carbon emitters that account for two-thirds of global industrial emissions and several dozen more companies the network says will be key to a “clean energy transition.” Climate Action 100+ is now backed by 617 institutional investors with assets of more than $65 trillion.

Carbon Asset Risk

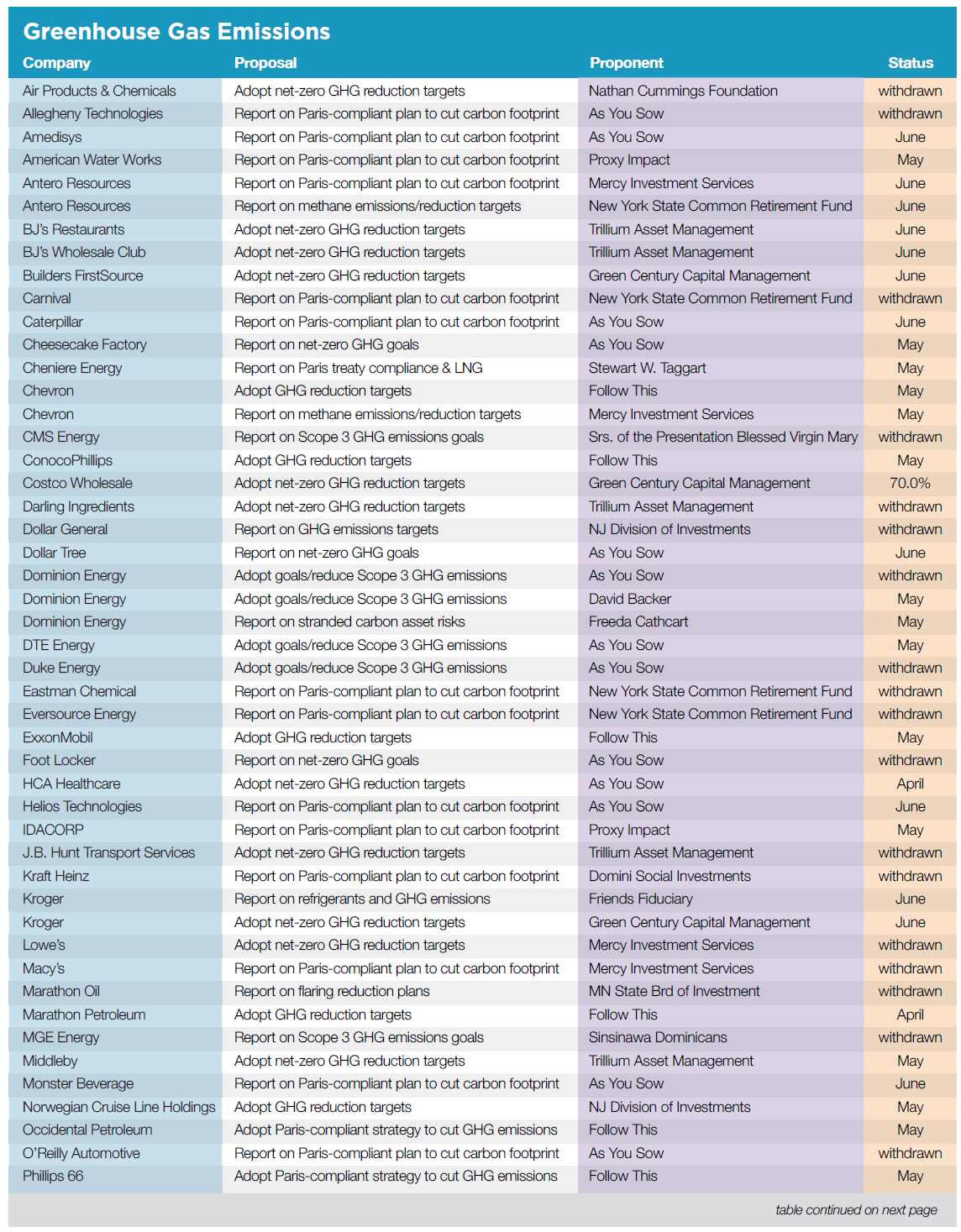

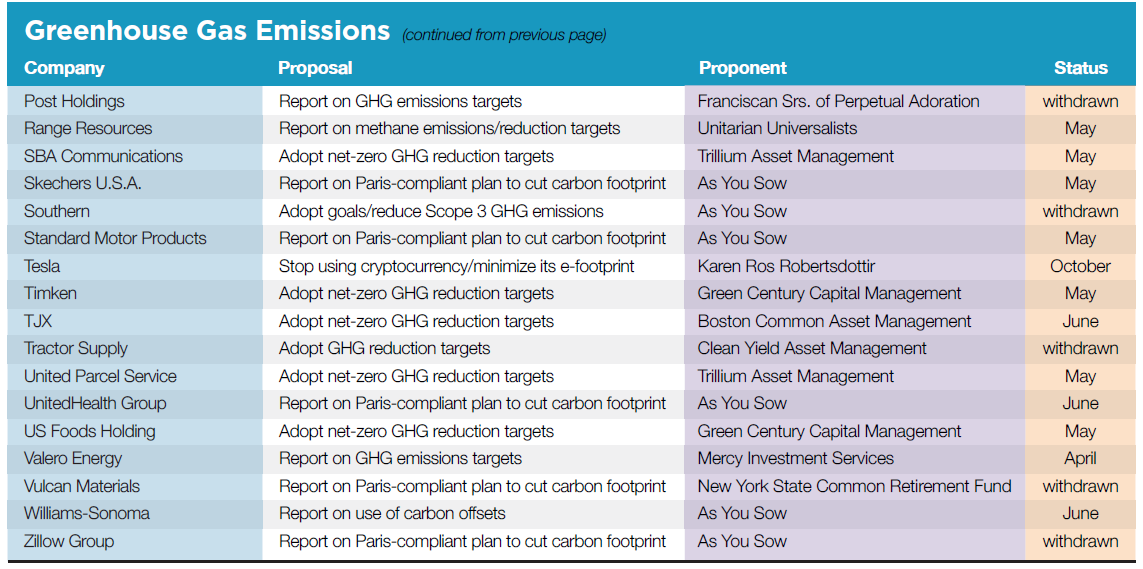

While 2021 saw more generalized requests seeking company plans to reconfigure businesses to cut carbon footprints in line with the Paris climate accord, this year specificity is back in spades. More proposals ask about indirect “Scope 3” emissions from supply chains and products, and more seek net-zero emissions goals and reports. In November 2021, when the SEC rescinded three Trump-era Staff Legal Bulletins that had constrained the types of proposals shareholders could file, it set the stage for this year’s more precise requests.

Adopting Emissions Goals

Adopt net-zero goals: The biggest group of resolutions asks companies to set net-zero climate emissions targets. All ask that goals apply to the “full value chain,” with a few variations. Only one of 16 companies (UPS) has recently received such a proposal and proponents have withdrawn four so far (table, above).

Specified terms for scienced-based targets—Proponents are taking advantage of their new freedom from earlier SEC restrictions and are proposing that eight companies—Builders FirstSource, Costco Wholesale, Darling Ingredients, J.B. Hunt Transport Services, Lowe’s, TJX, Timken and US Foods Holding—adopt:

short, medium, and long-term science- based greenhouse gas emissions reduction targets, inclusive of emissions from its full value chain, in order to achieve net-zero emissions by 2050 or sooner and to effectuate appropriate emissions reductions prior to 2030.

Independent verification—A resolution from Trillium Asset Management is pending at five companies— SBA Communications, BJ’s Restaurants, BJ’s Wholesale Club, Middleby and UPS—seeking:

independently verified short, medium, and long-term science-based greenhouse gas emissions reduction targets, inclusive of emissions from its full value chain, in order to achieve net-zero emissions by 2050 or sooner and to attain appropriate emissions reductions prior to 2030, in line with the Paris Agreement's goal of maintaining global temperature rise at 1.5 degrees Celsius.

A similar proposal at UPS earned 36.7 percent last year and 29.6 percent in 2020, but all the other recipients are new.

Transition to net-zero—The Nathan Cummings Foundation has withdrawn a request at Air Products & Chemicals to “address the risks and opportunities presented by climate change and the global transition toward net zero emissions by setting emission reduction targets covering the Company's full value chain (Scope 1, 2 and 3) GHG emissions.”

At Kroger, Mercy Investments swaps out “near-term and long-term science-based” targets, with the rest identical to the Air Products language.

An early majority: Investors started out the year with a big majority of 70 percent at Costco.

Withdrawals: Trillium Asset Management withdrew at J.B. Hunt but also was facing a procedural challenge at the SEC (earlier, a request for reporting on a Paris-compliant emissions plan earned 54.5 percent at the company in 2020). Mercy Investments withdrew when Lowe’s agreed to set science-based GHG targets. The other withdrawals also came after agreements at Air Products and Darling Ingredients.

NET ZERO ASSET MANAGERS INITIATIVE: TRANSPARENCY AND ACCOUNTABILITY ON CLIMATE

BENEDICT BUCKLEY

CFA, ClearBridge Investments

In July 2021, ClearBridge Investments announced it had joined the industry-leading Net Zero Asset Managers Initiative (NZAM), an international group of asset managers committed to supporting the goal of achieving net-zero greenhouse gas emissions globally by 2050. We are proud to be part of a community of over 200 asset management peers, representing over $50 trillion, in this commitment.

Long-range targets: Four energy companies (Chevron, ConocoPhillips, ExxonMobil and Marathon Petroleum) have requests from the Dutch collaborative Follow This that go beyond short-term aims, asking each

to set and publish medium- and long-term targets to reduce the greenhouse gas (GHG) emissions of the Company's operations and energy products (Scope 1, 2, and 3) consistent with the goal of the Paris Climate Agreement: to limit global warming to well below 2 degrees C above pre-industrial levels and to pursue reports to limit the temperature increase to 1.5 degrees C.

At Marathon Petroleum, the reference to the Paris treaty is not included, while at ConocoPhillips it asks for short-term targets as well as medium- and longterm goals.

Most of these companies have received dozens of proposals on climate change over the years. In 2021, Follow This saw two majority votes for a similar proposal, earning 60.7 percent at Chevron and 59.3 percent at ConocoPhillips. At Exxon, though, the Follow This resolution in 2021 was omitted on procedural grounds and other recent proposals only have asked about disclosing goals, not setting them; in 2021, the California Public Employees’ Retirement System (CalPERS) withdrew an Exxon resolution seeking a report on its full carbon footprint including Scope 3 emissions, after it produced the assessment. In contrast, Marathon Petroleum has never received a climate-related resolution.

A more expansive proposal at Occidental Petroleum and Phillips 66 asks each to:

set and publish targets that are consistent with the goal of the Paris Climate Agreement: to limit global warming to well below 2 degrees C above preindustrial levels and to pursue efforts to limit the temperature increase to 1.5 degrees C.

These quantitative targets should cover the short-, medium-, and long-term greenhouse gas (GHG) emissions of the company's operations and the use of its energy products (Scope 1, 2, and 3).

Shareholders request that the company report on the strategy and underlying policies for reaching these targets and on the progress made, at least on an annual basis...

A similar proposal in 2021 from the same proponent at Phillips 66 earned 80.3 percent last year. An additional goal-setting proposal is pending at Norwegian Cruise Lines, but the text is not yet available.

Withdrawal— Clean Yield filed the energy company proposal at Tractor Supply, seeking goals for the “full range of operational and product related emissions,” and withdrew after a commitment.

SEC challenge—Occidental is arguing its report at the end of January about GHG targets makes the resolution moot. Earlier, Follow This withdrew a 2021 request at Occidental to set goals for Scope 3 emissions after a commitment, while a proposal seeking a 2-degree scenario report earned early notable support of 67.3 percent in 2017, when such high votes were uncommon.

Scope 3 methane emissions at utilities: As You Sow and the individual David Backer both are concerned about methane emissions from natural gas. Methane is the second most potent greenhouse gas and has a global warming potential more than 80 times the warming power of CO2 over the first 20 years. At DTE, Duke Energy, Dominion Energy and Southern, the request is for each to

revise its net zero by 2050 target, and any relevant interim targets, to integrate Scope 3, upstream and downstream, value chain emissions consistent with guidelines such as the [Climate Action 100+] and [Science-based Targets Initiative], or publish an explanation of why the Company does not include these emissions.

Backer’s proposal at Dominion is similar, asking for the inclusion of “medium-term targets covering the greenhouse gas (GHG) emissions of the Company’s energy products (Scope 3) on their pathway to their long-term target, which is net-zero emissions before 2050.”

SCOPE 3 CLIMATE IMPACTS MISSING FROM UTILITY NET ZERO TARGETS

DANIEL STEWART

Energy and Climate Program Manager, As You Sow

FRANK SHERMAN

Executive Director, Seventh Generation Interfaith Coalition for Responsible Investment

Most utility companies are not including Scope 3 emissions from the corporate value chain in their net zero climate targets. Yet, emissions from customers’ use of natural gas for heat and other applications, purchased power emissions, and methane leakage from the production and distribution of natural gas can amount to as much as half of a utility’s total emissions.

No proposals on climate change have gone to votes at these companies since 2017, when investors gave 47.8 percent support to a request asking Dominion to analyze how it will adjust operations to a lower-carbon future that keeps warming below 2 degrees Celsius.

Withdrawals—As You Sow has withdrawn after reaching agreements with Dominion Energy, Duke Energy and Southern. Dominion will add to its goals the emissions associated with upstream fuel consumed by its power and gas distribution businesses. Duke will add to its net-zero-by-2050 reduction target the upstream methane leakage from natural gas production, customer’ usage emissions and purchased power. Southern will improve GHG disclosures by disclosing its upstream Scope 3 natural gas emissions to CDP in 2022 and discuss calculation methods and disclosures with the UN Oil & Gas Methane Partnership.

Reporting on Emissions Goals

Paris-compliant plans: Proponents have filed the largest group of goals disclosure proposals this year at a mixed array of 15 companies (table, p. 18), with As You Sow the lead filer at nine. Proponents generally specify that the reports should encompass all operations, including supply chains.

Annual 1.5-degree limit report, all times frames and scopes—At six companies—Antero Resources, Amedisys, Eastman Chemical, IDACORP, Macy’s, O’Reilly Automotive and Standard Motor Products—the proposal asks for

a report within a year, and annually thereafter…that discloses short, medium, and long term GHG gas reduction targets aligned with the Paris Agreement’s goal of maintaining global temperature rise at 1.5 degrees Celsius, and progress made in achieving them. Reporting should cover the company's full range of operational and product related emissions. [The last sentence is left off at Amedisys.]

CLIMATE TARGETS - THE LATEST TREND IN CORPORATE GREENWASHING

AMY GALLAND, PHD MBA

Founder and Principal, Empower Venture Partners

Each year, investors express more interest in company action to combat climate change. In response, companies make highly publicized statements that they are aligned with the Paris Accord or have a net-zero commitment to persuade investors, the SEC, and customers that their corporate practices are in line with keeping global temperature rise below 1.5°C.

Withdrawals: NYSCRF reached an agreement and withdrew at Eastman Chemical. As You Sow also has withdrawn at O’Reilly Automotive because it agreed to announce an ambition to achieve net zero emissions and to set interim greenhouse gas reduction targets to maintain global warming to 1.5 degrees Celsius.

SEC challenge: IDACORP has lodged an SEC challenge, arguing it has already implemented the proposal. (Climate change has not been raised in a resolution at the company since 2009, when a request to adopt quantitative GHG goals and report received 51 percent – making it the first climate resolution to receive a majority vote.)

“How”—At Allegheny Technologies and UnitedHealth Group, the report should simply cover “how the Company intends to reduce its operational and supply chain GHG emissions in alignment with the Paris Agreement’s 1.5-degree goal.” It is pending at UnitedHealth but As You Sow withdrew for procedural reasons at Allegheny.

Interim and long-term Paris targets—At five more companies—American Water Works, Caterpillar, Helios Technologies, Skechers U.S.A. and Zillow Group—the report should go beyond short-term aims and be issued

within a year, and annually thereafter…disclosing medium- and long-term greenhouse gas targets aligned with the Paris Agreement's goal of maintaining global temperature rise at 1.5 degrees Celsius, and progress made in achieving them. This reporting should cover the Company’s full scope of operational and product related emissions.

Withdrawal: As You Sow has withdrawn at Zillow because it will establish a goal for net zero emissions by 2050 or sooner and set interim emissions reduction targets aligned with 1.5 degrees warming.

Capital allocation—Getting to the heart of how companies plan their operations, the Kraft Heinz resolution from Domini Social Investments is more specific and seeks annual reports

on its climate transition plan to align its operations and value chain with the Paris Agreement's ambition of limiting global temperature increase to 1.5 degrees C, including short- medium- and long-term science-based greenhouse gas emissions reduction targets for Kraft Heinz's full carbon footprint (scope 1, 2, and 3), and how capital allocation plans align with the climate transition plans, where relevant.

Report on net-zero GHG goals: Another group of resolutions from As You Sow specially mentions “net-zero”:

At Cheesecake Factory, Foot Locker and Monster Beverage the resolution asks “how the Company intends to reduce its operational and supply chain GHG emissions in alignment with the Paris Agreement's 1.5 degree goal requiring net zero emissions by 2050.”

Withdrawal: As You Sow withdrew at Foot Locker because it agreed to set a net-zero-by-2050 goals, plus interim GHG targets aligned with the Science-Based Targets initiative.

“If and how”—The proposal is less specific (as was more common last year) at Dollar Tree and HCA Healthcare. At Dollar Tree it asks for the inclusion of “relevant Scope 3 emissions,” following last year’s vote of 73.5 percent for a report on a “Paris-compliant” plan. At HCA, it asks “if and how” HCA “intends to reduce its enterprise-wide operational and supply chain GHG emissions in alignment with the Paris Agreement's 1.5-degree goal requiring net zero emissions by 2050.”

Near and long-term goals: Proponents have withdrawn two of three more reporting proposals:

The Franciscan Sister of Perpetual Adoration asked Post Holdings to report by June and annually thereafter “outlining if and how it could increase the scale, pace, and rigor of its efforts to reduce its total contribution to climate change, covering the greenhouse gas emissions of the Company's operations as well as its supply chain (scope 1, 2, and 3).” The withdrawal came after discussions with the company, which also had argued at the SEC that the resolution was moot given its disclosures.

The New Jersey Division of Investment also withdrew at Dollar General, having asked it for annual reports on its emissions and with short-, medium- and long-term reduction goals to reduce Scopes 1 and 2 and progress achieved. Ceres reports an agreement, but the resolution also was filed late and vulnerable to exclusion after a company challenge at the SEC.

Still pending, however, is a proposal to Valero Energy seeking disclosure of “near- and long-term GHG gas reduction targets” aligned with the 1.5-degree goal, “and a plan to achieve them,” covering “the full range of operational and supply chain emissions.” In 2018, Mercy Investments withdrew a request for a climate strategy plan here after the company agreed to provide it, following votes of about 39 percent in 2015 and 2014 on proposals seeking adoption of GHG targets.

CARBON OFFSETS ARE NOT EMISSIONS REDUCTIONS

ALISON LAFRANCE

Climate Fellow, As You Sow

As more companies announce net-zero emissions by 2050 commitments, many are relying on carbon offsets to achieve these targets, rather than decarbonizing their own operations and value chain. This business-as-usual approach risks continuation of unabated carbon pollution from the extraction and combustion of fossil fuels.

Offsets: As You Sow raises a concern about how robust emissions reduction goals are at Williams-Sonoma given the company’s apparent reliance on carbon offsets to achieve its net-zero aims. The proposal, which is new, asks for a report, “disclosing additional information on its use of carbon credits, including type of credits, verification, timing, and whether carbon credits are intended to substitute for emissions reductions beyond current goals.”

Methane

Scope 3 emissions reporting at utilities: Bookending the proposals noted above about setting goals to cut methane emissions, two ICCR members asked for reports from utilities but have withdrawn after agreements. At CMS Energy and MGE Energy, the Sisters of the Presentation of the Blessed Virgin Mary and the Sinsinawa Dominicans sought an annual report from each company:

that discloses how the company will reduce all material categories of scope 3 greenhouse gas emissions, related to emissions upstream and downstream, aligned with the goals of the Paris Agreement of limiting global warming to wellbelow 2 degrees C with the ambition to limit to 1.5 degrees C. The report should include short-, medium- and long-term targets and strategies on how to achieve them.

MGE agreed to analyze its Scope 3 GHG emissions, including those from up- and downstream gas distribution, and to set a Scope 3 emissions reduction goal by the first quarter of 2023.

Liquid natural gas: Individual proponent Stewart Taggart has returned to Cheniere Energy and wants more information about planned expenditures related to natural gas. Similar requests from Taggart were omitted for procedural flaws in 2021 and received 28.1 percent in 2020. This year, he wants a report

discussing price, amortization and obsolescence risk to existing and planned Liquid Natural Gas capital investments posed by carbon emissions reductions of 50% or higher by 2030 (in line with the Paris Accord's 2C target) applied to Cheniere's Scope Two and Scope Three emissions as well as impact 2050 ‘net zero’ emissions targets—also called for in the Paris Accord.

Individual proponent Freeda Cathcart seeks a report from Dominion Energy “describing how it is responding to the risk of stranded assets of planned natural gas-based infrastructure and assets as the global response to climate change intensifies.” The company has lodged an SEC challenge that argues its reporting makes the proposal moot and this approach blocked a vote on a similar resolution in 2020.

Metrics: Mercy Investments and the Unitarian Universalists seek more information on measuring releases from Antero Resources, Chevron and Range Resources, requesting a report that will:

summarize the outcome of any efforts to directly measure methane emissions by the Company;

provide investors with insight as to whether there is likely to be a material difference between direct measurement results and the Company’s published estimates of methane emissions;

assess the degree to which any differences would alter estimates of the Company’s Scope 1 emissions.

Investors have given strong support to methane proposals in the past at Chevron (45 percent in 2018) and Range Resources (50.3 percent, also in 2018), but this is the first such resolution at Antero.

The Minnesota State Board of Investments reached a commitment and withdrew a less specific at Marathon Oil, asking for a report “on if, and how” the company “will curtail its impact on climate change from routine flaring and venting, beyond existing efforts, including any new short, medium or long-term targets.”

Refrigerants and Cryptocurrency

Hydrofluorocarbons: The Rhode Island pension fund last year earned 5.5 percent for a report on releases of hydrofluorocarbons, potent greenhouse gases, from the company’s refrigerators. This year, Friends Fiduciary is addressing the issue at another big multiline retailer, Kroger. It is more specific than last year’s resolution and asks for a report

describing how it can adopt strategies above and beyond legal compliance to curtail the predominant source of its operational (Scope 1) GHG emissions, by deploying the best available technological options for eliminating the use of hydrofluorocarbons (HFCs) in refrigeration. The report should describe the extent to which the Company will act consistent with the Consumer Goods Forum commitments on ultralow GWP refrigerants, including any related capital spending commitments, or explain why the Company is not acting consistent with those commitments.

Cryptocurrency: In a brand-new proposal that seeks to address the heavy carbon footprint of cryptocurrency, Karen Ros Robertsdottir of Iceland wants Tesla to stop using it, requesting:

that the company adopt a policy of immediate (within five business days) liquidation of newly-acquired cryptocurrency assets, and fully divest from existing cryptocurrency assets (including mining hardware) within one year.

If the company continues to accept payments of high-impact cryptocurrencies (eg., with a per-transaction energy or e-waste footprint more than 10x of Visa’s), it should minimize their environmental impact (such as Level 2 processing).

While cryptocurrencies such as bitcoin require large amounts of energy for computation, Level 2 processing requires less data and less energy. Climate 360, a collaborative project from several U.S. universities, noted last August that bitcoin uses about the same amount of energy annually as Sweden.

Financing Climate Change

Investors’ focus increasingly has turned to the financial institutions that help to underwrite and finance the expensive, long-term capital investments that sustain companies’ current reliance on fossil fuels. In 2022, several new types of proposals have been filed and companies have challenged most of them at the SEC. A key industry initiative that sets out how financial firms can approach carbon financing is the Partnership for Carbon Accounting Financials, representing companies that have invested more than $3.8 trillion in the fossil fuel sector since the Paris climate treaty.

End underwriting and financing: The Presbyterian Church (USA), Trillium Asset Management, Green Century and Harrington Investments are asking four insurers and five banks to cut off support:

Insurers—At American International Group, Chubb, Hartford Financial Services Group and Travelers, the request is to “adopt and disclose new policies to help ensure that its underwriting practices do not support new fossil fuel supplies, in alignment with the [International Energy Agency’s] Net Zero Emissions by 2050 Scenario.”

Banks—At Bank of America, the resolution says it should “build upon its net zero commitment by adopting a policy by the end of 2022 in which the company takes available actions to help ensure that its financing does not contribute to new fossil fuel supplies that would be inconsistent” with the IEA net-zero goal. At Citigroup, Goldman Sachs, Morgan Stanley and Wells Fargo it says the companies should take

proactive measures to ensure that the company’s lending and underwriting do not contribute to new fossil fuel development…consistent with” the UN Environmental Finance Initiative’s “recommendations to the G20 Sustainable Finance Working Group for credible net zero commitments.”

HOW BIG BANKS PUT CLIMATE AND INVESTORS AT RISK

PAUL RISSMAN

Co-founder, Rights Co-Lab

To avoid impending climate catastrophe, vast investment must be diverted from fossil fuel-based power generation, industrial processes, transport, and land use to carbon-free alternatives. McKinsey recently estimated this figure at $1 trillion per year, on top of an additional $3.5 trillion in new low-carbon investment, highlighting the critical role of private finance in driving decarbonization. Banks have recognized their central role and 102 institutions from 40 countries have signed on to the Net Zero Banking Alliance (NZBA), committed to aligning their lending and investment portfolios with net-zero emissions by 2050. Among the signatories are the six largest U.S. banks.

JPMorgan has two similar proposals. Harrington Investments asks it to

adopt a policy by the end of 2022 in which the company takes available actions to help ensure that its financing does not contribute to new fossil fuel supplies that would be inconsistent with the IEA’s Net Zero Emissions by 2050 Scenario.

Tulipshare asks only that the bank “in light of the ongoing climate crisis and to meet the goals of the Paris Agreement, end its investment, underwriting, and lending activities in fossil fuels.”

SEC challenges—All but AIG, Bank of America, Goldman Sachs and Wells Fargo have lodged SEC challenges. The firms variously argue that their current reporting makes the proposal moot, that the proposal is too vague and that it is ordinary business. For the Tulipshare resolution, JPMorgan says there are procedural missteps, that it is ordinary business because it is about product offerings and would micromanage, and that it duplicates the Harrington proposal it received first. (A third similar proposal also has been filed at JPMorgan by the Sierra Club, noted below.)

Previously, As You Sow withdrew a carbon finance proposal at Citigroup after an agreement in 2021, and at Wells Fargo in both 2021 and 2020 when it argued its reports made the proposal moot.

Report on financing/underwriting: As You Sow has approached four additional insurers (three of those with the finance-ban proposals, plus another) to ask for more data on their practices. It wants Berkshire Hathaway, Chubb Limited, Hartford Financial Services and Travelers each to report,

if and how it intends to measure, disclose, and reduce the GHG emissions associated with its underwriting, insuring, and investment activities, in alignment with the Paris Agreement’s 1.5 degree C goal, requiring net zero emissions.

Withdrawal—As You Sow withdrew after Hartford Financial Services agreed to respond substantively to the proposal; it will announce specifics at its May annual meeting.

SEC challenges—So far, Chubb and Travelers have filed SEC challenges. Chubb is arguing the proposal impermissibly duplicates the “end financing” proposal noted above that was filed first by Green Century, but it also says the resolution is too vague. Chubb further says it is moot, as does Travelers. Travelers points to its extensive climate-related reporting that uses guidelines set out by the Taskforce on Climate-related Financial Disclosures.

INSURING NET-ZERO PROGRESS

DANIELLE FUGERE

President, As You Sow

ANDREA RANGER

Shareholder Advocate, Green Century Capital Management

The UN Finance Initiative recently underscored the critical role of banks, insurers and investors in addressing climate change:

Climate change is referred to by leading economists as the greatest market failure in human history, with potentially disruptive implications on the social well-being, economic development, and financial stability of current and future generations: conservative estimates see unabated climate change leading to global costs equivalent to losing in-between 5 to 20% of global gross domestic product (GDP) each year, now and forever.

Goals and reporting: At JPMorgan Chase, where a high carbon financing proposal in 2020 received 49.6 percent support, a third climate financing proposal has been filed this year by the Sierra Club. It combines disclosure and goals-setting, seeking:

a report that sets absolute contraction targets for the Company’s financed greenhouse gas emissions, in accordance with United Nations Environmental Program Finance Initiative (UNEP FI) recommendations to the G20 Sustainable Finance Working Group, for credible net zero commitments.

Proponents request that, in the discretion of board and management, the report address the lack of need for new fossil fuel development beyond projects already committed as of 2021, as set forth in the UNEP FI recommendations.

Climate-related risk ratings: SumOfUs had a new resolution at two ratings firms, filed on behalf of James McRitchie and Myra Young. It asked Moody’s and S&P Global to report,

analyzing the feasibility of increasing the period of assessment to greater than five years when considering exposure to physical and transition risks associated with climate change for [company] credit ratings.

SEC challenges and withdrawal—Both firms told the SEC the resolution already has been implemented, but also would be illegal. Moody’s also said it was false and misleading and ordinary business. A withdrawal at S&P Global came after the company agreed the timeframe for its risk assessments was a legitimate concern and it provided additional information.

Capital expenditures: The New York City Comptroller’s Office had a new, comprehensive request about financing carbonintensive projects at Dominion Energy, long the target of shareholder proponents concerned about its operations and their climate impacts. The proposal asked for a report

describing how Dominion plans to align the company’s capital expenditures with any of its anticipated short, medium and long-term targets for its Scope 1, 2 and 3 greenhouse gas emissions. The report should provide quantitative and qualitative information on Dominion’s planned and projected investments in renewable energy resources, grid investments, storage, transmission, and electrification of customer energy use, and their impact on Dominion’s greenhouse gas emissions.

SEC challenge—The company argued at the SEC that that its current reporting made the proposal moot and also that it was an ordinary business matter since it was too detailed. The NYC funds withdrew after Dominion agreed to explicitly state its capital investment plan aligns with its net-zero GHG goals, and agreeing to expand on the subject in a forthcoming report that will include quantitative and qualitative data about its decarbonization plans.

DIRECTORS AND AUDITORS FAIL TO ACCOUNT FOR CLIMATE RISKS

NATASHA LANDELL-MILLS

Partner and Head of Stewardship,

Sarasin & Partners LLP

We need to get real on climate change. The world is now awash in grand promises and ambitions to deliver net-zero carbon emissions by 2050, in line with a 1.5C global warming cap, but these promises are not being backed by hard capital commitments. Turning the spotlight on the hidden world of accounting can help.

Strategy

Audited climate plans: Last year, proponents asked companies for the first time to issue formally audited plans that would explain how they will transition to a low-carbon economy, producing votes of just under 50 percent at both Chevron and Exxon. The slate of companies has expanded this year, with resubmissions at both Chevron and Exxon and seven more companies added to the list (two more energy companies, two banks and three utilities):

Energy—The proposal to Chevron, ExxonMobil and Marathon Oil asks for an audited report,

assessing how applying the assumptions of the International Energy Agency’s Net Zero by 2050 pathway would affect the assumptions, costs, estimates, and valuations underlying its financial statements, including those related to long-term commodity and carbon prices, remaining asset lives, future asset retirement obligations, capital expenditures and impairments.

A slightly different iteration is at Valero Energy, asking how the IEA Net Zero approach would affect its assessment so of “supply and demand, resiliency of assets, remaining asset lives, capital expenditures, and impairments.”

Banks—The Sierra Club asks for a report by the end of January 2023 on how the IEA net-zero assumption (known as “NZE”)

could affect underlying assumptions in financial filings, such as the magnitude of stranded assets, declining commercial credit quality, or enhanced regulatory capital requirements…Proponents recommend that, in the discretion of board and management, the report be supported by reasonable assurance from an independent auditor and that the report take account of information on:

Assumptions, costs, estimates, and valuations that may be materially impacted;

The absence of need, according to the IEA NZE pathway, for new fossil fuel development beyond projects already committed as of 2021.

Utilities—Three more proposals are at utilities. Proponents ask Duke Energy and PPL to produce

an independently audited report to shareholders on whether and how a significant reduction in fossil fuel utilization, envisioned in the [NZE] by 2050 scenario, would affect its financial position and underlying assumptions.

Previously, 2-degree analysis scenario proposal requests did well in 2017 at both companies, earning 46.4 percent at Duke and 56.8 percent at PPL.

Withdrawals—The Presbyterians have withdrawn at PPL and at another utility, Entergy, after reaching agreement. The Entergy proposal asked for a report that

considers the strategic feasibility and financial consequences of committing to an 80 percent carbon pollution-free electricity interim net zero target by 2030 to align Entergy’s net zero climate commitments to the Paris-aligned US nationally determined contribution (“US NDC”) electricity pledge.

Transition plans: Five more proposals seek reports (without an explicit audit provision) on plans about transitioning to a low-carbon economy and providing emission accountability. They reference several of the prominent initiatives investors have devised to measure and reduce emissions.

Hermes Investment Management asks the famously decentralized Berkshire Hathaway:

In the interest of the long-term success of [the company] and so investors can manage risk more effectively, shareowners request…an annual assessment addressing how the Company manages physical and transitional climate-related risks and opportunities, commencing prior to its 2023 annual shareholder’s meeting. Shareowners recommend the assessment address:

Summaries of risks and opportunities at the parent Company level and for only those Company subsidiaries and investee organizations that the board believes could be materially impacted by climate change, disclosed in accordance with the Taskforce on Climate-related Financial Disclosure (TCFD) recommendations,

The board’s oversight of climate related risks and opportunities, and

The feasibility of establishing company-wide science-based, greenhouse gas (GHG) reduction targets.

The assessment may be a stand-alone report or incorporated into existing reporting, be prepared at a reasonable cost, and omit proprietary information.

SAY ON CLIMATE GLOBAL SHAREHOLDER COALITION

DAVID SHUGAR

Say on Climate Initiative Manager, As You Sow

The Say on Climate global shareholder initiative aims to move companies to develop net zero transition plans, adopt annual 5 percent GHG emissions reduction targets (aligned with Climate Action 100+ benchmarks), provide annual emissions disclosure and give shareholders an annual vote. The annual advisory vote would be similar to votes on executive compensation, but it would be about implementation of a company’s climate transition plan.

TCFD—An undisclosed proponent has filed at Charter Communications, where a resolution last year seeking annual advisory votes on climate change strategy earned 40 percent. The 2022 resolution asks Charter to prepare

no later than 150 days after each annual meeting…a climate-related financial risk report (the "Climate Action Plan") consistent with the recommendations of the Task Force on Climate-related Financial Disclosures. The Climate Action Plan should disclose the Company’s greenhouse gas emissions and its plan to reduce them and whether, how and to what extent such plans align with or vary from the ten Disclosure Indicators set forth in the Climate Action 100+ Net-Zero Company Benchmark...

CA100+—Two proposals reference Climate Action100+ goals, described in the supporting statement. At Boeing, As You Sow asks for a report that includes “any rationale for a decision not to set and disclose goals in line with the Net Zero Indicator.” At Ross Stores, it says the report should evaluate and discuss “how the Company intends to measure and begin reducing its supply chain GHG emissions in alignment with the Benchmark and the Paris Agreement…” (A 2019 proposal seeking a report on GHG targets at Ross earned 40.9 percent.) “Benchmark” refers to the March 2021 Net-Zero Company Benchmark from CA100+ that gives comparative performance assessments on company progress.

New profit model? Arjuna Capital asks ExxonMobil to report on “how the company could alter its business model to yield profits within the limits of a 1.5-degree Celsius global temperature rise by substantially reducing its dependence on fossil fuels.”

Long-term financial priorities: The Shareholder Commons (TSC), which started filing shareholder resolutions last year about the long-term impacts corporations impose on society and the economy by “externalizing their costs,” saw little success in its proposed solution, which was to reincorporate as public benefit corporations (PBCs). This year, TSC has branched out to become more explicit about the types of costs specific companies may impose and how it believes companies should account for these costs, which it says are borne most heavily by institutional investors whose holdings reflect the whole market.

This year, on climate change, TSC has filed a resolution at United Parcel Service, where proposals asking it to set Paris-compliant GHG goals earned 36.7 percent in 2021 and 29.6 percent in 2020. The TSC proposal now asks for a report on

(1) the extent (if any) to which Company decisions involving the greenhouse-gas emissions reduction prioritize Company financial performance over the environmental costs and risks of climate change and (2) the manner in which any consequent environmental costs and risks threaten returns of diversified shareholders who rely on a stable and productive economy.

(See p. 47 for a similar proposal at 3M on environmental costs, financial priorities and political influence.)

Just Transition

Two new proposals seek to address inequities that will increase as the world warms and economic disruption affects the most vulnerable, seeking to ensure a “just transition” to a low-carbon world:

Arctic drilling—Green Century asks Chevron about financial and ecosystem risks and threats to Indigenous peoples. It wants a report

assessing the benefits and drawbacks of committing to not engage in oil and gas exploration and production in the Arctic, particularly in the Arctic Refuge, as well as the financial and reputational risks to the company associated with such development.

Community impact—The Teamsters propose that Marathon Petroleum issue a report

stating how Marathon is responding to the social impact of Marathon’s climate change strategy on workers and communities, consistent with the "Just Transition" guidelines of the International Labor Organization ("ILO")…

It should include:

Marathon’s commitment to providing a just transition for its workforce and communities in its plans to address its climate-related risks and opportunities;

Marathon’s plans to address the impacts of its climate change strategy on workers and communities.

The integration of these concerns into the governance structure, including executive compensation, stakeholder and workforce engagement processes, and Board oversight.

Forests and Water

A handful of proposals ask companies to address how their businesses contribute to deforestation, a major driver of climate change. Home improvement companies, with their wood products, have been routine targets, and this year two banks also are asked about how their financing practices should support healthy ecosystems, preserve biodiversity and reduce deforestation. In addition, Amazon.com has a proposal from a newly active social investment firm, Prentiss Smith. Green Century, a longtime supporter of responsible forest practices, is the proponent of the other four resolutions.

Banks: At Bank of New York Mellon and Citigroup, Green Century wants a report on how each “could improve efforts to reduce negative impacts and enhance positive impacts on natural ecosystems and biodiversity across its banking and investment portfolios.” Proponents withdrew a similar resolution in 2021 at JPMorgan Chase after the company released a requested report on the subject, but the issue has not been addressed before in this form at either of this year’s recipients.

Home improvement stores: The resolution at Home Depot and Lowe’s asks each to make more effort and report “if and how it could increase the scale, pace, and rigor of its efforts to eliminate deforestation and the degradation of primary forests in its supply chains.” Various proponents have asked Home Depot to set climate-related goals in the past and were withdrawn after negotiations, with an agreement in 2019 where the company said it would release targets for 2030 and 2035. The only previous climate-related proposal at Lowe’s to go to a vote asked for renewable energy targets and received 6.9 percent in 2017, although it also had a net-zero GHG goals resolution this year, described above, which Mercy Investments withdrew after an agreement.

Amazon.com: Prentiss Smith has withdrawn a proposal asking for annual reports

on how the company is addressing climate impacts caused by deforestation in its supply chain. The report should include quantitative metrics on supply chain-related deforestation impacts, as well as progress against goals for reducing those impacts.

The company told the SEC the proponent did not substantiate its stock ownership and the withdrawal came before any SEC response. Previously, a 2019 proposal from a group of workers, Amazon Employees for Climate Justice, asked for a report about climate change disruptions and reducing fossil fuel dependence; it earned 30.9 percent.

Water

Three resolutions ask about water use this year, with explicit climate change references, at companies that have not received such proposals in the past:

At Alphabet, the request is for annual reports about “quantitative water-related metrics by location, including data centers, and for each location, practices implemented to reduce climate-related water risk.”

A Chipotle and Kraft Heinz, a resolution seeks “quantitative indicators where available, an assessment to identify, in light of the growing pressures on water supply quality and quantity posed by climate change, its total water risk exposure, and policies and practices to reduce this risk and prepare for water supply uncertainties associated with climate change.”