Until now, most investor concern about addressing undue corporate political influence has centered on arrangements for formal oversight and disclosure of spending on elections and lobbying. Many companies have become comfortable with this framework and most large companies have formal board oversight of their contribution processes. Many also disclose at least some information on their spending, even while mostly eschewing disclosure of their support for politically active intermediaries such as trade associations. The increasingly rancorous tone of the political scene has spilled over into shareholder resolutions, however, and proponents today are asking more pointed questions about how company money is spent, and what recipients of company-connected money support. While companies routinely assert they give across the aisle to politicians who support their interests, a careful look at the record shows this is not always accurate. The January 6, 2021, attack at the U.S. Capitol prompted some companies to stop giving—at least temporarily to members of Congress who voted to overturn the 2020 election results, but almost no companies have ended all their support for the Republican Party and its various committees that support such politicians, who are part of what some call a “sedition caucus.” Further, state-level spending patterns reflect regional political power realities—where new laws reflect an increasingly radicalized agenda from the right end of the political spectrum.

The volume of proposals on political spending is no longer the largest of any proxy season issue—being surpassed this year by climate change—and the breakdown of proposals has shifted. Election spending resolutions have steadily fallen in number since 2019 and the proportion of those about lobbying has grown (boosted by climate-related lobbying resolutions). Resolutions that question conflicts between corporate policies and the partisan preferences of recipients have steadily grown, doubling to 20 this year. Proponents have filed 101 proposals thus far in 2022, up from 89 in all of 2021 and down from an apex of 135 in 2014.

Proponents: Proponents include social investment and religious organizations, leading pension funds from New York City and State, trade unions and some individuals. Investor concern about corporate election spending began in 2003 with the founding of the Center for Political Accountability (CPA) and intensified after the Citizens United U.S. Supreme Court decision in 2010. The CPA’s model oversight and disclosure approach is the standard template for lobbying transparency, too, and forms the basis for the lobbying disclosure campaign run by Boston Trust Walden and the American Federation of State, County and Municipal Employees (AFSCME). The umbrella Corporate Reform Coalition supports shareholder activity on corporate spending and includes other reformers.

Resources: An ICCR initiative supports climate lobbying proposals and Ceres has set out guidelines in its Responsible Policy Engagement on Climate Change report. Rhia Ventures is coordinating investor engagement about corporate policies and spending regarding reproductive and maternal health.

The most recent version of the CPA-Zicklin Index, released in fall 2021, tracks S&P 500 performance about spending on elections. No similar index exists on lobbying, although Si2’s annual survey tracks that issue. The Conference Board’s Committee on Corporate Political Spending offers a generally supportive business perspective on accountability.

New code—In October 2020, the CPA released a new Model Code that aims to more fully address partisan risks, but it has yet to fully incorporate related metrics into its index ratings. Its preamble says the code explains how companies can:

be responsible members of society and participants in the democratic process and responsive to the range of stakeholders, in both letter and spirit,

be recognized for their leadership in aligning corporate integrity and accountability with codified values,

prudently manage company resources, and

avoid the increased level of reputational, business and legal risk posed by the seismic shifts in how society engages with and scrutinizes corporations. The risk is exacerbated by the evolution of social media and a resurgence of activism in civil society.

The code’s provisions that aim to address partisan harms say companies should “review the positions of the candidates or organizations to which it contributes to determine whether those positions conflict with the company’s core values and policies” and stipulates that boards should “consider the broader societal and economic harm and risks posed by the company’s political spending.”

A MODEL CODE FOR COMPANIES TO GOVERN THEIR POLITICAL SPENDING

BRUCE F. FREED

President, Center for Political Accountability

DAN CARROLL

Vice President for Programs, Center for Political Accountability

As the 2022 proxy season unfolds, there’s good news and concerning news about companies and their political spending. Which wins out – greater control over political spending or a return to business as usual – will affect how companies fare as shareholders pay even closer attention to what they do with their political money and how it aligns with their values and positions.

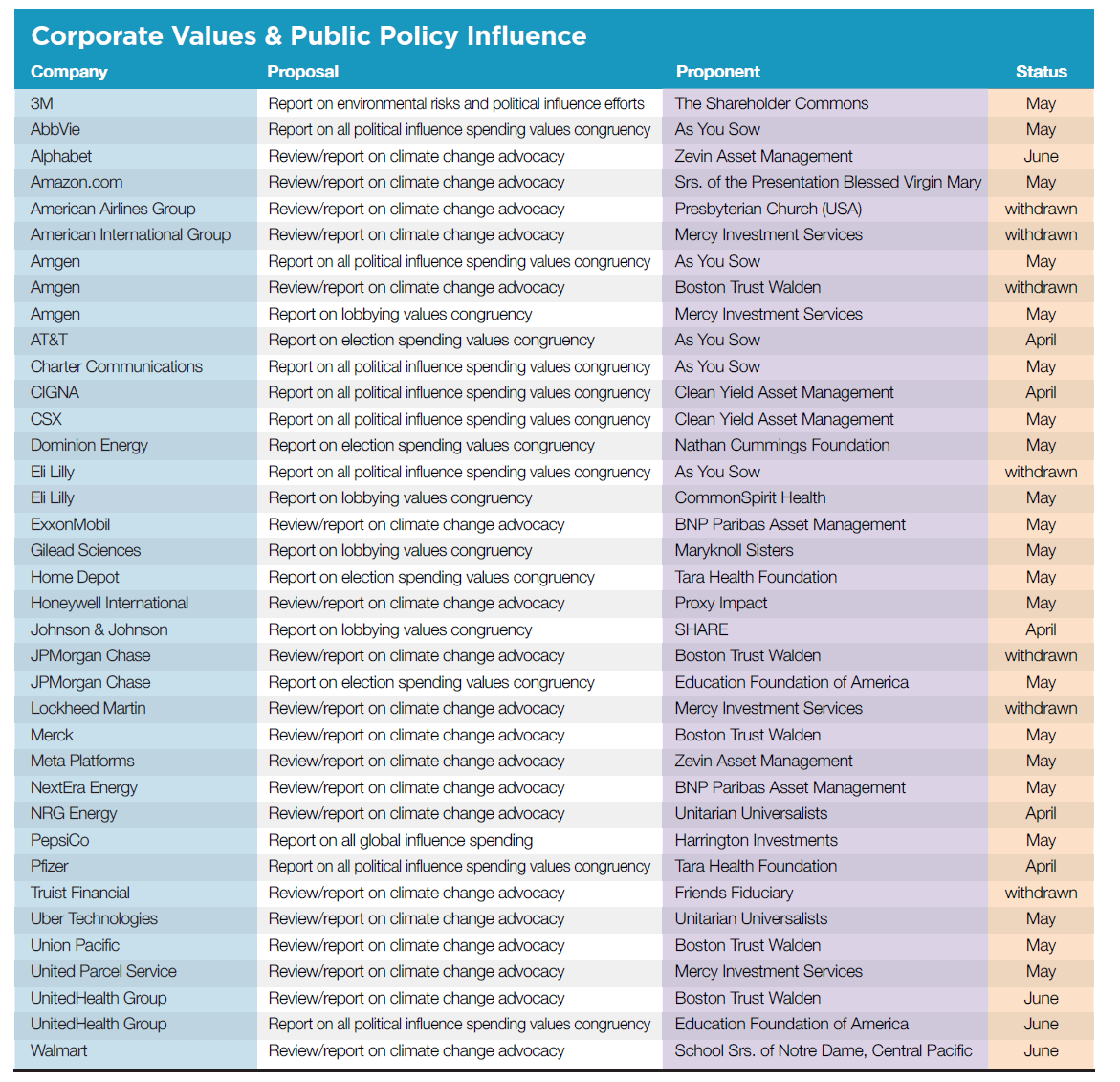

Multiple proposals: Fourteen companies have more than one proposal about lobbying, election spending or climate change advocacy, in one combination or another: AbbVie, Alphabet, Amazon.com, American Airlines, Amgen, Charter Communications, Eli Lilly, ExxonMobil, HCA Healthcare, Meta Platforms (the former Facebook), Pfizer, Uber, United Parcel Service and Walmart.

Conservatives: Proponents espousing free market ideals occasionally borrowed the resolved clauses written by disclosure advocates and block the main campaign proposals. These proponents continue to question corporate charitable giving and they raise new questions about corporate political activity at Coca-Cola and Target. (See Conservatives, p. 83.)

Lobbying

The resolved clause for the main lobbying campaign resolution submitted this year to 36 companies remains the same as in the past and many (22) are at companies where votes have occurred before, most of them last year (table, page 42). The main proposal asks for an annual report that includes:

Company policy and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications.

Payments by [the company] used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the amount of the payment and the recipient.

[The company’s] membership in and payments to any tax-exempt organization that writes and endorses model legislation.

Description of the decision-making process and oversight by management and the Board for making payments described in sections 2 and 3 above.

SECRET INFLUENCE: ASTROTURFING SWAYS PUBLIC POLICY

JOHN KEENAN

Corporate Governance Analyst, AFSCME Capital Strategies

Lobbying by companies can provide governments with valuable insights and data for public policy making, yet only 8 percent of the world’s 1,000 largest companies report their spending on lobbying to investors. And when companies make undisclosed payments to dark money groups to secretly influence public policy, this “astroturf” lobbying creates legal, financial, and reputational risks for shareholders as evidenced by utility FirstEnergy’s agreement to pay $230 million for funneling $60 million through dark money groups as part of a bribery scheme.

For purposes of this proposal, a “grassroots lobbying communication” is a communication directed to the general public that (a) refers to specific legislation or regulation, (b) reflects a view on the legislation or regulation and (c) encourages the recipient of the communication to take action with respect to the legislation or regulation. “Indirect lobbying” is lobbying engaged in by a trade association or other organization of which [the company] is a member.

Both “direct and indirect lobbying” and “grassroots lobbying communications” include efforts at the local, state and federal levels.

The report shall be presented to the Audit Committee or other relevant oversight committees of the Board and posted on [the company]’s website.

Withdrawals—Proponents have withdrawn after agreements at AECOM and Quanta Services.

SEC action—Three companies have lodged challenges at the SEC so far. AbbVie says the proponent made procedural missteps. Both it and Eli Lilly also say the resolution duplicates another they received first about lobbying, election spending and values congruency (described below). In like mien, Amazon.com says the resubmitted proposal duplicates another it received first on climaterelated lobbying; the resolution is in its seventh year and the 36.1 percent vote last year was the highest yet. Finally, Eli Lilly also says its disclosures make the proposal moot; the proposals earned 48.2 percent in 2021, up from earlier votes in the 20-percent range.

Election Spending

The Center for Political Accountability and its allies, a wide variety of institutional investors, continue to seek board oversight and transparency about election spending from corporate treasuries, with 32 proposals filed this year. Only five are resubmissions and nine have yet to be made public. (See table for list.) Support from investors for these resolutions has continued to climb and averaged 43.8 percent last year, up sharply from earlier years.

Last year there were majority votes on election spending at four companies, including 80.2 percent at Chemed and 52.9 percent at Royal Caribbean where it has been resubmitted. Other resubmissions earned 2021 votes in the 30-percent range, at Dollar General, ExxonMobil and Flowers Foods.

CPA proposal: The main CPA resolution remains the same, with most noting it excludes lobbying activity. It asks companies to produce reports twice yearly on:

Policies and procedures for making, with corporate funds or assets, contributions and expenditures (direct and indirect) to (a) participate or intervene in any political campaign on behalf of (or in opposition to) any candidate for public office, or (b) influence the general public, or any segment thereof, with respect to an election or referendum.

Monetary and non-monetary contributions and expenditures (direct and indirect) used in the manner described in section 1 above, including:

a. The identity of the recipient as well as the amount paid to each; and

b. The title(s) of the person(s) in the Company responsible for decision-making.

Withdrawals—So far proponents have withdrawn after agreements at Analog Devices, Coterra (formerly Cabot Oil & Gas), Hanesbrands and PPG Industries.

SEC challenges—Chemed has challenged the proposal at the SEC, arguing a report it issued on January 14 about its political giving policy and corporate contributions details and trade association spending makes the resolution moot. For its part, Expeditors International of Washington told the SEC the resolution is moot because as of Nov. 4, 2021, it has been forbidding direct or indirect contributions to political parties, campaigns or candidates.

No votes on new indirect spending proposal: Myra Young and James McRitchie filed a new proposal working with the CPA that tried to zero in on indirect spending by organizations supported by companies, at Costco and Walgreens Boot Alliance. It asked that each

adopt a policy requiring that any trade association, social welfare organization, or other organization that engages in political activities seeking financial support from Company agree to report to [the Company], at least annually, the organization’s expenditures for political activities, including the amount spent and the recipient, and that each such report be posted on [the Company’s] website. For purposes of this proposal, “political activities” are:

i. influencing or attempting to influence the selection, nomination, election, or appointment of any individual to a public office; or

ii. supporting a party, committee, association, fund, or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making expenditures to engage in the activities described in (i).

SEC action—The proponents withdrew after SEC challenges. Costco said it was not significantly related to the company’s business since it forbids any use of its funds for political use. Walgreens said it could not implement the proposal and that it was ordinary business.

Values Congruency

While proposals in the past have asked about lobbying on climate change or consistency between stated corporate values and spending in elections, these types of proposals have expanded in 2020 to reach their highest number yet, with a range of issues invoked.

Climate Change Lobbying

The biggest group includes 20 proposals that ask companies to explain their involvement in public policy advocacy about climate change. Last year, five of seven similar proposals that went to votes earned support well above 50 percent. Only one of this year’s crop is a resubmission—the proposal at ExxonMobil that last year earned 63.9 percent. Sixteen proposals are now pending and four have been withdrawn. (See table for list.) With slight variations, each asks for a report within a year,

describing if, and how, [the company’s] lobbying activities (directly and indirectly through trade associations and social welfare and nonprofitorganizations) align with the Paris Climate Agreement’s aspirational goal of limiting average global warming to 1.5 degrees Celsius. The report should also address the risks presented by any misaligned lobbying and the company’s plans, if any, to mitigate these risks.

At ExxonMobil, Honeywell International, Lockheed Martin, Truist Financial and United Parcel Service, it specifies “well below 2 degrees Celsius.”

Withdrawals—Boston Trust Walden has withdrawn at JPMorgan Chase because it agreed to include more information on its public policy advocacy in its forthcoming TCFD report. JPMorgan also had challenged the proposal at the SEC, arguing it was an ordinary business matter because it was too specific. Additional agreements and withdrawals have occurred at American Airlines, Amgen, Lockheed Martin and Truist Financial (the combination of BB&T and SunTrust).

SEC challenges—Amazon.com and Meta Platforms have lodged challenges. Amazon says it already has reported on its climate goals and included related public policy advocacy information, but also has told the SEC the climate lobbying proposal is duplicated by a more general one on lobbying it also received. Meta says the proponent failed to provide sufficient proof of its stock ownership duration.

Values and Influence Spending

Reproductive health: Proposals coordinated last year by Rhia Ventures earned considerable support and the group is back in 2022 with nine resolutions relating to the alignment of corporate policies and spending in elections and beyond. It asks AT&T, JPMorgan Chase and Home Depot for annual reports about election spending,

analyzing the congruence of political and electioneering expenditures during the preceding year against publicly stated company values and policies and disclosing or summarizing any actions taken regarding pausing or terminating support for organizations or politicians, and the types of incongruent policy advocacy triggering those decisions.

At AT&T, where a procedural problem blocked the resolution last year, the proposal notes the company’s support for politicians working to restrict reproductive health and other civil rights. (AT&T was one of the largest donors to Texas legislators who supported SB 8, which bans abortion at six weeks of gestation.) At JPMorgan the resolution questions the consistency of the company’s giving with its policies on clean energy, LGBTQ equality and reproductive rights.

The proposal is in its third year at Home Depot, having earned 38 percent in 2021 and 32.9 percent in 2020. The proposal is a resubmission at JPMorgan Chase, where it received 30 percent last year.

MISALIGNMENT BETWEEN COMPANY REPRODUCTIVE HEALTH POLICIES AND INFLUENCE SPENDING

SHELLEY ALPERN

Director of Corporate Engagement, Rhia Ventures

Rhia Ventures, now in its third year of advocating for better corporate policies related to reproductive and maternal health care, has worked with allied investors to file 14 proposals for 2022.

Reproductive rights are on the line this year as the U.S. Supreme Court considers a direct challenge to Roe v. Wade, the landmark decision protecting the right to access abortion without excessive government restriction. Should Roe be overturned or gravely weakened, as is widely anticipated, as many as 26 states are poised to ban abortion completely within their borders. Texas Senate Bill 8, enacted into law in September 2021 and undergoing challenge in court, is another potential game changer if it is allowed to stand. The law imposes a ban on abortions past the detection of fetal electrical activity described by its supporters as a “fetal heartbeat,” usually around the sixth week of pregnancy.

The other Rhia Ventures proposal is more expansive and asks six healthcare firms and a cable company—AbbVie, Amgen, Charter Communications, Cigna, Eli Lilly, Pfizer and UnitedHealth—for annual reports that will analyze and report on:

the congruence of its political, lobbying, and electioneering expenditures during the preceding year against its publicly stated company values and policies, listing and explaining instances of incongruent expenditures, and stating whether the identified incongruencies have or will lead to a change in future expenditures or contributions.

The resolutions raise questions about the consistency of company policies on issues beyond reproductive health, mentioning diversity, voting rights and climate change at Charter, for instance. (As noted above, a different proposal about climate-related lobbying also has been filed at UnitedHealth Group. A second proposal at Amgen on lobbying and access to medicine is discussed below.)

SEC action and withdrawal—Eli Lilly told the SEC the resolution had been implemented and also duplicated a lobbying proposal filed by SEIU as well as a proposal about lobbying values from CommonSpirit (described below). As You Sow withdrew before any SEC response.

At Pfizer, an election spending and values congruency proposal from Tara Health, part of the Rhia campaign, earned 47.2 percent in 2021 after surviving an SEC challenge. But this year the company is arguing the proposal duplicates another it received first from the conservative National Center for Public Policy Research—which uses the same resolved clause but elsewhere in the proposal argues against disclosure. NCPPR takes issue with several topics supported by various candidates funded by the company, criticizing the company’s diversity approach and its support for candidates in favor of reproductive rights among other topics. (See Conservatives, p. 84.)

Social justice: The Nathan Cummings Foundation has a similar but more specific proposal at Dominion Energy, asking for a report on “if and how” its “political activities (direct and through trade associations) align with the Company’s stated commitment to social justice and racial equality. The report should also address the risks presented by any misalignment and the company’s plans, if any, to mitigate these risks.”

Lobbying Congruency

Racism: Clean Yield Asset Management proposes that CSX evaluate and report “describing whether, and how, CSX lobbying activities (direct and through trade associations and social welfare and nonprofit organizations), and any political contributions from the company or its PAC, align with the Company’s stated commitments to anti-racism.”

Access to healthcare: Three ICCR members have a new resolution at four drug companies, suggesting their lobbying efforts conflict with formal vision statements. Each asks for a “third party review within the next year” and specifies it covers both direct lobbying and that via trade associations; each also says the board “should report on how it addresses the risks presented by any misaligned lobbying and the company’s plans, if any, to mitigate these risks.” The proposals ask whether the companies’ lobbying activities align with their commitments:

SEC action—Gilead and Johnson & Johnson have filed challenges at the SEC. Gilead says it is about ordinary business because it mentions drug pricing in its supporting statement. Johnson & Johnson also contends it is ordinary business. Eli Lilly says its disclosures make the resolution moot but also that it duplicates a proposal it received first from Trinity Health on board oversight of drug pricing.

(Proposals that asks about drug companies’ pricing practices and related public policy influence efforts are covered in the section on Health, p. 58.)

Environmental Risks

The Shareholder Commons continues its focus on the impact of company activities on societal costs. It wants 3M to “commission and publish a report on (1) the link between the environmental costs created by 3M’s operations and political influence activities and 3M’s continuing prioritization of enterprise risk, and (2) the manner in which such costs and prioritization may affect the market returns available to its diversified shareholders.” The resolution says that while the CEO asserts 3M wants to be a sustainability leader, its actions belie this commitment because:

3M is active in three trade associations that work against comprehensive U.S. policies to address climate change.

3M does not appear to have committed to meet the Science-Based Targets initiative for a 1.5-degree Celsius world and failed to receive an “A” grade in 2020 from CDP, a widely used and respected climate rating.

Belgian regulators recently ordered 3M to stop PFAS production after recent blood samples taken from 800 people near 3M’s plant showed elevated levels of PFAS.

TSC concludes the company is overly focused on optimizing its financial position and is not taking needed action that broadly threatens the world.

Global Influence

PepsiCo faces a new resolution from Harrington Investments, which previously has filed proposals about the company’s sugary drinks. The resolution says the company should

annually issue a transparency report on global public policy and political influence, disclosing company expenditures and activities outside of the United States. Such report should disclose company funding and in-kind support directed to candidates or electioneering, lobbying, scientific advocacy, and charitable donations for the preceding year including:

recipients and amounts;

date and timeframe of the activity taking place

the Company’s membership in or payments to nongovernmental organizations including trade and business associations, scientific or academic organizations and charities.

the rationale for these activities.

The Board and management may, in its discretion, establish a de minimis threshold, such as contributions to an individual or organization totaling less than $250, below which itemized disclosures would not be required.

The company is arguing at the SEC that the proposal impermissibly consists of multiple requests by asking for information on political influence and charitable giving. PepsiCo says the two are unrelated. Unlike other political influence resolutions this one focuses on activity outside the United States, such as lobbying against food labeling regulations in Mexico.