Diversity on the Board

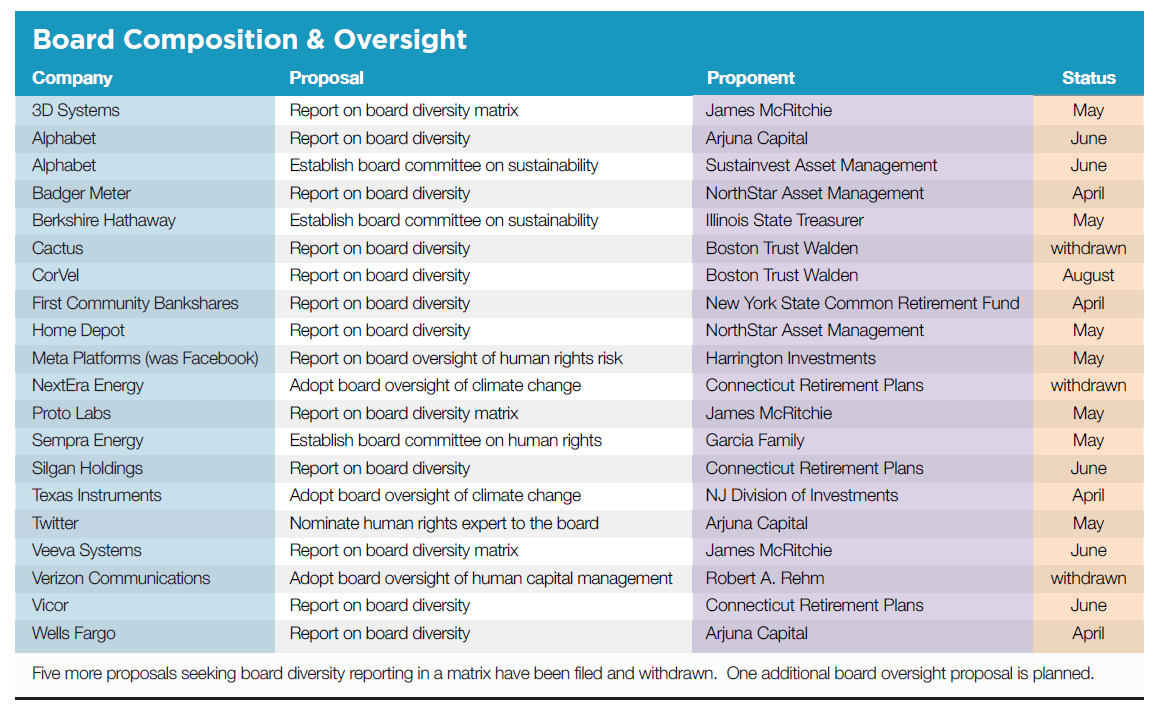

Eighteen proposals seek reports on diverse board composition, down from the decade’s high of 48 in 2019, and half last year’s total, although diversity in the workplace remains top-of-mind for many (see Diversity at Work, p. 54.) It appears that the spotlight has shifted down an echelon to the executive suite, which is still what some call “stale, male and pale.”

The 30 Percent Coalition has played a key role in persuading companies to diversify boards, expressing the aims of its members who come from in- and outside the investment and corporate world. Proponents are filing proposals at companies with no women or people of color on the board, seeking expanded representation even where there are one or two diverse board members.

Proxy voting support: When companies fail to put in place diverse boards, leading institutional investors—and investment managers—increasingly also have begun to vote against either nominating committee members or the entire board in elections for the board if diversity is lacking, illustrating how social issues have changed who runs corporate America. The two leading proxy advisory services now vote against non-diverse boards and State Street, one the largest managers, does as well—an idea first raised by social investment firms more than 10 years ago. As the corporate advisory firm Shearman & Sterling says, “board diversity initiatives are gaining momentum.” There is pushback, though, and a new mandate from California to include at least one woman on the board of any company with executive offices in the state is being challenged in the courts on the grounds it imposes an unlawful quota.

POSITIVE SIGNS ON THE ROAD TO BOARD DIVERSITY

AMY D. AUGUSTINE

Director of ESG Investing, Boston Trust Walden

SAMANTHA BURKE

ESG Analyst, Boston Trust Walden

Board diversity is improving, but this is not the time to back down. Companies, shareholders, and the overall economy benefit when board oversight better reflects the marketplace and draws from the broadest possible talent pool.

In 1992, Boston Trust Walden launched “Just Vote No” — voting against boards of directors without people of color or women. Thirty years later, champions of diversity within U.S. corporate boardrooms have reason to celebrate. In 2021, an astonishing 72 percent of new directors among S&P 500 companies were women and people of color. Particularly noteworthy in the current context of heightened national attention to racial justice, one-third of new independent directors are African American compared to 11 percent the previous year.

New Nasdaq requirement: In another sign that the issue has become embedded in financial analysts’ expectations, on August 6, 2021, the Nasdaq exchange attained approval from the SEC for its new rule that requires its listed companies by 2023 “to have, or explain why it does not have, at least two ‘Diverse’ directors (‘Diverse Board Requirement’), including one who self-identifies as ‘Female’ and one who self-identifies as either an ‘Underrepresented Minority’ or ‘LGBTQ+.’ The exchange will only verify that companies have complied with the requirement and will not review explanations, but it will de-list them for noncompliance. Nasdaq requires reporting in a matrix format such as that shareholder proponents have been suggesting for many years. Reporting on composition must occur this year.

Resolutions Shift in 2022

Expanded reporting: Many proposals in the past asked that boards make sure that each pool of potential nominees include diverse nominees. This request has shifted and expanded this year to include senior executives and consideration of diversity among various company stakeholders. Proponents have withdrawn already at Cactus but the proposal it received is still pending at CorVel, Silgan Holdings and Vicor, asking for a report by January 2023 on efforts to “enhance board diversity” by:

Embedding in governance documents a commitment to diversity inclusive of gender, race, and ethnicity;

Committing publicly to include women and people of color in each candidate pool for board and senior leadership seats;

Disclosing in annual proxy statements the gender, racial, and ethnic composition of the board; and

Detailing board strategies to reflect the diversity of the company’s workforce, community, and customers.

NYSCRF has withdrawn a similar proposal after reaching an agreement at First Community Bankshares; it earned 70.6 percent last year. The proposal asked the company to report on “broader diversity” efforts using the new Nasdaq rule categories:

Embedding a commitment to diversity inclusive of sex, race, ethnicity, age, gender identity, gender expression, and sexual orientation in Nominating and Corporate Governance charters;

Committing publicly to include women and people of color in each candidate pool from which director nominees are chosen; and

Disclosing in proxy statements the number of women and people of color nominated for or sitting on the board.

Reflecting customers: Arjuna Capital has a new proposal that seeks annual reports from Alphabet and Wells Fargo on how each is working to attain on their boards “racial and gender representation that is better aligned with the demographics of its customers and/or regions in which it operates.” (The AFL-CIO withdrew a proposal at Wells Fargo last year on adding diverse board nominees when it agreed to do so.)

SEC action—Alphabet is arguing that its current practices make the resolution moot.

Racial equity: At Badger Meter, where last year its request to report on board diversity earned 86.4 percent, NorthStar Asset Management has returned to ask how the company plans to take “action steps to foster greater racial equity on the board.” At Home Depot the request is the same but adds “gender equity.”

SEC action—Badger Meter is arguing at the SEC that its October 2021 report on the subject makes the resolution moot.

Matrix reporting: A key problem for investors seeking to assess diversity on boards is the relative dearth of consistent data on board members’ race, gender and ethnicity, although this will be addressed for Nasdaq companies soon. The New York City Comptroller’s Office has led a push for reporting on board or nominee attributes in a matrix that presents this and other qualifications. A public list of New York’s targets is not yet available, but James McRitchie has filed at three proposals along the same lines, asking 3D Systems, Proto Labs and Veeva Systems to disclose in their proxy statements

each director/nominee’s self-identified gender and race/ethnicity, as well as the skills and attributes that are most relevant to 3D Systems’ overall business, long-term strategy, and risks. The requested information shall be presented in matrix format and shall not include any attributes the Board identifies as minimum qualifications for all director candidates (the “Board Matrix”)

Experts: Just one proposal so far suggests a specialized board member is needed. Arjuna Capital has resubmitted a proposal to Twitter that earned 14.3 percent last year. It asks that the board nominate an independent candidate who “has a high level of human and/or civil rights expertise and experience and is widely recognized as such, as reasonably determined by Twitter’s Board.”

Board Oversight

This year only seven resolutions ask about ESG board oversight, about the same as last year. Companies have challenged five of them and none is a resubmission.

BOARDS FACE “NO” VOTES DUE TO LACK OF CLIMATE GOVERNANCE PRACTICES

ROB BERRIDGE

Senior Director of Shareholder Engagement, Ceres

RHONDA BRAUER

Founder and President, RLB Governance; former Corporate Secretary and Governance Officer at The New York Times Company

Investors increasingly are ready to hold board members of U.S. public companies accountable for failing to appropriately oversee their companies’ climate-related risks and opportunities.

This trend is accelerating in the wake of the 2021 proxy season. Last year, tiny Engine No. 1 waged a David-versus-Goliath battle with ExxonMobil, helping win the election of three board members experienced in clean energy and energy transitions – ousting ExxonMobil’s favored incumbents in the process. This move by investors on climate was just one important development from last year; the 2021 season wrapped up with a record-shattering 18 climate-related shareholder proposals winning majority votes.

Climate change: Still pending is a proposal about board oversight of climate change, at Texas Instruments. The New Jersey Division of Investments wants the company to “establish comprehensive board oversight of the Company’s climate change policies and programs and report to shareholders on steps taken or planned toward this within a time frame deemed reasonable by the board.” It says the proposal does not seek to “micromanage” nor “impose methods for implementing complex policies in place of the ongoing judgement of management as overseen by its board of directors.” (The SEC has in the past used such strictures to omit proposals on ordinary business grounds.) Last year, Green Century withdrew a proposal asking the company to address material climate risks in its sustainability report after the company agreed to do so.

The Connecticut Treasurer has withdrawn a similar request at NextEra Energy after an agreement.

Human capital: Individual proponent Robert A. Rehm has withdrawn at Verizon Communications having asked it to

strengthen board oversight of workforce equity issues by assigning responsibility for oversight to the existing Human Resources Committee, or to a new board committee. For purposes of this proposal, ‘workforce equity issues’ include those related to diversity in recruitment and hiring, racial and gender pay equity, employment discrimination, and the relationship between compensation and benefits provided to senior executives and those provided to the rest of the workforce

The company told the SEC that its policies make the resolution moot and the withdrawal came before any response.

Human rights: Harrington Investments would like Meta Platforms to “commission an independent assessment of the Audit and Risk Oversight Committee’s capacities and performance in overseeing company risks to public safety and the public interest and in supporting strategic risk oversight on these issues by the full board.” A similar 2020 proposal about board oversight and risk earned 7.2 percent, after a 2018 proposal on the same issue received 11.6 percent support.

Members of the Garcia family face a challenge to their proposal at Sempra Energy, which asks it to “create a standing committee to oversee the Company’s response to domestic and international developments in human rights” that affect the company’s business. Sempra says it has delegated responsibility for human rights to a company committee and further asserts the proposal is a personal grievance.

Sustainability: Three resolutions ask for a board committee on sustainability, although one has yet to be disclosed. Sustaininvest wants Alphabet to “create a board committee on environmental sustainability to oversee and review policies and provide guidance on matters relating to environmental sustainability.” The company has told the SEC the resolution is moot and ordinary business but the commission has yet to respond.

A proposal from the Illinois Treasurer to Berkshire Hathaway asks that independent directors form a

a new Board Committee on Environmental and Social Issues….The Committee should provide an ongoing review of corporate policies and practices, above and beyond legal and regulatory matters, to assess how Berkshire Hathaway manages material sustainability factors, including issues related to the environment, human capital, and social capital. At its discretion, the Board should publish a formal charter for the Committee and a summary of its functions, and direct the Committee to issue periodic reports.