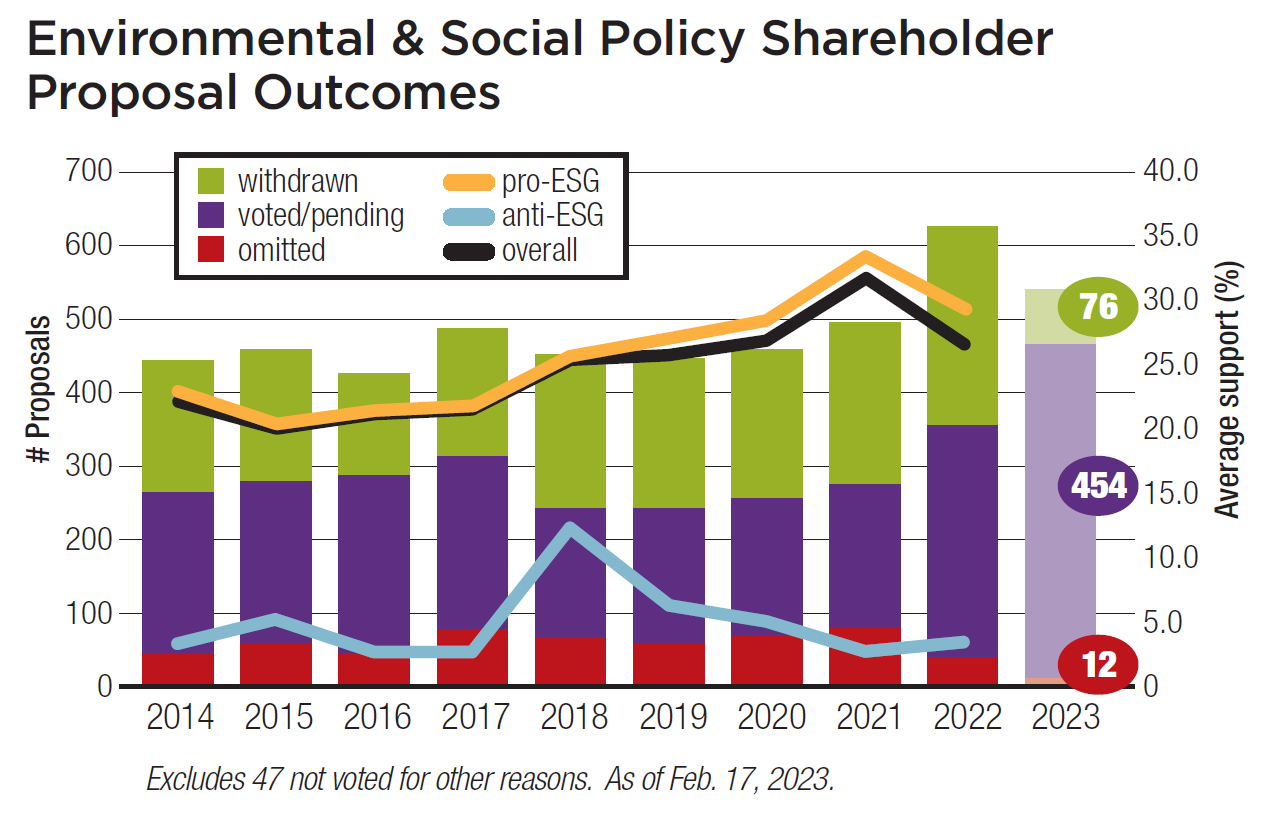

Proponents have filed at least 542 shareholder resolutions on environmental, social and related sustainable governance issues for the 2023 proxy season, about the same as last year and on track to match or exceed last year’s unprecedented final total of 627. A shift at the Securities and Exchange Commission (SEC) last year dramatically cut the number of proposal omitted and far fewer companies have submitted challenges in 2023; 12 have been omitted to date and the SEC staff has yet to respond to 76 more challenges (compared with 103 in mid-February 2022). Withdrawals appear to be down—just 76 so far compared with 106 last year, but negotiations in engagements are ongoing and many are likely to produce agreements. While 454 were slated for votes as of mid-February, this number will drop.

Record high votes on many issues in 2021 appear to have prompted both more filings in 2022 and—to some extent—more expansive proposals. After the average vote then fell, though, proponents now have reframed some requests. The 2022 overall average also was pulled down by 34 votes on anti-ESG proposals that attracted average support of only 3.5 percent support. (Bar chart below.)

Key shifts for 2023: The two biggest changes for 2023 are a continued increase in climate change proposals and a significant expansion of resolutions about reproductive health, in response to the U.S. Supreme Court decision last June that is prompting a wave of restrictions nationwide. Also new are proposals pressing companies to commit (or recommit) to international standards that protect the right to organize unions. Corporate political influence resolutions are now split in three roughly equal buckets: lobbying, election spending and values congruency (between company policies and the viewpoints of recipients). Early indications are that anti-ESG resolutions, which expanded last year, will increase still further despite the cool reception they receive.

A more detailed look at topic trends appears below on p. 10, while this year’s breakdown by topic appears on the pie chart here.

Regulation: In November 2021, the SEC rescinded guidance issued during the Trump administration in Staff Legal Bulletin 14L, providing clarification about which proposals can be omitted on ordinary business grounds and narrowing the basis for exclusion, in what shareholder advocate and attorney Sanford Lewis called a reset of the process. The result is that there are about 30 percent fewer requests from companies to omit proposals in 2023, as of the end of January.

In 2022, the commission proposed further amendments to its rules about whether a proposal has been implemented, if it can be resubmitted and if it is duplicative. This may address the “Trojan horse” issue discussed later in this report, in which similar sounding resolved clauses are filed by proponents that have competing aims.

Proponents continue to feel the impact of the September 2020 rule that makes it harder to file and resubmit shareholder resolutions but it had little impact on volume. A decision on the lawsuit from the Interfaith Center on Corporate Responsibility, As You Sow and James McRitchie has yet to occur; the latest of several postponements has set a potential decision date for May 2023, well past when it could affect this proxy season.