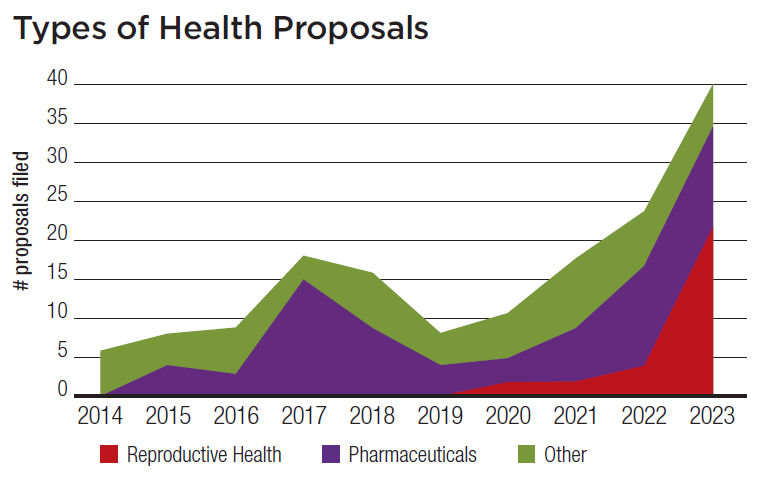

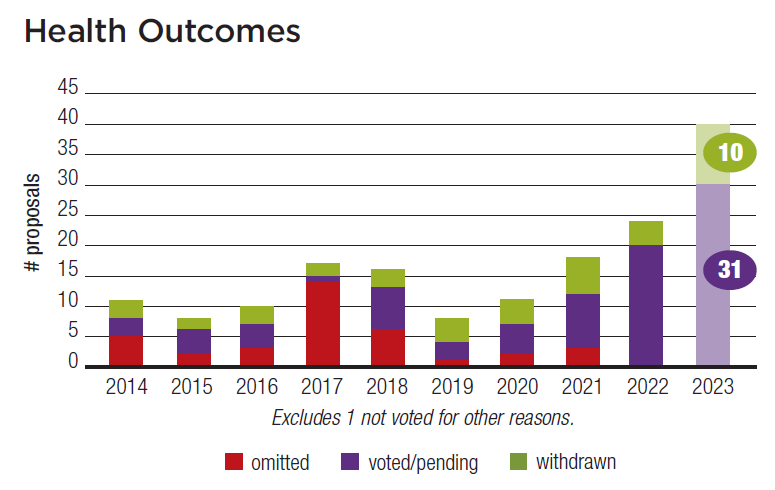

Reproductive health options are fast eroding in much of the United States following the June 2022 U.S. Supreme Court decision that struck down the nearly 50-year-old Roe v. Wade decision. Rhia Ventures and its investor allies have substantially expanded their effort to support abortion and other reproductive health options, with about two dozen proposals and several new angles. These proposals join more longstanding concerns about the high prescription drug prices; a dozen resolutions include a new question about “patent thickets” that protect profits and four resubmissions about Covid-19 drugs. Three more proposals are about the harms of tobacco. In all, there are 41 proposals and so far proponents have withdrawn 10.

Reproductive Rights

Proposals reprise a handful of resolutions that have gone to votes in the last couple of years asking about how companies will respond to restrictions on reproductive health rights, but this year add more pointed proposals about cooperation with law enforcement agencies in states that ban abortion, suggest new digital privacy policies, ask about health insurance product offerings, point to widely divergent maternal health outcomes and seek to clarify when emergency abortion care is available. One has gone to a vote, 10 have been withdrawn and 11 are pending.

(Rhia Ventures also has filed 10 proposals continuing to question inconsistencies between company policies and the political aims of politicians they support, with regard to reproductive health and other issues. See Corporate Political Influence above, p. 36).

RECORD NUMBER OF PROPOSALS ADDRESS THREATS TO REPRODUCTIVE HEALTH CARE

SHELLEY ALPERN

Director of Corporate Engagement, Rhia Ventures

Investors working with Rhia Ventures filed a record 30 proposals this proxy season to advance comprehensive and reproductive health care, double the number from the 2022 proxy season. The subject matter of the proposals expanded from last year’s focus on risk mitigation and political spending misalignment to include a number of new areas of concern that have intensified since the U.S. Supreme Court overturned the constitutional right to abortion in June 2022. Since that ruling, 12 states have enacted total or near-total abortion bans, and 13 are expected to. Furthermore, a lawsuit is working its way through the courts that could shut down the distribution of a key pharmaceutical used in medication abortions.

Risks of reproductive health restriction: Proponents are asking seven companies to report by the end of the year on “any known and potential risks or costs to the company caused by enacted or proposed state policies severely restricting reproductive rights, and detailing any strategies beyond litigation and legal compliance that the company may deploy to minimize or mitigate these risks.”

The resolution earned 13.3 percent at Costco in January and it is still pending for first-time votes at Coca-Cola, PepsiCo and United Parcel Service. It is a resubmission at Lowe’s (32.2 percent in 2022).

Withdrawals—TJX reported it has adopted travel benefits for accessing reproductive care and engaged its insurance providers about contraceptives, prompting Trillium Asset Management to withdraw the proposal. A similar proposal at the company last year received 30.2 percent. Proponents also withdrew at McDonald’s after a procedural error.

Sharing abortion-related data: Seven more financial services and health companies face proposals seeking reports describing “any known and potential risks and costs to the Company of fulfilling information requests” about company customers “for the enforcement of state laws criminalizing abortion access, and setting forth any strategies beyond legal compliance that the Company may deploy to minimize or mitigate these risks.” The resolution is new to all the companies, although the more general proposal about reproductive health risks noted above earned 12.9 percent at Walmart last year. Votes may occur at American Express, CVS Health, Laboratory Corp. of America and PayPal.

Withdrawals—Proponents have withdrawn at Bank of NY Mellon and Verisk Analytics.

SEC action—An ownership challenge may sink the resolution at American Express, although it also asserts the proposal is an ordinary business matter, as does Lab Corp. The companies argue the resolution concerns routine oversight and evaluation of government regulation, would micromanage and does not raise a transcendent policy issue but this seems unlikely to persuade commission staff given its more permissive stance begun last year.

Digital privacy: Arjuna Capital, a persistent critic of social media companies, has turned to Alphabet and Meta Platforms to ask for expanded digital privacy protections, with a slightly different spin on the request about data sharing noted above. The proposal suggests privacy protection similar to that sought by human rights advocates for authoritarian regimes outside U.S. borders. It wants a report “assessing the feasibility of reducing the risks of abortion-related law enforcement requests by expanding consumer privacy protections and controls over sensitive personal data.” Law enforcement agencies “frequently relies on digital consumer data” such as “geolocation data, browsing history and financial activity,” the proposal says, noting the two companies complied with about 80 percent of such requests in 2021. One solution Arjuna references is a California law that forbids disclosure of such data if it “does not involve any crime related to an abortion that is lawful” in the state.

Benefits: None of three insurers—Elevance Health, Humana and UnitedHealth Group—will see a vote on yet another new proposal that seeks disclosure about their products—”current corporate policies regarding its offering of reproductive health care coverage in both self-funded and fully funded plan options.” The proponents were satisfied with information the companies provided and withdrew.

The resolution points out that three-quarters of college-education adults want their employers to cover all reproductive health care—products and services for menstruation, fertility, pregnancy, contraception, menopause and abortion. Most medium and large companies have private, self-funded health plans regulated by the federal government, while smaller employers usually offer insurance plans regulated by states that “vary greatly” on contraception and abortion. The proposal asks whether company insurance covers all FDA-approved contraception options and travel policies to obtain services if they are banned in a particular state, as well as emergency abortion care to protect a mother’s health.

Maternal health: The Tara Health Foundation wants companies to address maternal health problems and the disproportionately poor outcomes for Black women. Three times more pregnant Black women die than non-Hispanic white and Hispanic women. The proposal says, “In order to limit the impact of the maternal mortality crisis on its workforce, shareholders request [the company] report on any specialized current health services and support provided for pregnant and postpartum employees and assess the feasibility of establishing and expanding additional maternal support for employees.” Tara Health withdrew at Ulta Beauty after it provided information.

Abortion access: Proponents have continued the theme of maternal health with a new proposal at three hospital companies (one unnamed), asking each for a report “on its current policy regarding availability of abortions in its operations, including but not limited to whether such policy includes an exception for the life and health of the pregnant person, and how the Company defines an emergency medical condition.”

At HCA Healthcare, United Church Funds notes the company operates 182 hospitals and 2,300 clinics and other “sites of care” and that while most abortions do not occur in a hospital, those that do often pose threats to women’s life or health. Further, it notes that miscarriages can threaten a women’s health and that ectopic pregnancies are never viable. The withdrawal came after HCA clarified its hospitals will perform emergency abortions as determined by its doctors. HCA also had argued at the SEC that it was moot.

Health Equity

Parallel to the Rhia campaign are proposals from NYSCRF about maternal and general health disparities based on race. Comptroller DiNapoli discussed all three resolutions in a February 15 press release. At Centene, the focus is on maternal health and it says,

In order to limit the impact of the maternal mortality crisis on its workforce, shareholders request that Centene report on any specialized current health services and support provided for pregnant and postpartum employees, and assess the feasibility of establishing and expanding additional maternal support for employees. The report should be prepared at reasonable cost, omitting proprietary information and shall be completed by September 1, 2024.

The other new proposal raises more general health equity concerns at Elevance Health and Humana. It asks for a report and says each should

commission an audit analyzing the impacts of racial and ethnic disparities in healthcare outcomes on [the company’s] business. The report should include data on the extent of such racial and ethnic disparities, information about impediments to collecting such data, and efforts taken by [the company] to eliminate such disparities by improving healthcare outcomes.

Withdrawal: Humana will produce the requested report and NYSCRF has withdrawn.

Pharmaceuticals

Patents: ICCR members and their allies have filed dozens of shareholder proposals over the years about the prices pharmaceutical companies charge for their products. In 2023, they have a new and very specific proposal about the drug patenting process, which eight of nine recipients (see table) have challenged at the SEC. The resolution asks for an evaluation of how companies assess the impact of their policies on patenting, calling for a report

on a process by which the impact of extended patent exclusivities on product access would be considered in deciding whether to apply for secondary and tertiary patents. Secondary and tertiary patents are patents applied for after the main active ingredient/molecule patent(s) and which relate to the product.

The proposal points out that U.S. drug prices are 3.5 times higher than in other advanced industrial economies and the enduring controversy over the ese prices. A key new development is the federal government’s capacity to negotiate some prices because of the Inflation Reduction Act of 2022. The proponents point to particular cases where each of the recipient companies have applied for additional patents to stave off competition and asks “not only whether” a company can apply to do so “but also whether it should do so,” which they say tempts “regulatory blowback” and reputation risks.

A similar proposal in 2022 at Gilead Sciences, one of this year’s companies, earned 39.6 percent.

SEC action—All but Bristol-Myers Squibb have lodged SEC challenges, arguing variously that it is ordinary business since it is too specific, too vague or moot given current disclosures. The SEC has yet to respond. In addition to the two others mentioned, the proposal also is pending at AbbVie, Amgen, Eli Lilly, Johnson & Johnson, Merck, Pfizer and Regeneron Pharmaceuticals.

COVID-19: Since the onset of the COVID-19 pandemic, Oxfam America has been a key critic of how drug companies have used public money to fund treatments to combat the coronavirus and warning of a crisis when subsidies for vaccines and treatment end. The group’s proposals in 2023, both resubmissions, have new relevance in the United States now that the Biden administration plans to end the public health emergency in May. Support from investors for more disclosure has been significant.

Government subsidies—The first proposal is in its third year and asks for a report “on whether and how [the company’s] receipt of government financial support for development and manufacture of vaccines and therapeutics for COVID-19 is being, or will be, taken into account when engaging in conduct that affects access to such products, such as setting prices.” The proposal earned 33.8 percent at Johnson & Johnson in 2022 and 31.8 percent in 2021; it also earned 36 percent at Merck last year and 35.6 percent in 2021. It is pending again at both companies.

Technology transfer—Pending for the second year in a row is a request to report “analyzing the feasibility of promptly transferring intellectual property…and technical knowledge…to facilitate the production of COVID-19 vaccine doses by additional qualified manufacturers located in low- and middle-income countries (LMICs), as defined by the World Bank.” It earned 23.8 percent last year at Moderna and 27. 4 percent at Pfizer and Oxfam has filed both proposals again.

Tobacco

Phillip Morris International has a new proposal from Trinity Health asking for a report “on the nicotine levels for each of our brands, including heated tobacco products, how those levels are determined,” plus when it will “begin reducing nicotine levels in our brands to a less addictive level.” Last year, Trinity earned 1.5 percent for a proposal that it start phasing out all hazardous and addictive products within three years, not enough to qualify for resubmission.

One of three tobacco proposals has already gone to a vote. The Sisters of St. Francis of Philadelphia earned 10.3 percent support for a resubmitted proposal that asked Walgreens Boots Alliance for a report “on the external public health costs created by the sale of tobacco products…and the manner in which such costs affect the vast majority of its shareholders who rely on overall market returns.” The vote was down slightly from 11.4 percent last year and missed the 15 percent resubmission threshold. The same proposal is pending at Kroger, where it will go to a vote for the first time.