The 2021 proxy season moved into uncharted waters, with more majority votes than ever (39) and a momentous proxy fight at ExxonMobil that ended with three dissident directors winning board seats. Yet shareholder proponents also were coming to terms with new rules issued from the SEC in the waning days of the Trump administration aimed at curbing shareholder proposals. While the new rules affect the 2022 proxy season, legal action and a sympathetic ear from the Biden Administration’s SEC will shape the ultimate outcome.

Average support for the 185 proposals seeking social and environmental changes at companies was 33.8 percent, up from just under 19 percent 10 years earlier; this excludes low votes on resolutions from conservatives. Total filings surged to a new high of 499. One key change pushing the averages up in 2021 were votes above 90 percent that occurred when companies voiced no opposition.

Company efforts to block resolutions from inclusion in proxy statements using provisions of the Shareholder Proposal Rule continued to bear fruit, reflecting changes in SEC staff interpretations put in place during the Trump era. By November, however, the SEC rescinded all three interpretive bulletins, promising an easier road in 2022 for proponents.

Major Themes

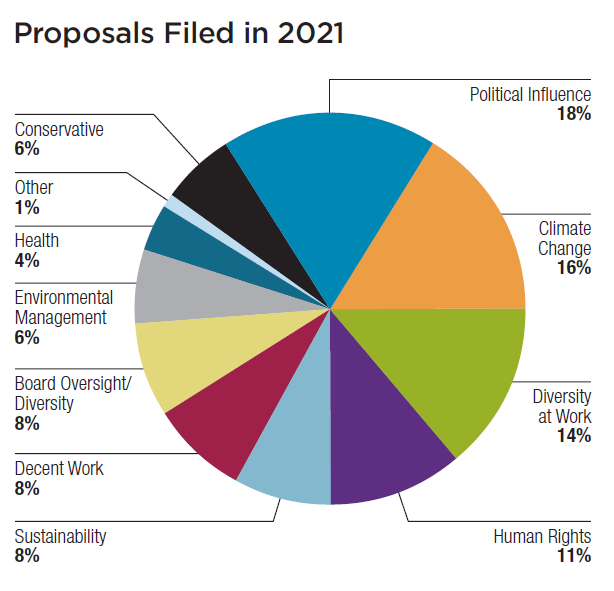

Proposals about diversity expanded substantially in 2021, at least partly in response to the Black Lives Matter movement, with a jump in filings articulating issues both old and new. Other major themes of proxy season persisted, addressing corporate political influence and climate change.

Diversity, equity and inclusion: Proposals sought fair representation, treatment and pay in the workplace and more diverse boards of directors, with 14 majorities. Proponents reached agreements and withdrew many proposals. In addition, 20 new resolutions asked companies how they are combatting systemic racism.

Corporate political influence: Investor support for more oversight and disclosure of corporate spending andlobbying continued to grow, with 15 majority votes and six more above 40 percent. There were 85 filings and 29 withdrawals, with corporate commitments most likely for election spending proposals. Average support reached alltime highs of 43.8 percent on election spending and 38.7 percent on the main lobbying proposal. Much higher, though, were the votes on climate-related political advocacy; seven proposals average 62.5 percent support, with five strong majorities.

Climate change: Proposals addressed climate change directly and took on mostly related environmental management issues, often about plastic. The number of votes on these issues has fallen as companies and proponents find common ground, but proponents now also want companies to do more; support for more robust action continued to build; there were 25 votes with average support of 53.2 percent. Almost all asked about carbon asset risk and how companies plan to cut emissions and re-tool for a lower carbon world.

2021 Highlights

Environment

Climate change: A modest resurgence of climate proposal brought the total to 79, but there were only 20 votes. Proponents asked how companies plan to address carbon asset risks but raised few other issues. Most asked for greenhouse gas (GHG) emissions reduction targets in the context of the Paris climate treaty. The consistency of requests for reporting was notable.

The highest votes included 48 percent in favor of reporting on net-zero GHG goals at Caterpillar, and a 98 percent vote (after management support) for the same resolution at General Electric. An early win for proponents came when ExxonMobil agreed to report on its full carbon footprint, prompting a withdrawal. Investors were strongly in favor of emissions reductions. They gave 60.7 percent support to a new proposal at Chevron that sought Scope 3 (indirect) emissions reductions, and majority support for adopting GHG reduction targets at ConocoPhillips and Phillips 66.

Resolutions on strategic planning and shareholder feedback included those asserting the new idea that shareholders should be given the opportunity to annual vote on corporate climate change plans; this idea morphed proposals that continue in 2022 and only ask about plans for the climate transition. High votes for a climate transition plan included 56.5 percent at Booking Holdings. Two new proposals seeking a formally audited plan earned 48 percent at both Chevron and ExxonMobil. Proponents also withdrew four proposals at banks asking for reports on how they plan to finance GHG cuts in line with the Paris climate treaty, when the companies agreed to act.

Investors gave 76.2 percent support to a resolution asking how Bloomin Brands addresses deforestation in its supply chain, while support from the board at Bunge pushed the vote there to nearly 99 percent.

Environmental management: Concern that plastics are overwhelming and harming the ecosystem was by far the most important issue, although a dozen more proposals also inquired about industrial agriculture. There were only six votes, but they included the highest ever vote at Du Pont de Nemours—81.2 percent—on plastics pollution. In response to a similar proposal, Coca-Cola announced it will cut its virgin plastic use by 3 million metric tons by 2025.

Social Issues

Corporate political activity: Investors went to the proxy ballot box not long after the unprecedented attack on our democracy on January 6, when supporters of ex-President Trump sought to overturn the election. Many companies announced after the attack that they would “pause” corporate and PAC political spending and re-evaluate how they spend, but those pledges now are evaporating.

Ever-present filings about corporate influence numbered 89 and produced 50 votes. The most important development was an expanded set of resolutions on climate-related lobbying, with five of the six proposals that went to votes earning majority support—at Phillips 66, Delta Air Lines, ExxonMobil, United Airlines and Norfolk Southern. Few of the main lobbying proposals were withdrawn and three earned majorities, at AECOM, ExxonMobil and GEO Group. Proposals on election spending included six majorities—at Chemed, Duke Energy, Netflix, Omnicom Gorup, Royal Caribbean and United Airlines.

What really changed on this issue in 2021 was a shift that continues in 2022—more scrutiny about the views of those that receive company-connected money. There was a near-majority at Pfizer (47.2 percent) after the Tara Health Foundation asked it about incongruencies between its spending and expressed support for women’s health, noting the company has supported many abortion rights foes.

Decent work: Proposals about decent work were split about evenly between those about fair pay and those on working conditions. But none of the CEO pay disparity proposals earned more than 11 percent and most received much less. Votes were higher for reporting on pay differentials based on gender and race, with the highest vote of 32.6 percent at CIGNA. Sexual harassment problems and the role mandatory arbitration can play in shielding them from public view were on the ballot and received majority support at Goldman Sachs (53.2 percent) and Sunrun (59.4 percent). Also notable was a vote of 95.3 percent at Wendy’s, where management supported a request to report on how it is addressing worker health and safety in the pandemic.

Diversity in the workplace: Shareholder proponents responded to the Black Lives Matter movement sparked by the May 2020 murder of George Floyd in Minnepolis by filing twice as many proposals as about diversity, with 72 filings. A lead player was the New York City Comptroller’s Office and it was largely successful in persuading companies to voluntarily release their EEO-1 forms that break down employment by job category, race, gender and ethnicity. As The Wall Street Journal noted at the start of September, 78 out of the 100 largest publicly traded companies now release this information. Startling high votes were in favor of EEO disclosure—83.8 percent at Du Pont de Nemours and 86.4 percent at Union Pacific. Additional important corporate concessions included the decision by Home Depot to release its EEO-1 data, after 20 years of shareholder resolutions.

As You Sow pushed the envelope to ask for more than EEO-1 data, however, seeking additional information on hiring, recruitment and retention to better understand the impact of diversity and inclusion programs. Three majorities included 59.7 percent at American Express, 94.3 percent at IBM (with management support) and 81.4 percent at Union Pacific. Further, Trillium Asset Management continued its push for executive suite diversity and earned 93.8 percent at Paycom Software where management made no recommendation.

Health: As might be expected amid a global pandemic, several shareholder resolutions raised health issues, producing nine votes. ICCR members asked drug companies about pricing and access for drugs and vaccines to counteract Covid-19; the highest of three votes was 33.6 percent at Merck.

Human rights: Proponents filed 55 proposals about human rights, raising explicit new concerns about systemic racism at financial firms and others, earning significant support when they asked for racial justice audits. The SEC turned back challenges and the highest vote was 40.5 percent at JPMorgan Chase. NYSCRF earned even more—44.2 percent—at Amazon.com, where it called out racist incidents.

Other strategy and accountability proposals notched the most support of 32.2 percent at Lockheed Martin; one of the company’s weapons had killed a school bus full of children in Yemen. The company gives its employees 24 minutes of training a year on human rights and says concerns about its business are best addressed by governments.

Taking up controversies about electronic media content, technology and privacy were another 13 resolutions. Two at Amazon.com on different aspects of surveillance technology earned about 35 percent.

Sustainable Governance

Board diversity: A diminished complement of just 28 proposals addressed board diversity. But no S&P 500 company is now without at least one woman on the board, although racial and ethnic diversity remains scarce. Five votes included three majorities—85.4 percent at Badger Meter, 70.6 percent at First Community Bankshares and 91.2 percent at First Solar, where the company took no position.

Board oversight and experts: Also lower in number were proposals seeking specific types of board oversight, with just 10 filings, down from two dozen three years ago. The highest vote was 14.3 percent in response to a request for a human rights expert on Twitter’s board.

Sustainability: Replacing a former flood of generalized sustainability reporting proposals were new resolutions about the nature of corporate purpose, but proposals asking companies to reincorporate as public benefit corporations earned scant support. There were 40 filings, down from a peak of 58 three years ago, and 23 votes. There were only six votes on ESG pay links, well below earlier years. The highest was 25.6 percent for a serial repeat at Wells Fargo seeking more information on how it guards aginast incentives that may encourage risky practices.