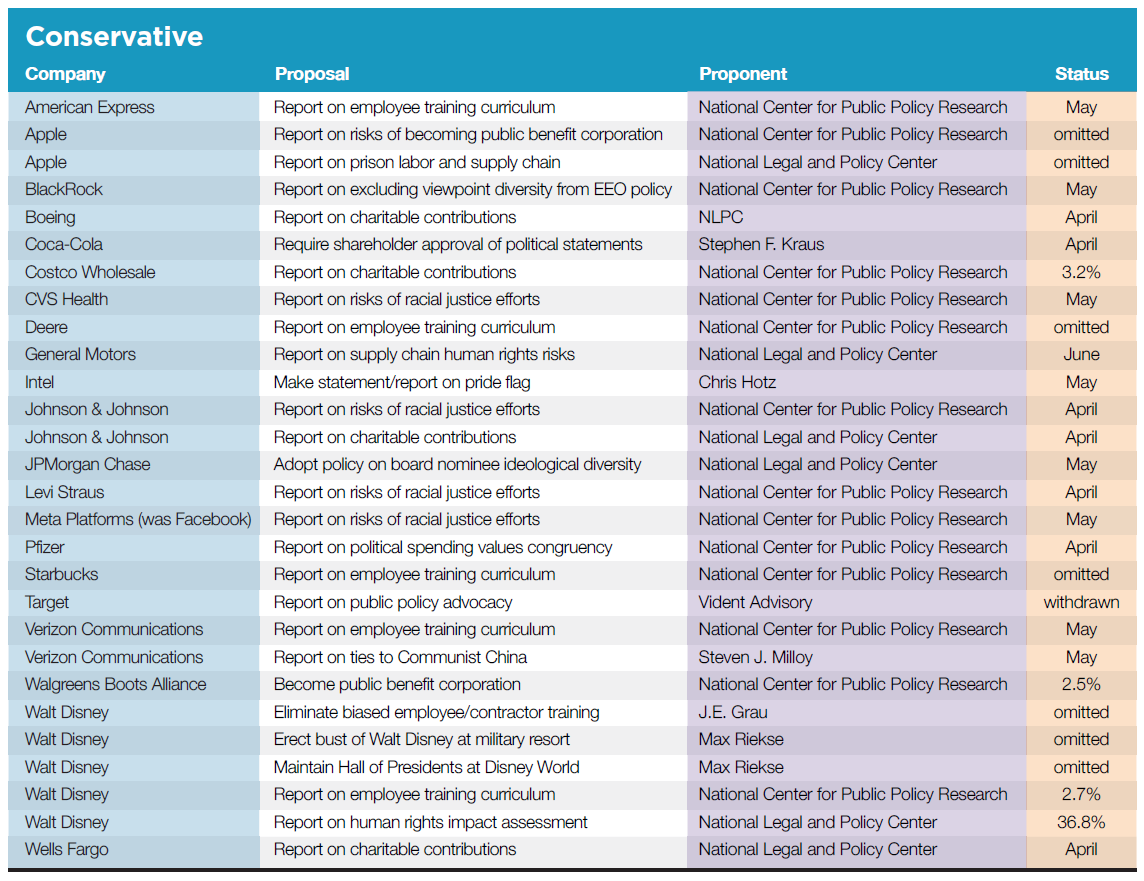

Proponents with a conservative political perspective file resolutions that are the mirror image of those from most investors who want corporate disclosure and action on all the disparate social and environmental issues discussed in this report. From 2019 until last year, most of these proposals asked for more ideological diversity on boards of directors, positing that corporate America is too liberal. This year, the focus is on combating what proponents believe is a rash of “woke” policies on racism. Conservative groups also have consistently filed proposals about corporate political influence, while also suggesting philanthropic efforts inappropriately support liberal causes. After the 2019 Business Roundtable statement on stakeholder capitalism, these proponents started questioning CEOs’ commitments to that idea. (Top graph.)

Investors generally have not given much support to these proposals, with the limited exception being those that borrow the resolved clause from the main political spending and lobbying campaigns.

The National Center for Public Policy Research (NCPPR),a think tank, is the main player, with resolutions also filed by its principals and like-minded supporters. NCPPR calls itself “the nation’s preeminent free-market” shareholder activist group, via its Free Enterprise Project. Its representatives also attend annual meetings without filing proposals.

The National Center for Legal and Policy Center (NLPC) also files shareholder proposals but was inactive for a time. In 2022, it has five resolutions. Investors may want to note NLPC proposals about China express concern about the same human rights issues that bother other proponents. Common ground for all is an expressed concern about government repression and free speech.

Outcomes: Many conservative resolutions have been omitted over the years, for procedural and substantive reasons. But since 2019 about a dozen have appeared on proxy statements each year; average support in the last two years has been at only about 3 percent, however, rarely enough to qualify for resubmission.

Diversity

Workplace: New in 2022 are proposals about employee diversity training and (mirroring the racial justice audit resolutions) ask for a “workplace nondiscrimination audit.” Two companies—Deere and Starbucks—have persuaded the SEC it is an ordinary business issue or moot. There are two main variants:

Training materials and audit: At American Express, Starbucks and Verizon Communications the proposals seeks annual publication of “the written and oral content of employee-training materials offered to the company’s employees by the company or with its consent, as well as any such materials that were sponsored by the company in whole or part.” It also says:

In the alternative we request the Board commission a workplace nondiscrimination audit analyzing the company’s impacts, including the impacts arising from company-sponsored or-promoted employee training, on civil rights and non-discrimination in the workplace, and the impacts of those issues on the company’s business. In the latter instance, a report on the audit, prepared at reasonable cost and omitting confidential or proprietary information, should be publicly disclosed on the company’s website.

SEC action—Starbucks lodged a successful challenge and the SEC agreed it is moot. American Express and Verizon are still waiting for an outcome; they also say the proposal is moot, false and misleading, ordinary business by dint of being about workforce relations, and impermissibly constitutes two separate proposals.

Audit: The second proposal combines the above requests in a more concise resolution, at Walt Disney and Deere. The proposal earned 2.7 percent at Disney on March 9 but was omitted at Deere. The resolution asks the board to

commission a workplace non-discrimination audit analyzing Disney’s impacts, including the impacts arising from Disney-sponsored or -promoted employee training, on civil rights and non-discrimination in the workplace, and the impacts of those issues on Disney’s business. A report on the audit…should be publicly disclosed on Disney’s website.

SEC action—Both recipients challenged at the SEC on ordinary business grounds, but only Deere was successful. It argued the proposal was about workforce management and training and would micromanage.

Political discrimination: At BlackRock, NCPPR wants the company to “issue a public report detailing the potential risks associated with omitting ‘viewpoint’ and ‘ideology’ from its written equal employment opportunity (EEO) policy.”

SEC action—The company has challenged the proposal, arguing it concerns ordinary business and is moot, noting that earlier similar proposals were omitted and that its non-discrimination policy forbids political discrimination, the proponent’s chief concern. (A similar version of this proposal was omitted at American Express and Walgreens last year.)

“Woke” training: A resolution from individual investor J.E. Grau at Walt Disney has been omitted on the grounds that it was too vague. Its long resolved clause asked that employees not be required “to listen, read” or be exposed to “any other form of communication” about “‘Woke Cult’, ‘Delete Culture’, ‘Supremacy Innuendos’, ‘1776 Project’, ‘1619 Project’ or other similar biases.” It said Disney should not be “transformed” by management into “a political-outpost for the benefit and or interests of any political faction / persuasion from the Right - Center - Left (or others) of the political spectrum either domestically or [foreign].

Pride flag: Individual investor Chris Hotz has been trying for four years to convince Intel to stop flying the pride flag during the month of June, which celebrates LGBTQ people. His proposal this year asks for a report “on whether, and/or to what extent, the public display of the pride flag has impacted current, and to the extent reasonable, past and prospective employee’s view of the company as a desirable place to work.” Each previous proposal has been omitted, but each also was more prescriptive than this year’s version. The company is arguing at the SEC that the proposal relates to ordinary business since it concerns workforce management.

Board ideology: The National Legal and Policy Center at JPMorgan Chase uses the same language as mainstream proponents to ask for “greater diversity” on the board by requiring diverse candidates, with qualifications presented in a matrix format in the proxy statement, with annual updates. The only difference is that it wants to see their “skills, experience and intellectual strengths.” The supporting statement expresses support for diversity and does not discuss ideology but notes most directors now hold upper echelon corporate positions, and states the board “could additionally benefit from individuals whose life experience and perspectives are diverse.”

SEC action—The company has filed a challenge at the SEC, arguing it is moot. Last year, the AFL-CIO withdrew a similar proposal after the company agreed to include diverse board nominee hiring slates.

Political Influence and Charitable Giving

Philanthropy: Costco Wholesale shareholders gave 3.2 percent support to a proposal from the NLPC that asked for a report listing “the recipients of corporate charitable contributions of $5,000 or more on the company website, along with the material limitations, if any, placed on the restrictions, and/or the monitoring of the contributions and its uses, if any, that the Company undertakes.” The vote was too low to qualify for resubmission.

It looks likely that investors at three other companies will also vote on a similar, but longer, NCPPR proposal. It asks Wells Fargo to issue a semi-annual report

that discloses, itemizes and quantifies all Company charitable donations, aggregated by recipient name & address each year for contributions that exceed $999 annually. This report shall include:

Monetary and non-monetary contributions made to non-profit organizations operating under Section 501(c)(3) and 501(c)(4) of the Internal Revenue Code, and any other public or private charitable organization;

Policies and procedures for charitable contributions (both direct and indirect) made with corporate assets;

Rationale for each of the charitable contributions.

To the extent reasonable and permissible, the report may include the type of information requested above for charities and foundations controlled or managed by the Company, including the Wells Fargo Foundation.

At Boeing and Johnson & Johnson, NLPC has a similar version but switches out “Personnel participating in the decisions to contribute” for the third point and eliminates discussion of charities or foundations associated with the companies.

SEC action—Wells Fargo says the proposal is moot and has yet to receive a response, but the SEC disagreed with assertions from the other two companies that the resolution is moot.

Public policy advocacy: Two resolutions with a similar aim ask about public policy endorsements.

At Pfizer, NCPPR asks for an annual report “analyzing the congruency of political and electioneering expenditures during the preceding year against publicly stated company values and policies.” The resolved clause is the same as a resubmitted proposal from the Tara Health Foundation that received 47.2 percent in 2021. However, the NCPPR proposal is critical of several positions taken by various candidates funded by the company, criticizing Pfizer’s diversity approach and its support for candidates in favor of abortion rights. (See p. 46 for Tara proposal.)

Vident Advisory has withdrawn a proposal at Target that asks it for an annual report

listing and analyzing policy endorsements made in recent years. The report should include public endorsements, including press statements released by the company and signing of public statements associated with activist groups and statements of threat or warning against particular states in response to policy proposals. The report should analyze whether the policies advocated can rigorously be established to be of pecuniary benefit to the company and describe possible risks to the company arising from such statements, endorsements, or warnings.

SEC action and withdrawal—Pfizer says the NCPPR resolution is moot, but also suggests that if the SEC disagrees, the inclusion of the NCPPR proposal will make the resubmitted Tara resolution duplicative, allowing that one to be omitted. Target argued at the SEC that the proposal is ordinary business and too vague, but the proponent withdrew before any SEC response after discussions with the company.

Shareholder approval: Stephen K. Kraus, an individual investor, proposes that Coca-Cola “Require the company to submit any proposed political statement to the next shareholder meeting for approval prior to issuing the subject statement publicly.” The resolution has not been proposed at any other company before; it raises concerns about the company’s statements on Georgia’s elections in 2020, which were contested by the former U.S. president.

SEC action—Coca-Cola says the proposal is too vague and also concerns ordinary business by dint of micromanagement but the SEC has yet to respond.

Statues and displays: Individual investor Max Riekse has seen both his proposals to Walt Disney omitted because they were filed too late. He first asked the company to erect a bust of the company founder at a military resort near Disney World in Florida. He also asked that the company take very specific actions regarding its displays about U.S. presidents at Disney World, including:

That former President Donald Trump be fully represented in the Hall of Presidents and that the Hall of Presidents be kept in the same location at Magic Kingdom for 75 years. And that a President Donald Trump mannequin be placed next to either former Presidents Teddy Roosevelt, Ronald Reagan or Andrew Jackson in the Hall of Presidents.

Be it further resolved that the current representation of President Donald Trump in the Hall of Presidents, 2017-2020, be donated at no cost and in full working order, to the future President Donald Trump Presidential Library and Museum.

Human Rights

Racial justice audit risks: Inspired by last year’s racial justice audit proposals that have burgeoned this year, NCPPR has filed at least four proposals—at CVS Health, Johnson & Johnson, Levi Straus and Meta Platforms, asking each to

commission an audit analyzing the Company’s impacts on civil rights and non-discrimination, and the impacts of those issues on the Company’s business. The audit may, in the Board’s discretion, be conducted by an independent and unbiased third party with input from civil rights organizations, public interest litigation groups, employees and other stakeholders—of a wide spectrum of viewpoints and perspectives. [this modifier is left out at Johnson & Johnson]. A report on the audit, prepared at reasonable cost and omitting confidential or proprietary information, should be publicly disclosed on the Company’s website.

Although the proposal borrows the language of civil rights advocates, it argues that corporate efforts to combat discrimination disadvantage White people, which it says is racist.

SEC action—CVS, Levi Strauss and Meta each filed challenges at the SEC, arguing variously that it is too vague, is ordinary business because it concerns workforce management and legal compliance, or (in Meta’s case) that it is moot given civil rights audits it conducted in 2019 and 2020. Johnson & Johnson says it plans to include this resolution in its proxy statement, which it argues means a resolution supporting a racial justice audit resubmitted by ICCR members can be struck because it is duplicative.

Forced labor in China and Africa: The NLPC filed two proposals that raise concerns about doing business in China, but just one will go to a vote. Its request for an annual report at Apple “on the extent to which its products are produced through the direct or indirect use of forced (or slave) labor” has been omitted, as discussed below.

However, investors gave 36.8 percent support to a resolution asking Walt Disney to report “on the process of due diligence, if any, that the Company undertakes in evaluating the human rights impacts of its business and associations with foreign entities, including foreign governments, their agencies, and private sector intermediaries.” NLPC was prompted by controversy about the 2020 live-action movie, Mulan, which was filmed in the Xinjiang region of China where the Chinese government is persecuting the Uyghur people. The film gave thanks in its credits to regional government authorities; Disney’s current human rights policies are largely focused on supply chain labor and human rights concerns about manufacturing of its licensed products, which both NLPC and SumOfUs, its counterpart on the other side of the political divide, find inadequate.

At General Motors, NLPC seeks a report “on the extent to which its business plans with respect to electric vehicles may involve, rely or depend on child labor outside the United States.” The resolution notes the company’s plans to promote electric vehicles (EVs), which use cobalt in their batteries, pointing out that about 60 percent of cobalt globally comes from the Democratic Republic of Congo where child labor is rife. The proposal says investors “have the right to know the extent to which, if any and intentionally or not,” GM relies on child labor in its supply chain. (Last year, Steven J. Milloy asked the utility Exelon about its support for EV infrastructure given his stated concern about cobalt and child labor and the vote was 5.2 percent.)

Milloy this year wants Verizon Communications to report on its ties to China with a report

on the general nature and extent to which corporate operations involve or depend on Communist China, which is a serial human rights violator and a geopolitical threat and adversary to the US. The report should exclude confidential business information but provide shareholders with a basic sense of Verizon’s reliance on activities conducted within, and under control of the Communist Chinese government.

SEC action—The SEC agreed the Apple proposal could be omitted because it duplicated a similar proposal filed first by SumOfUs. (See p. 69 for a description of that proposal.) The commission rejected Walt Disney’s contention that the resolution there is ordinary business and has yet to decide on a challenge from General Motors that argues its reporting makes the resolution moot. The SEC also has not responded yet to Verizon’s contentions that its proposal raises ordinary business questions because it concerns management decisions about where and with whom to do business, and is too vague.

Sustainability

NCPPR again mirrored its foes on the other end of the political spectrum at Apple, asking it

to become a public benefit corporation (a “PBC”) in light of its adoption of the Business Roundtable Statement of the Purpose of a Corporation (“the Statement”) [referred to in a footnote]. Shareholders further request that the Board then present such amendments to the shareholders for approval, along with a full disclosure of the implications for shareholders that will follow from approval and adoption of the amendments, and the risks that append to such approval and adoption.

The SEC agreed, however, that this was too vague because it was unclear “whether the Company, a California corporation, must become a public benefit corporation and therefore reincorporate in Delaware to implement the proposal, or whether the Company should instead covert to a form of benefit corporation recognized under California law.” In its challenge, Apple noted it also received a proposal asking it to reincorporate as a public benefit corporation (PBC), received after the NCPPR version and from The Shareholder Commons, but it said that proposal should be included. (See p. 80 above for more on the TSC resolution, which earned 3.1 percent (about what the NCPPR proposals have done).)